Mercury Insurance 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

MERCURY GENERAL CORPORATION

ifty years later, our premium volume has

grown to $2.6 billion and our product

offerings have expanded to include

homeowners, commercial automobile and

property, and mechanical breakdown insurance.

We employ 4,600 professionals and about 7,700

independent agents who offer Mercury’s products

in thirteen states throughout the nation. Mercury’s

growth from a small California startup insurer fifty

years ago to a multi-billion dollar enterprise would

not have been possible without the talented team

of professionals that helped build this company.

We would like to thank all of our past and present

employees and agents for their contributions to

the success of Mercury.

Our poor financial performance in 2012 is

not how we envisioned celebrating our 50-year

anniversary. Our operating earnings, which

exclude realized gains and losses, were $73.8

million in 2012 compared to $ 153.2 million in 2011,

a decrease of 52%. The decrease in operating

earnings was primarily due to the deterioration in

the combined ratio from 98.5% in 2011 to 102.8%

in 2012. Our 2012 combined ratio was negatively

impacted by a variety of factors, including $39 million

of catastrophe losses, most of which came from

Hurricane Sandy, higher recorded frequency and

severity and $42 million in unfavorable loss reserve

development.

Although our 2012 operating results were

disappointing, they masked several positive

milestones. Total premiums written grew by 3% in

2012 and in the fourth quarter premiums written

grew 5.9% compared to the same period in 2011, the

highest percentage increase since the first quarter of

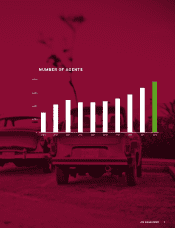

2006. The growth is attributable to several factors,

including our California revenue neutral rating plan

we implemented in December 2011, which made us

more competitive for new business, as well as an

increase in the number of agents selling our products.

California new business private passenger automobile

applications increased year over year by 19%.

In addition, our results outside of California continue

to improve. Excluding the impact of Hurricane

Sandy, our operations outside of California posted

a combined ratio under 100% in the fourth quarter

and slightly over 100% for the year. Over the past few

years we have taken significant rate action in most

states outside of California and the impact of those

rate actions is having a positive impact on our results.

We believe our underlying results outside of California

For Mercury, 2012 was a milestone year as we celebrated our 50th year in business. Mercury’s

operations began in 1962 in a small office on Wilshire Boulevard in Los Angeles, California.

Our strategy was to provide a competitively priced private passenger automobile product

to California consumers by establishing valuable partnerships with agents, underwriting

our business carefully, effectively managing our claims processes and providing excellent

customer service. We started with six employees in our first year in business and wrote

less than $1 million in premiums.

“ Total premiums written grew by 3% in 2012

and in the fourth quarter, premiums written

grew 5.9% compared to the same period in

2011, the highest percentage increase since

the first quarter of 2006.”