Marks and Spencer 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Marks and Spencer Group plc Annual report and financial statements 2010 Directors’ report 10

Page Title

Page Title continued

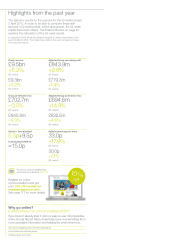

Performance overview

Key performance indicators

£9.5bn

+5.2%

Analysis: During the year

we grew our value market

share and held on volume,

see page 16 onwards for

details of our clothing

business.

Source: Kantar Worldpanel

Value market share

11. 0 %

2008/09 10.7%

2007/08 11.0%

2006/07 11.1%

UK market share Clothing and footwear

Volume market share

11. 2 %

2008/09 11.2%

2007/08 11.3%

2006/07 10.7%

UK market share Food

Analysis: Our market share is slightly

down, reflecting the fact we were the

only retailer to lower prices during what

was an inflationary period. See page

24 for details on how we are working

to further improve our Food business.

Source: Kantar Worldpanel

3.8%

2008/09 3.9%

2007/08 4.3%

2006/07 4.2%

What we sell

Growing our core UK business

Average weekly UK footfall

Analysis: Around half of UK stores

have cameras fitted at the entrance

to allow us to track customer visits.

We calculate our average footfall by

analysing the ratios between visits

and sales in these stores and then

applying it to stores without cameras.

£843.9m

+9.8%

UK mystery shopping programme

Analysis: Mystery shoppers anonymously visit

all of our UK stores once a month – twice for

flagship stores – to evaluate the levels of

service, scoring factors such as how staff

welcome customers and the management of

store environment. This year over 6,500 visits

were conducted and we have seen a 5%

increase in service scores.

Visits completed

6,500

average

score 89%

2008/09

2009/10

Apr

%

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

88 88 88

89

88 88 88 88

90

88

90 90

80 82

83

81

84

83 83

84

86

84

87 86

2007/08

21.8m

2006/07

21.0m

2008/09

21.6m

Financial performance These financial performance indicators are based on the statutory 53 week period ended 3 April 2010.

Performance against our strategy

Average weekly footfall

21.0m

Group revenue

Adjusted Group operating profit*

2009/10

21.0m

2009/10

2008/09

£8.588.1m

£9,536.6m

2006/07

2007/08 £9.022.0m

£9,062.1m

2009/10

2008/09

£1,044.0m

£843.9m

2006/07

2007/08 £1,089.3m

£768.9m

£m 06/07 07/08 08/09 09/10

UK 7,977. 5 8,309.1 8,164.3 8,5 67.9

International 610.6 712.9 8 9 7.8 968.7

Total 8,588.1 9,022.0 9,0 6 2.1 9,536.6

£m 06/07 07/08 08/09 09/10

UK 956.5 972.9 652.8 701.2

International 87.5 116.4 116.1 142.7

Total 1,044.0 1,089.3 768.9 843.9

p16