National Grid 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

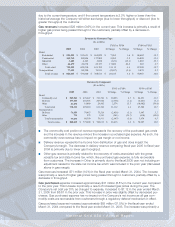

effects of the decreased value of the plan assets due to poor market performance (primarily

in the equities market).

■The decrease in bad debt expense for the year ended March 31, 2005 was mainly the result

of improved collections in New York.

■Insurance expense decreased primarily due to decreased third-party claims against the

Company, decreases in employee accident claims and an expanded emphasis on safety

practices, partially offset by higher insurance premiums due to insurance market conditions.

■Regulatory commission fees are fees paid to the FERC and the state utility commissions

having jurisdiction.

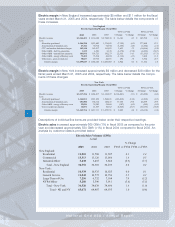

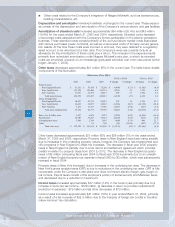

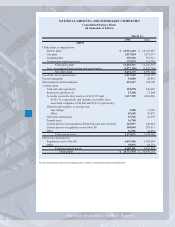

Pass-through items

These costs do not affect operating income or net income as they are recovered through reconcil-

ing rate adjustments or are deferred under the Company’s rate plans.

■Energy conservation expenses include New England’s costs incurred for programs to reduce

energy consumption by customers through various energy efficiency programs. The New

England retail distribution companies manage their own energy efficiency programs while the

New York program is managed by the New York State Energy Research and Development

Authority which assesses the Company a fee.

■Transmission expenses represent New England transmission costs (wheeling, load dispatch-

ing, substations, etc) that are recoverable through rate agreements. The $22 million increase

during fiscal 2005 compared to fiscal 2004 is primarily related to wheeling (transmitting

Company electricity over transmission lines owned by other utilities) and due to retail

electric customers migrating to competitive suppliers for their commodity requirements.

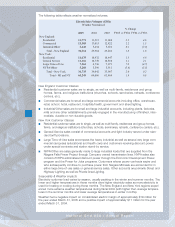

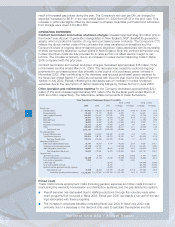

Integration-related costs

■Enterprise resource planning system implementation costs reflect non-capitalizable costs for

new information systems that were implemented on May 1, 2004.

■Voluntary early retirement program costs reflect the special termination benefits offered to

employees to reduce staffing redundancies. During fiscal year 2005, Narragansett Electric was

permitted recovery approximately $23 million of its pension and post retirement benefit obliga-

tions other than pension cost that had been expensed in fiscal year 2004.

■Other costs related to the Company’s integration of Niagara Mohawk, such as severance pay,

building consolidations, etc.

Atypical costs

These items are expenses that the Company considers outside the scope of normal recurring costs.

■In April 2003 the Company experienced an ice storm in its upstate New York service territory

which resulted in excessive repair and power restoration costs beyond normal storm costs.

■Pension settlement losses have resulted primarily from significant lump-sum cash withdrawals

made by retirees of Niagara Mohawk. The pension settlement loss recovery of $14 million

reflects the PSC’s July 2004 approval for Niagara Mohawk to recover a portion of the $30 mil-

lion pension settlement loss incurred in fiscal 2003. Niagara Mohawk has petitioned the Public

Service Commission (PSC) for recovery for $21 million of the pension settlement loss that was

recorded to expense in fiscal 2004.

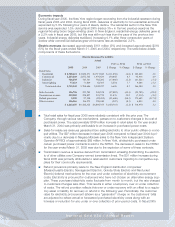

■During fiscal year 2005, the Company recognized a loss on the sale of the following three

properties (i) Buffalo Electric building - $3.5 million, (ii) Towpath property - $0.5 million and (iii)

O’Neil building - $3.2 million.

■The Company recorded a charge of $19 million in fiscal 2003 to write off certain pre-acquisi-

tion Niagara Mohawk projects in its construction work-in-process (CWIP) accounts resulting

from a post-acquisition review of pre-acquisition CWIP projects.

■The Company adjusted Niagara Mohawk’s estimated allowance for doubtful accounts for

customer receivable accounts with balances greater than 90 days in arrears which resulted

in an additional expense of approximately $42 million in fiscal 2003.

17

National Grid USA / Annual Report