Mercury Insurance 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 ANNUAL REPORT

Table of contents

-

Page 1

2 0 1 2 A N N U A L R E P O R T -

Page 2

... OUR EMPLOYEES AND AGENTS FOR THEIR SUPPORT AND DEDICATION TO OUR CUSTOMERS "I founded Mercury with the belief we could create a better insurance company. Today, with the help and support of the best agents and employees in the business, we have done that and more. Our products, pricing and service... -

Page 3

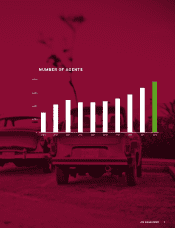

NUMBER OF AGENTS 8,000 6,000 4,000 2,000 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2012 ANNUAL REPORT 1 -

Page 4

... San Diego. 1970 Mercury writes $1 million in premiums during a single month. 1964 Mercury opens its ï¬rst Orange County, CA ofï¬ce. 1971 Number of Mercury agents increases to 467 1966 Mercury opens its ï¬rst ofï¬ces in the San Fernando Valley. San Fernando Valley, California and a product... -

Page 5

...customers can always count on personalized service -24 hours a day, seven days a week. In 1977, the company formed a new subsidiary, Mercury Insurance Company, which would ultimately grow to become the largest insurance subsidiary, producing over $1.2 billion in premiums in 2012. 2012 ANNUAL REPORT... -

Page 6

... like Georgia and Illinois. Mercury would open an office in Florida in 1998, and subsequently open offices in nine additional states over the next two decades, including in New York and Virginia. The acquisition of American Fidelity Insurance Group (renamed American 4 MERCURY GENERAL CORPORATION -

Page 7

...reach across different product lines to offer policies for the home and umbrella coverage. Today, Mercury is proud to offer comprehensive insurance policies for auto, home and businesses, providing its customers broader, more cohesive protection at even more competitive rates. 2012 ANNUAL REPORT 5 -

Page 8

..., Mercury insures more than 1 million vehicles statewide. 2003 Company-wide written premiums top $2.25 billion. Mercury enters New Jersey market. 2004 Mercury increases market share to nine percent of the California market. Mercury begins writing in Arizona, Michigan, Nevada and Pennsylvania... -

Page 9

... 2009). Mercury purchases AIS (Auto Insurance Specialists), the nation's largest personal lines independent insurance agency. 2005 Mercury's total assets exceed $4 billion for the ï¬rst time. 2011 Mercury launches Buy Button project in Georgia, the company's ï¬rst direct-toconsumer sales effort... -

Page 10

... to California consumers by establishing valuable partnerships with agents, underwriting our business carefully, effectively managing our claims processes and providing excellent customer service. We started with six employees in our first year in business and wrote less than $1 million in premiums... -

Page 11

... the California Department of Insurance. Catastrophe losses are part of this business and we experienced our share of them in 2012. We price our products to include a catastrophe load for expected catastrophe losses and in years when there are low "In our largest market, California, increases in... -

Page 12

...and customers to transact business with us; • Increasing the number of relationships with qualified agents; • Converting states with legacy systems to our new technology platform; • Managing expenses prudently; and • Continuing our Service Excellence program. 10 MERCURY GENERAL CORPORATION -

Page 13

... to provide a generous dividend yield based on the recent market price of our stock. Our strong capital position has allowed us to pay a dividend in years, such as 2012, Sincerely, George Joseph Chairman of the Board Gabriel Tirador President and Chief Executive Officer 2012 ANNUAL REPORT 11 -

Page 14

... SUMMARY All dollar figures in thousands, except per share data 2012 2011 2010 2009 OPERATING RESULTS (GAAP BASIS): Net premiums written Change in net unearned premiums Net premiums earned Losses and loss adjustment expenses Underwriting expenses Net investment income Net realized investment... -

Page 15

... 1.72 60.45-51.16 $ $ 19.9% 54,471 54,515 1.48 60.26-46.29 $ $ 15.0% 54,402 54,424 1.32 50.30-33.50 2012 ANNUAL REPORT 13 -

Page 16

... 12, 2013 This Annual Report document includes Mercury General Corporation's financial statements and supporting data, management's discussion and analysis of financial condition and results of operations and quantitative and qualitative disclosures about market risks from the Company's Form 10... -

Page 17

...Automobile Homeowners Commercial Automobile Commercial Packages Mechanical Breakdown Personal Umbrella Private Passenger Automobile Homeowners Mechanical Breakdown NEW JERSEY CALIFORNIA NEW YORK FLORIDA OKLAHOMA GEORGIA PENNSYLVANIA ILLINOIS TEXAS MICHIGAN VIRGINIA 2012 ANNUAL REPORT 15 -

Page 18

16 MERCURY GENERAL CORPORATION -

Page 19

..., Los Angeles, California (Address of principal executive offices) 90010 (Zip Code) _____ Registrant's telephone number, including area code: (323) 937-1060 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock New... -

Page 20

...,826,147 shares of common equity held by non-affiliates multiplied by $41.67, the closing sales price on the New York Stock Exchange for such date, as reported by the Wall Street Journal). At February 1, 2013, the Registrant had issued and outstanding an aggregate of 54,921,877 shares of its Common... -

Page 21

... and Servicing of Business Underwriting Claims Losses and Loss Adjustment Expenses Reserves and Reserve Development Statutory Accounting Principles Investments Competitive Conditions Reinsurance Regulation Executive Officers of the Company Risk Factors Unresolved Staff Comments Properties Legal... -

Page 22

...the "Insurance Companies") in a number of states, principally California. The Company also writes homeowners, commercial automobile and property, mechanical breakdown, fire, and umbrella insurance. The direct premiums written for the years ended December 31, 2012, 2011, and 2010 by state and line of... -

Page 23

... accident for property damage. The principal executive offices of Mercury General are located in Los Angeles, California. The home office of the Company's California insurance subsidiaries and the Information Technology center are located in Brea, California. The Company also owns office buildings... -

Page 24

..., the Company offers mechanical breakdown insurance in most states; and homeowners insurance in Arizona, California, Georgia, Illinois, New Jersey, New York, Oklahoma, Texas, and Virginia. The Company completed its exit of the Florida homeowners market in 2012. In California, "good drivers," as... -

Page 25

basis of historical information by line of insurance. Inflation is reflected in the reserving process through analysis of cost trends and review of historical reserve settlement. The Company's ultimate liability may be greater or less than management estimates of reported losses and loss adjustment ... -

Page 26

... to an increase in the estimated loss severity for accident years 2010 and 2011 California BI losses. In addition, the Company experienced unfavorable development on the run-off of California commercial taxi business and Florida homeowners business, both of which the Company ceased writing in 2011... -

Page 27

... to an increase in the Company's prior accident years' loss estimates for personal automobile insurance in Florida and New Jersey. In addition, an increase in estimates for loss severity for the 2004 accident year reserves for California and New Jersey automobile lines of business contributed to... -

Page 28

..., Aggregates & Averages (2009 through 2012), for all property and casualty insurance companies (private passenger automobile line only, after policyholder dividends). Source: A.M. Best, "Best's Special Report U.S. Property/Casualty-Review & Preview, February 4, 2013." Premiums to Surplus Ratio The... -

Page 29

... Consolidated Financial Statements. At December 31, 2012, 67.4% of the Company's total investment portfolio at fair value and 89.0% of its total fixed maturity investments at fair value were invested in tax-exempt state and municipal bonds. For more detailed information including credit ratings, see... -

Page 30

... losses in excess of $500,000 per person and has no maximum limit. Michigan law provides for unlimited lifetime coverage for medical costs caused by automobile accidents. For California homeowners policies, the Company has reduced its catastrophe exposure from earthquakes by placing earthquake risks... -

Page 31

... recent homeowners loss trends support an increase. Consequently, the Company recently filed for a rate increase of 6.9%. Insurance rates in Georgia, New York, New Jersey, Pennsylvania, and Nevada require prior approval from the state DOI, while insurance rates in Illinois, Texas, Virginia, Arizona... -

Page 32

... there will be additional assessments in 2013. The CEA is a quasi-governmental organization that was established to provide a market for earthquake coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowner policy directly with the CEA... -

Page 33

...the property and casualty insurance business. Mr. Tirador, President and Chief Executive Officer, served as the Company's assistant controller from 1994 to 1996. In 1997 and 1998, he served as the Vice President and Controller of the Automobile Club of Southern California. He rejoined the Company in... -

Page 34

...1991, and named Chief Underwriting Officer in January 2010. Mr. Minnich, Vice President-Marketing, joined the Company as an underwriter in 1989. In 2007, he joined Superior Access Insurance Services as Director of Agency Operations and rejoined the Company as an Assistant Product Manager in 2008. In... -

Page 35

...'s Business The Company remains highly dependent upon California and several other key states to produce revenues and operating profits. For the year ended December 31, 2012, the Company generated 77.2% of its direct automobile insurance premiums written in California, 8.0% in Florida, 3.3% in New... -

Page 36

..., regulations, or new interpretations of existing regulations that would adversely affect the Company's business, financial condition, and results of operations. Loss of, or significant restriction on, the use of credit scoring in the pricing and underwriting of personal lines products could reduce... -

Page 37

... even the most credit-worthy borrowers. In addition, financial strength and claims-paying ability ratings have become an increasingly important factor in the Company's ability to access capital markets. Rating agencies assign ratings based upon an evaluation of an insurance company's ability to meet... -

Page 38

... the volatility of the losses on its financial condition and results of operations. The availability and cost of reinsurance is subject to market conditions, which are outside of the Company's control. From time to time, market conditions have limited, and in some cases prevented, insurers from 17 -

Page 39

... sales of its policies at any time. The Company sells its insurance policies through approximately 7,700 independent agents. The Company must compete with other insurance carriers for these agents' business. Some competitors offer a larger variety of products, lower prices for insurance coverage... -

Page 40

... and actuarial processes and policies, and to maintain its policyholder data. The Company is developing and deploying new information technology systems that are designed to manage many of these functions across all of the states in which it operates and all of the lines of insurance it offers... -

Page 41

...the Company's business. The Company's policyholders and employees have a high expectation that it will adequately protect their personal information. The regulatory environment, as well as the requirements imposed by the payment card industry and insurance regulators, governing information, security... -

Page 42

... Company, which could adversely affect premium revenue. The Company's business is vulnerable to significant losses related to sinkhole claims, which could have an adverse effect on its results of operations. In 2011, the Company began its withdrawal from the Florida homeowners market due to the high... -

Page 43

...a market. For example, these states may limit a private passenger auto insurer's ability to cancel and non-renew policies or they may prohibit the Company from withdrawing one or more lines of insurance business from the state unless prior approval is received from the state insurance department. In... -

Page 44

... non-public consumer information and related privacy issues; the use of credit history in underwriting and rating; limitations on the ability to charge policy fees; limitations on types and amounts of investments; the payment of dividends; the acquisition or disposition of an insurance company or of... -

Page 45

... Company conducts its business and results of operations, which could materially increase the Company's legal expenses. In addition, potential litigation involving new claim, coverage, and business practice issues could adversely affect the Company's business by changing the way policies are priced... -

Page 46

... by the Company at December 31, 2012 Location Purpose Brea, CA Folsom, CA Los Angeles, CA Rancho Cucamonga, CA St. Petersburg, FL Oklahoma, OK Item 3. Legal Proceedings Home office and I.T. facilities (2 buildings) Administrative and Data Center Executive offices Administrative Administrative... -

Page 47

... to notify the California DOI of any dividend after declaration, but prior to payment. There are similar limitations imposed by other states on the Insurance Companies' ability to pay dividends. As of December 31, 2012, the Insurance Companies are permitted to pay in 2013, without obtaining DOI... -

Page 48

... repurchase on July 27, 2012, and the authorization will expire in July 2013. The Company may repurchase shares of its common stock under the program in open market transactions at the discretion of management. The Company will use dividends received from the Insurance Companies to fund the share... -

Page 49

... financial statements and notes thereto contained elsewhere in this Annual Report on Form 10-K. Year Ended December 31, 2012 2011 2010 2009 2008 (Amounts in thousands, except per share data) Income Data: Net premiums earned Net investment income Net realized investment gains (losses) Other Total... -

Page 50

..., particularly in California; the Company's ability to obtain and the timing of required regulatory approvals of premium rate changes for insurance policies issued in states where the Company operates; the Company's reliance on independent agents to market and distribute its policies; the investment... -

Page 51

... of insurance accounted for 80.6% of the $2.7 billion of the Company's direct premiums written in 2012. 78.0% of the private passenger automobile premiums were written in California. The Company also operates in Arizona, Florida, Georgia, Illinois, Michigan, Nevada, New Jersey, New York, Oklahoma... -

Page 52

...-to-use agency portal that provides a customized work queue for each agency user showing new business leads, underwriting requests and other pertinent customer information in real time. Agents can also assist customers with processing payments, reporting claims or updating their records. The system... -

Page 53

... increase. Consequently, the Company recently filed for a rate increase of 6.9%. In January 2013, the California DOI approved auto body repair regulation to strengthen consumer protection. This regulation builds on existing protection by requiring insurers to settle automobile insurance claims using... -

Page 54

... for loss reserves. This uncertainty comes from many factors which may include changes in claims reporting and settlement patterns, changes in the regulatory or legal environment, uncertainty over inflation rates and uncertainty for unknown items. The Company does not make specific provisions for... -

Page 55

... motorists. BI payments are primarily for medical costs and general damages. The following table presents the typical closure patterns of BI claims in the California automobile insurance coverage: % of Total Claims Closed Dollars Paid BI claims closed in the accident year reported BI claims... -

Page 56

... average cost for all claims (severity) but increasing the total number of claims (frequency). Mercury has historically used this approach to handle its BI claims. Beginning late in 2008 and continuing through the end of 2009, the Company changed its claims handling procedures and discontinued the... -

Page 57

California Bodily Injury Claim Count Reserve Sensitivity Analysis Amount Recorded at 12/31/12 at 7% Claim Count Development Total Expected Amount If Claim Count Development is 0% Total Expected Amount If Claim Count Development is 10% 2012 Accident Year Claims Reported Claim count 26,757 28,671 ... -

Page 58

... gains or losses in the consolidated statements of operations. The majority of equity holdings, including non-redeemable fund preferred stocks, is actively traded on national exchanges or trading markets, and is valued at the last transaction price on the balance sheet dates. Fair Value of Financial... -

Page 59

..., the Company increased private passenger automobile insurance rates in twelve states outside California and grew its homeowners business in several states outside of California during 2012. Net premiums written is a non-GAAP financial measure which represents the premiums charged on policies issued... -

Page 60

... line of business. The 2011 loss ratio was negatively impacted by a total of $18 million of catastrophe losses due to California winter storms, Hurricane Irene, and Georgia tornadoes during 2011. Expense ratio is calculated by dividing the sum of policy acquisition costs plus other operating... -

Page 61

... and $31.3 million in 2012 and 2011, respectively, due to changes in the fair value of total investments pursuant to application of the fair value accounting option. The net gains during 2012 arise from $36.3 million and $9.2 million increases in the market value of the Company's fixed maturity and... -

Page 62

...for the Insurance Companies are premiums, sales and maturity of invested assets, and dividend and interest income from invested assets. The principal uses of funds for the Insurance Companies are the payment of claims and related expenses, operating expenses, dividends to Mercury General, payment of... -

Page 63

... in 2012 was $148.1 million, a decrease of $10.5 million compared to 2011. The decrease was primarily due to the increased payment of income taxes and losses and lower investment income as a result of the lower interest rate environment, partially offset by increased premiums collected. The Company... -

Page 64

... and agencies Municipal securities Mortgage-backed securities Corporate securities Collateralized debt obligations Equity securities: Common stock: Public utilities Banks, trusts and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund... -

Page 65

...securities is credit risk, which is managed by maintaining a weighted-average portfolio credit quality rating of AA-, at fair value, consistent with the average rating at December 31, 2011. To calculate the weighted-average credit quality ratings as disclosed throughout this Annual Report on Form 10... -

Page 66

... bonds and agencies: Treasuries Government Agency Total Municipal securities: Insured Uninsured Total Mortgage-backed securities: Commercial Agencies Non-agencies: Prime Alt-A Total Corporate securities: Communications Consumer-cyclical Consumer-non-cyclical Energy Financial Industrial Technology... -

Page 67

... in a private credit fund. The net gains in 2012 due to changes in fair value of the Company's equity portfolio were $9.2 million. The primary cause of the gains on the Company's equity securities was the overall increase in the equity markets. The Company's common stock allocation is intended... -

Page 68

... include money market accounts, options, and short-term bonds which are highly rated short duration securities and redeemable within one year. D. Debt Effective August 4, 2011, the Company extended the maturity date of the $120 million Bank of America credit facility from January 1, 2012 to January... -

Page 69

... after-tax yields, mitigate market risks, and optimize capital to improve profitability and returns. The Company manages exposures to market risk through the use of asset allocation, duration, and credit ratings. Asset allocation limits place restrictions on the total funds that may be invested... -

Page 70

... policy on an aggregate risk management basis, as well as their ability to recover their investment on an individual issue basis. Equity price risk Equity price risk is the risk that the Company will incur losses due to adverse changes in the equity markets. At December 31, 2012, the Company... -

Page 71

...years at December 31, 2011 and 2010, respectively. Given a hypothetical parallel increase of 100 or 200 basis points in interest rates, the Company estimates that the fair value of its bond portfolio at December 31, 2012 would decrease by $75.4 million or $150.8 million, respectively. Conversely, if... -

Page 72

...Data INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Reports of Independent Registered Public Accounting Firm Consolidated Financial Statements: Consolidated Balance Sheets as of December 31, 2012 and 2011 Consolidated Statements of Operations and Consolidated Statements of Comprehensive Income for... -

Page 73

... issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 11, 2013 expressed an unqualified opinion on the effectiveness of the Company's internal control over financial reporting. /s/ Los Angeles, California February 11, 2013 KPMG LLP 52 -

Page 74

...statements of operations, comprehensive income, shareholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2012, and our report dated February 11, 2013 expressed an unqualified opinion on those consolidated financial statements. /s/ Los Angeles, California... -

Page 75

... AND SHAREHOLDERS' EQUITY Losses and loss adjustment expenses Unearned premiums Notes payable Accounts payable and accrued expenses Current income taxes Deferred income taxes Other liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock without par value or... -

Page 76

...CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) Year Ended December 31, 2012 2011 2010 Revenues: Net premiums earned Net investment income Net realized investment gains Other Total revenues Expenses: Losses and loss adjustment expenses Policy... -

Page 77

MERCURY GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in thousands) Year Ended December 31, 2012 2011 2010 Common stock, beginning of year Proceeds of stock options exercised Share-based compensation expense Tax benefit on sales of incentive stock options ... -

Page 78

... of stock options Increase in premiums receivable Changes in current and deferred income taxes (Increase) decrease in deferred policy acquisition costs Increase (decrease) in unpaid losses and loss adjustment expenses Increase (decrease) in unearned premiums Increase (decrease) in accounts payable... -

Page 79

... 13 Insurance Companies in a number of states, principally California. The Company also writes homeowners, commercial automobile and property, mechanical breakdown, fire, and umbrella insurance. The private passenger automobile lines of insurance exceeded 80% of the Company's direct premiums written... -

Page 80

.... If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Company has realized a gain or loss. The Company, as writer of an option, bears the market risk of an unfavorable change in the price of the security... -

Page 81

... as those related directly to the successful acquisition of new or renewal insurance contracts. Effective January 1, 2012, the Company adopted the new standard using the prospective method. Deferred policy acquisition costs consist of commissions paid to outside agents, premium taxes, salaries, and... -

Page 82

... basis for evaluating ultimate losses, particularly in the Company's larger, more established lines of business which have a long operating history. The average severity method analyzes historical loss payments and/or incurred losses divided by closed claims and/ or total claims to calculate an... -

Page 83

... performance. The Company does not have any operations that require separate disclosure as reportable operating segments for the periods presented. The annual direct premiums written attributable to private passenger automobile, homeowners, commercial automobile, and other lines of insurance were as... -

Page 84

... value of stock option awards is estimated using the Black-Scholes option pricing model with the grant-date assumptions and weighted-average fair values. Under its 2005 Incentive Award Plan (the "2005 Plan"), the Compensation Committee of the Company's Board of Directors granted performance vesting... -

Page 85

... At December 31, 2012, fixed maturity holdings rated below investment grade and non-rated comprised 2.8% of total investments at fair value. Additionally, the Company owns securities that are credit enhanced by financial guarantors that are subject to uncertainty related to market perception of the... -

Page 86

... markets; or Either directly or indirectly observable inputs as of the reporting date. Pricing inputs are unobservable and significant to the overall fair value measurement, and the determination of fair value requires significant management judgment or estimation. In certain cases, inputs used... -

Page 87

... using multiple observable inputs, such as benchmark yields, reported trades and broker/dealer quotes, for identical or similar assets in active markets. The Company had holdings of $4.3 million and $0 at December 31, 2012 and 2011, respectively, in commercial mortgage-backed securities. Corporate... -

Page 88

...: Public utilities Banks, trusts and insurance companies Energy and other Non-redeemable preferred stock Partnership interest in a private credit fund Short-term bonds Money market instruments Total assets at fair value Liabilities Equity contracts Interest rate swap agreements Total liabilities at... -

Page 89

...Credit Fund Municipal Securities (Amounts in thousands) Beginning Balance $ Realized gains (losses) included in earnings Purchase Sales Settlements Ending Balance $ The amount of total (losses... fair value hierarchy in 2012 and 2011. At December 31, 2012, the Company did not have any nonrecurring... -

Page 90

... Financial Instruments The Company is exposed to certain risks relating to its ongoing business operations. The primary risks managed by using derivative instruments are equity price risk and interest rate risk. Equity contracts on various equity securities are intended to manage the price risk... -

Page 91

... for the Company's insurance subsidiaries under statutory regulations. The Company manages the risk associated with covered calls through strict capital limitations and asset diversification throughout various industries. 8. Goodwill and Other Intangible Assets Goodwill There was a slight change in... -

Page 92

... (Amounts in thousands) Net Carrying Amount Useful Lives (in years) As of December 31, 2012: Customer relationships Trade names Technology Favorable leases Software Total intangible assets, net As of December 31, 2011: Customer relationships Trade names Technology Favorable leases Software... -

Page 93

...Income tax provision The Company and its subsidiaries file a consolidated federal income tax return. The provision for income tax expense consists of the following components: Year Ended December 31, 2012 2011 (Amounts in thousands) 2010 Federal Current Deferred State Current Deferred Total Current... -

Page 94

...50% likely of being realized upon ultimate settlement is recognized in the financial statements. There were no material changes to the total amount of unrecognized tax benefits related to tax uncertainties during 2012. The Company does not expect any changes in such unrecognized tax benefits to have... -

Page 95

... commercial taxi business and Florida homeowners business, both of which the Company ceased writing in 2011. 2012 accident year losses were also impacted by higher loss severity and frequency on the California private passenger automobile line of business. The increase in the provision for insured... -

Page 96

... three years. The Plan includes an option for employees to make salary deferrals under Section 401(k) of the Internal Revenue Code. The matching contributions, at a rate set by the Board of Directors, totaled $7.2 million, $7.2 million, and $7.0 million for 2012, 2011, and 2010, respectively. The... -

Page 97

....73 As of December 31, 2012, $42,000 of total unrecognized compensation cost related to non-vested stock options is expected to be recognized over a weighted-average period of 0.4 years. Under the 2005 Plan, the Compensation Committee of the Company's Board of Directors granted performance vesting... -

Page 98

... have been anti-dilutive. 16. Commitments and Contingencies Operating Leases The Company is obligated under various non-cancellable lease agreements providing for office space, automobiles, and office equipment that expire at various dates through the year 2019. For leases that contain predetermined... -

Page 99

... that was established to provide a market for earthquake coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowners policies directly with the CEA. The Company receives a small fee for placing business with the CEA, which is recorded... -

Page 100

..., results of operations, and liquidity. The Company applies the fair value option to its investment portfolio. Rapidly changing and unprecedented credit and equity market conditions could materially impact the valuation of securities as reported within the Company's financial statements, and the... -

Page 101

... 2013, the Company announced a net workforce reduction of approximately 135 employees, representing less than 3% of the total workforce, resulting from the consolidation of its claims and underwriting operations located outside of California into hub locations in Florida, New Jersey, and Texas... -

Page 102

... the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow for timely decisions regarding required disclosure. In designing... -

Page 103

... Directors, Executive Officers, and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services Information... -

Page 104

... 2011-1 to the Mercury General Corporation Profit Sharing Plan. Management agreement effective January 1, 2001 between Mercury Insurance Services, LLC and Mercury Casualty Company, Mercury Insurance Company, California Automobile Insurance Company and California General Insurance Company. 83 -

Page 105

... Insurance Services, LLC and Mercury Insurance Company of Florida and Mercury Indemnity Company of Florida. Management Agreement dated January 22, 1997 between Mercury County Mutual Insurance Company and Mercury Insurance Services, LLC. Director Compensation Arrangements. Mercury General Corporation... -

Page 106

...document was filed as an exhibit to Registrant's Registration Statement on Form S-1, File No. 33-899, and is incorporated ...management contract or compensatory plan or arrangement. Pursuant to Rule 406T of Regulation S-T, the XBRL related information in Exhibit 101 to this Annual Report on Form 10K... -

Page 107

...this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated. Signature Title Date /S/ GEORGE JOSEPH George Joseph Chairman of the Board President and Chief Executive Officer and Director (Principal Executive Officer) Vice... -

Page 108

...ACCOUNTING FIRM The Board of Directors and Shareholders Mercury General Corporation: Under date of February 11, 2013, we reported on the consolidated balance sheets of Mercury General Corporation and subsidiaries (the Company) as of December 31, 2012 and 2011, and the related consolidated statements... -

Page 109

...agencies Municipal securities Mortgage-backed securities Corporate securities Collateralized debt obligations Total fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies...accompanying Report of Independent Registered Public Accounting Firm S-2 -

Page 110

...agencies Municipal securities Mortgage-backed securities Corporate securities Collateralized debt obligations Total fixed maturity securities Equity securities: Common stock: Public utilities Banks, trust and insurance companies...accompanying Report of Independent Registered Public Accounting Firm S-3 -

Page 111

... II MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT BALANCE SHEETS December 31, 2012 2011 (Amounts in thousands) ASSETS Investments, at fair value: Equity securities (cost $31,178; $24,885) Short-term investments (cost $47,174; $26,817) Investment in subsidiaries Total... -

Page 112

... MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF OPERATIONS Year Ended December 31, 2012 2011 (Amounts in thousands) 2010 Revenues: Net investment income Net realized investment gains (losses) Total revenues Expenses: Other operating expenses Interest Total... -

Page 113

SCHEDULE II, Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS Year Ended December 31, 2012 2011 (Amounts in thousands) 2010 Cash flows from operating activities: Net cash used in operating activities Cash flows from investing activities: ... -

Page 114

...American Mercury Lloyds Insurance Company Mercury County Mutual Insurance Company Mercury Insurance Company of Florida Mercury Indemnity Company of America Mercury Select Management Company, Inc. American Mercury MGA, Inc. Concord Insurance Services, Inc. Mercury Insurance Services LLC Mercury Group... -

Page 115

SCHEDULE IV MERCURY GENERAL CORPORATION AND SUBSIDIARIES REINSURANCE THREE YEARS ENDED DECEMBER 31, Property and Liability Insurance Earned Premiums 2012 2011 (Amounts in thousands) 2010 Direct amounts Ceded to other companies Assumed Net amounts $ $ 2,578,715 $ (5,066) 1,271 2,574,920 $ 2,569,... -

Page 116

... Company, Inc. American Mercury MGA, Inc.** Mercury Group, Inc.** Auto Insurance Specialists LLC AIS Management LLC PoliSeek AIS Insurance Solutions, Inc. TRANSFER AGENT & REGISTRAR Computershare Trust Company, N.A. 250 Royall Street Canton, MA 02021 Telephone number: (866) 214-7508 Website... -

Page 117

Environmental Benefits Statement To minimize our environmental impact, the Mercury General Corporation 2012 Annual Report was printed on paper containing fibers from environmentally appropriate, socially beneficial and economically viable forest resources.