National Grid 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The settlement between NEP and USGen also resolved the Company’s claims with respect to the

Hydro Quebec transmission line agreements (HQ Transmission Line Agreements), under which

USGen was obligated to reimburse NEP for monthly costs of approximately $1 million. As of April

2, 2004, NEP resumed performance and payment under the HQ Transmissions Line Agreements.

NEP’s resumption of performance and payment obligations has not affected the results of opera-

tions, as NEP is recovering any remaining costs of the HQ Transmission Line Agreements from its

customers through the CTC. The payment received from USGen relates in part to the HQ

Transmission Line Agreements and NEP has filed a plan with the regulators for it to credit the

$195.8 to customers through the CTC.

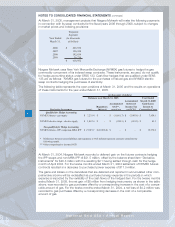

Niagara Mohawk

Niagara Mohawk’s distribution and transmission rates are regulated by the New York Public

Service Commission (PSC) and FERC. As part of the regulatory approval process for the acquisi-

tion of Niagara Mohawk, a 10-year rate plan was approved by the PSC which became effective

on January 31, 2002. Electricity delivery rates were reduced by $152 million and are subject to

only limited adjustments for a period of 10 years. However, Niagara Mohawk will continue to be

able to adjust rates to recover the cost to procure power for customers. Under the plan, rates

were designed so that Niagara Mohawk may earn a return on equity of up to 10.6% after reflect-

ing its share of savings related to the acquisition. Niagara Mohawk is also allowed to earn up to

12.0% if certain customer education targets are met, and half of any earnings in excess of that

amount. Returns above 11.75% are then subject to a sharing mechanism with customers.

Under the plan, gas delivery rates were frozen until the end of the 2004 calendar year, and

Niagara Mohawk now has the right to request an increase at any time, if needed. Under the plan,

rates were designed so that Niagara Mohawk may earn a threshold ROE of up to 10.6%. Niagara

Mohawk is also allowed to earn up to 12.0% if certain customer migration and education goals

are met, and is required to share earnings above this threshold with customers.

Massachusetts Electric Company and Nantucket Electric Company

Under Massachusetts Electric’s long-term rate plan, there is no cap on earnings and no earnings

sharing mechanism until 2010. From May 2000 until February 2005, rates were frozen. In March

2005, a settlement credit in the company’s rates expired, which represents an increase of $10 mil-

lion through February 2006. From March 2006, rates will be adjusted each March until 2009 by

the annual percentage change in average unbundled electricity distribution rates in the northeast-

ern US. In 2010, actual earned savings will be determined and the company will be allowed to

retain 100% of annual earned savings up to $70 million and 50% of annual earned savings

between $70 million and $145 million (all figures pre-tax). Earned savings represents the difference

between calendar year 2008 distribution revenue and the company’s cost of providing service,

including a regional average authorized return. These efficiency incentive mechanisms provide an

opportunity to achieve returns in excess of traditional regulatory allowed returns. Massachusetts

Electric will be allowed to include its share of earned savings in demonstrating its costs of provid-

ing service to customers from January 2010 until May 2020.

In December 2004, the Massachusetts Department of Telecommunications and Energy (MDTE)

approved a comprehensive settlement agreement between Massachusetts Electric, its wholesale

affiliate, NEP, and the Massachusetts Attorney General, which addressed contract termination

charges from NEP to the Company as well as the recovery of certain supply-related costs. For the

Company, the settlement provided for (i) deferred rate recovery of about $66 million of power sup-

ply-related costs (of which $40.5 million has been recognized on the balance sheet at March 31,

2005), with interest, until 2010 and (ii) one-time customer credits of about $10 million, reflecting

$8.5 million of reduced costs due to recent federal tax law changes and $1.4 million to reflect

increased supply costs resulting from reclassifying certain customers from default service to stan-

dard offer service. For NEP, the settlement resolved a broad range of outstanding wholesale rate

issues, including the reasonableness of the proceeds from the litigation and sale associated with

the NEP settlement on the Millstone 3 nuclear generating unit, for a settlement credit of about $10

million.

Nantucket Electric’s distribution rates are linked to Massachusetts Electric’s rates and became

effective on May 1, 2000.

The Narragansett Electric Company

In Rhode Island, Narragansett Electric’s distribution rates are governed by a long-term rate plan.

Between May 2000 and the end of October 2004, rates were frozen and it was permitted to retain

37

National Grid USA / Annual Report