National Grid 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

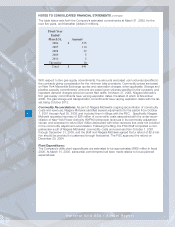

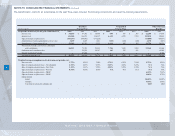

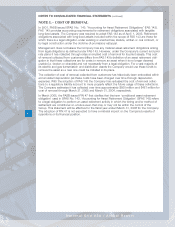

The following table provides a reconciliation of the changes in the Plans’ fair benefit obligations for the fiscal years 2005 and 2004, accumulated benefit obliga-

tion for the pension plans at March 31, and the assumption used in developing the obligations.

51

National Grid USA / Annual Report

(in thousands)

2005 2004 2005 2004 2005 2004

Accumulated benefit obligation 2,409,544$ 2,373,523$ 111,044$ 110,807$ N/A N/A

Change in benefit obligation:

Beginning balance, April 1, 2,609,731$ 2,441,307$ 114,190$ 113,805$ 1,834,258$ 1,585,462$

Service cost 50,656 47,342 690 647 22,200 17,930

Interest cost 144,100 146,273 6,149 6,578 103,810 98,849

Actuarial los s es 112,221 164,137 1,762 2,948 9,435 199,684

Plan amendments 31,201 - - - 146,689 (8,121)

Benefit payments (252,253) (144,292) (8,995) (8,399) (97,383) (85,203)

Settlements - (133,073) (1,057) (1,389) - -

Curtailments - (3,818) - - - 16,721

Special termination benefits - 91,855 - - - 8,936

Ending balance, March 31, 2,695,656$ 2,609,731$ 112,739$ 114,190$ 2,019,009$ 1,834,258$

Weighted average assumptions as of March 31, to determine obligation

Discount rate 5.75% 5.75% 5.75% 5.75% 5.75% 5.75%

Expected return on plan assets - Pension 8.50% 8.50% N/A N/A N/A N/A

Expected return on plan assets - PBOP Nonunion 6.75% 7.25%

Expected return on plan assets - PBOP Union 8.50% 8.75%

Medical trend

Initial 10.00% 10.00%

Ultimate 5.00% 5.00%

Year ultimate is reached 2010 2009

PBOP

Pension Plans

Qualified

Nonqualified

Pension Plans