National Grid 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

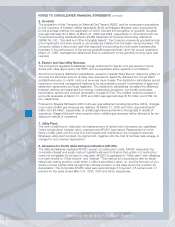

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

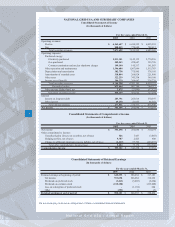

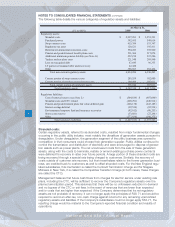

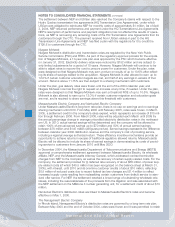

9. Depreciation and Amortization:

Depreciation expense is determined using the straight-line method. The depreciation rates for the

regulated subsidiaries are based on periodic studies of the estimated useful lives of the assets and

the estimated cost to remove them net of salvage value. The regulated subsidiaries use composite

depreciation rates that are approved by the respective state utility commissions. The average

depreciation rates for Property, Plant, and Equipment, by business segment, are presented in the

table below.

Regulatory assets, including those covered by CTCs, are amortized in accordance with the provi-

sions of the regulated subsidiaries rate settlement agreements and therefore are not necessarily

amortized on a straight-line basis. NEP and Niagara Mohawk had deferred certain costs related to

deregulation, including purchased power contract buyouts, and losses on the sale of generation

assets as a regulatory asset (See Note B – “Rate and Regulatory Issues”). Niagara Mohawk’s

costs are being amortized unevenly over ten years with larger amounts being amortized in the lat-

ter years, consistent with projected recovery through rates.

10. Cash equivalents:

The Company classifies short term investments with an original maturity of three months or less as

cash equivalents.

11. Restricted Cash:

Restricted cash consists of margin accounts for hedging activity, health care claims deposits, New

York State Department of Conservation securitization for certain site cleanup, and a worker’s com-

pensation premium deposit.

Under the Loan and Trust Agreement for the Massachusetts Development Finance Agency Tax

Exempt Electric Utility Revenue Bonds (Nantucket Electric Company Issue), Series 2004A (the

Bonds), the Company established a Construction Fund with the Trustee in which the proceeds

from the Bonds were deposited. The $10 million deposited was to fund the Second Nantucket

Cable Project costs. Disbursements from the Construction Fund may be made by the Trustee to

pay directly or to reimburse the Company for eligible project costs as directed by requisitions

signed by the Company. At March 31, 2005, the Company used $5.8 million of the funds deposit-

ed. This requisition process is the only manner in which project costs may be paid from Bond pro-

ceeds.

12. Income Taxes:

Income taxes have been computed utilizing the asset and liability approach, which requires the

recognition of deferred tax assets and liabilities for the tax consequences of temporary differences.

It does this by applying enacted statutory tax rates applicable to future years to differences

between the financial statement carrying amounts and the tax basis of existing assets and liabili-

ties (see Note H – “Income Taxes”).

32

National Grid USA / Annual Report

Business Segment 2005 2004 2003

Electricity distribution 3.53% 3.55% 3.62%

Electricity transmission 2.56% 2.69% 2.67%

Gas distribution 2.48% 2.49% 2.59%

Other 4.69% 4.62% 4.21%

Average Rate