Marks and Spencer 2016 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2016 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

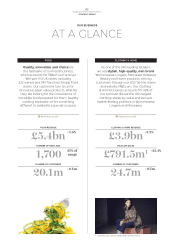

OUR BUSINESS

07

ANNUAL REPORT AND FINANCIAL STATEMENTS 2016

OUR PERFORMANCEGOVERNANCEFINANCIAL STATEMENTS

our price points and reshaped the structure

of our Womenswear team to better refl ect

the way our customers shop. This new

structure means that garments are now

bought by product category – such as

skirts, shirts, or trousers – rather than by

M&S Collection and the sub-brands, such

as Autograph and Limited Edition. This way

we reduce needless proliferation. We have

also dropped ‘General Merchandise’ as

the catch-all name for the non-Food half

of our business: we should be using the

same language as our customers to

describe our business.

We have a lot more to do. We have been

giving customers too many reasons not

to shop with us. They tell us that we have

not got the balance between fashion and

style right and that we don’t o er enough

choice. They say that we are sometimes too

expensive and that our stores are di cult

to shop. In addition, we know that our

internal structure has meant that we have

not pursued areas of high growth quickly

enough. Our plan this year is to address the

root causes of these issues. We will continue

to lower prices across the board and reduce

the number of promotions. We will put

increased emphasis on contemporary

styling rather than slavishly following

catwalk trends, and we will focus on

innovations that are genuinely useful to

our customers.

We know that our customers want to feel

that they’re getting great value every time

they shop with us. It is for the customer –

not us – to decide what constitutes value.

But I would say that the equation

customers use when assessing value is

satisfaction minus price. Did they enjoy

their experience? How good is the product?

Does it fi t well or taste good? How was

the service? These are the building blocks

of satisfaction. Once the customer has

assessed these, she can subtract the

price and determine whether she’s

received value.

FOOD

In our Food division we have an engine

for sustained, profi table growth. The

opportunity remains for us to grow our

Simply Food store network in the UK and

internationally as we strive to make every

food moment special for our customers

around the world. We will continue to

innovate, with an emphasis on health,

convenience, special occasions and gifting.

We will o er customers real choice by

carefully tailoring our ranges to the

location of the store and the mission of the

shopper. Whether they want a pork pie or a

superfood salad, a pint of milk or a chicken

tikka prepared meal, we will strive to give

them the best there is. In addition to the

250 Simply Food stores we have already

committed to, we will open a further 200 by

the end of 2018/19 to make our great food

o er accessible to even more customers.

COSTS

We will continue to be prudent on costs.

In some cases, our processes have become

too complicated and we continue to review

the way we work with a view to simplifying it.

We will use any cost savings to invest in

more store colleagues. After all, they are the

people who are closest to our customers.

OUR PEOPLE

Fairness and consistency are important

to me. I believe in rewarding people for

success, wherever they work in the

company. We have reviewed how we

reward our employees and have proposed

a new approach to pay and pensions.

The proposed pay changes, which would

make us one of the best payers in UK

retail, would reward our people in a fair and

consistent way and include proposals for

a signifi cant base rate increase for our

Customer Assistants. The proposed new

approach to pensions would ensure we

o er all employees the same Defi ned

Contribution Scheme; a competitive

pension scheme that is sustainable for

the future. Members of the Defi ned Benefi t

Pension scheme would not lose any

benefi ts they have previously earned

and would be auto-enrolled into the Defi ned

Contribution Scheme. We have started

a period of consultation with National

Business Involvement Group, the

appropriate representatives within

M&S’s network of elected employee

representatives, on both of these

proposals and will listen carefully to their

feedback. I believe that these changes

would mean we can o er one of the best

pay and benefi t packages in UK retail,

so we can keep retaining and attracting

the best people to our business.

INTEGRITY IN TOUCH

We always strive to do the right thing We listen actively and act thoughtfully

CUSTOMER AND BRAND

UK STORE

ESTATE

FINANCIAL PLAN

INTERNATIONAL ORGANISATION COST REVIEW

RECOVER AND GROW

CLOTHING & HOME

CONTINUE TO GROW

FOOD

PRIORITIES TO ADDRESS

FOCUS ON PUTTING CUSTOMERS AT THE

HEART OF M&S AND DRIVING SALES GROWTH

Implementing actions to recover and grow Clothing & Home:

> Re-establish style authority: focus on product, quality and fi t;

> Restore price position: lowering prices and reduced

promotional stance;

> Enhanced customer experience: sharper ranges, better

availability and investment in store sta ng.

Continuing to grow Food business:

> Build on strengths: focus on quality, innovation and choice;

> Commitment to value credentials: competitive pricing

while maintaining margin;

> Improved convenience: extended Simply Food store

opening programme.

Driving profi tability for shareholders:

> Continued tight control of costs and cash;

> Focus on shareholder returns.

Additional strategic questions, including International, UK store

estate and organisation to be answered in the autumn.