Mercury Insurance 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

MERCURY GENERAL CORPORATION

OPERATING LEVERAGE

(Net Premiums Written/Policyholders Surplus as ratio)

DIVIDENDS PER SHARE

(in dollars)

2.5

2.0

1.5

1.0

0.5

0

08 09 10 11 12

2.50

2.30

2.20

2.10

2.40

2.00

08 09 10 11 12

Bodily Injury developed at a rate significantly higher

than historical averages. In addition, we experienced

unfavorable development on the run-off of our California

commercial taxi business and Florida homeowners

business, both of which we ceased writing in 2011. For

the 2012 accident year, we weighed the more recent loss

trends more heavily which should reduce the potential

for unfavorable reserve development in 2013.

In our California homeowners line rate filing, an

administrative law judge recommended a net rate

reduction of 5.5%, which the Insurance Commissioner

accepted in February 2013. We strongly disagree with

the administrative law judge’s decision. In fact, our

actual results clearly demonstrate that the judge’s trend

selections were significantly too low for our most popular

homeowners form. Accordingly, we recently filed for a

6.9% rate increase that reflects our actual results and

have filed an action in Superior Court to overturn the

administrative law judge’s decision. We anticipate that

our Superior Court action will be decided later this year

and we will continue to pursue rates that allow a fair rate

of return.

We are consolidating our claims and underwriting

operations located outside of California into hub

locations in Florida, New Jersey and Texas. Although we

expect approximately $8 million to $13 million (pre-tax)

of office closure costs and severance related expense in

the first quarter of 2013, the new structure will improve

our long term profitability and will allow us to scale more

efficiently as we grow our business outside of California.

Last year, we informed you that we piloted a program

in Georgia that not only provides a quote on line, but

allows the consumer to purchase a policy on-line. In 2012,

we expanded this capability to California, our largest

state. Our initial results are encouraging, although we

are far from perfecting the on-line experience and are

testing and making adjustments as we learn more about

this process. We expect to expand this capability to other

states in 2013.

We plan to implement various initiatives to help grow

our business and improve our bottom line. Our priorities

for 2013 include:

• Implementing improved pricing segmentation and

overall rate adequacy;

• Introducing new commercial automobile products in

Illinois, Pennsylvania, Virginia, and Nevada;

• Introducing an improved homeowners and dwelling

fire product in California;

• Expanding the capability to sell on-line to other

states;

• Continuing to invest in our technology to make it

easier for our agents and customers to transact

business with us;

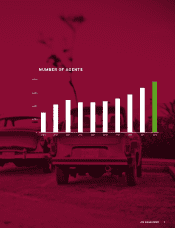

• Increasing the number of relationships with qualified

agents;

• Converting states with legacy systems to our new

technology platform;

• Managing expenses prudently; and

• Continuing our Service Excellence program.