National Grid 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

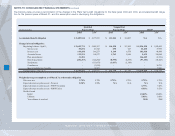

Change in Health Care Cost Trend Rate

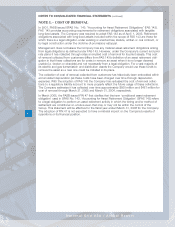

PSC Audit

In connection with an audit performed by the New York State Public Service Commission (PSC)

on one of the Company’s subsidiaries, Niagara Mohawk reached a settlement with the PSC that

resolves all issues associated with Niagara Mohawk’s pension and other postretirement benefit

obligations for the period prior to the acquisition of Niagara Mohawk by the Company. Among

other things, the settlement covers the funding of Niagara Mohawk’s pension and post-retirement

benefit plans. Under the settlement, Niagara Mohawk agreed to provide $100 million of tax-

deductible funding by April 30, 2003 (which it funded in March 2003), and an additional $209 mil-

lion, on a tax-deductible basis, by December 31, 2011. Niagara Mohawk will earn a rate of return

of at least 6.60 percent on any portion of the $209 million that it funds before December 31,

2011, plus 80 percent of the amount by which the rate of return on the pension and post-retire-

ment benefit funds exceeds 5.34 percent. Niagara Mohawk has funded the additional $209 million

to its pension and post-retirement benefit plans as of March 31, 2005.

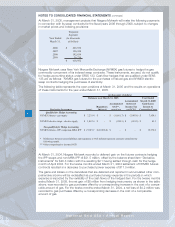

Additional Minimum Pension Liability

The Company has recorded an additional minimum pension liability of approximately $621 million

and $552 million at March 31, 2005 and 2004. While the offset to this entry would normally be a

charge to other comprehensive income, the Company’s subsidiaries NEP and Niagara Mohawk

have recorded regulatory assets in the amount of $252 million and $237 million at March 31, 2005

and 2004, respectively, because they fully recover all pension costs.

Voluntary Early Retirement Offers

In fiscal 2004, National Grid USA companies made two voluntary early retirement offers (VEROs).

The Company expensed approximately $67.2 million of non-union VERO costs in fiscal 2004.

Settlement Losses

As the result of the decline in the stock market since the close of the merger with Niagara

Mohawk and a reduction in the discount rate applied to pension obligations, Niagara Mohawk has

an unrecognized loss in its pension plans. Under Statement of Financial Accounting Standards

No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension

Plans and for Termination Benefits” (FAS 88), Niagara Mohawk must recognize a portion of this

loss immediately when payouts from the plans exceed a certain amount. Niagara Mohawk recog-

nized settlement losses of $21.6 million and $29.5 million in fiscal year 2004 and 2003, respective-

ly. In February 2004, Niagara Mohawk reached an agreement with PSC Staff that would provide

rate recovery for approximately $15 million of the $30 million pension settlement loss incurred in

fiscal 2003. This agreement was approved by the full New York State Public Service Commission

in July 2004. In addition, the agreement covers the funding of the entire settlement loss to benefit

plan trust funds. Under the agreement, Niagara Mohawk will fund the non-recoverable portion of

this loss within 30 days of receipt of the written order, which is expected to become effective in

August 2004. Niagara Mohawk recorded this recovery in the second quarter of fiscal 2005. In

addition, Niagara Mohawk has recently filed a petition with the PSC seeking recovery of its fiscal

year 2004 settlement losses and is unable to predict the outcome of this filing.

53

National Grid USA / Annual Report

Effect of one percentage point change in Health Care Cost Trend rate

2005 2004

Increase 1%

Total of service cost plus interest cost 21,637$ 14,603$

Postretirement benefit obligation 295,000 193,880

Decrease 1%

Total of service cost plus interest cost (18,196) (12,797)

Postretirement benefit obligation (257,030) (175,067)

PBOP