Marks and Spencer 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Marks and Spencer Group plc Annual report and financial statements 2010 Directors’ report 08

Page Title

Page Title continued

Performance overview

by Ian Dyson

Our performance*

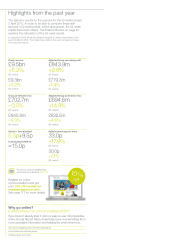

This year our Group sales were up 3.2% to

£9.3bn. A combination of improving market

conditions and our own efforts helped us

achieve an increase in UK sales of 2.9%,

with a strong performance in all areas

of our business. Despite tough trading

conditions, particularly in Republic of Ireland

and Greece, our International business

delivered a strong performance, with sales

up 5.7%.

GM has seen market share growth in

both value and volume, with sales up 4.0%.

Continued investment in our margins has

helped Food return to positive like-for-like

sales of +0.3%.

M&S Direct has delivered another good

performance, with sales increasing to £413m

and remains on track to deliver £500m

by 2010/11.

Margins*

Our UK gross margin was 41.2%, down 5 bps.

This reflects our continued investment in

Food margins to provide our customers with

the value they want, without compromising

quality. Food gross margin was down 95

bps at 30.6%, with investment in prices and

promotions partly offset by better buying

and a reduction in food waste. GM margin

was up 70 bps at 52.5%, despite the weak

sterling performance this year. Over the last

12 months we have worked with our

suppliers to manage currency pressures in

our supply chain and delivered tighter stock

control and management of markdowns.

Cost management*

Total UK operating costs, excluding

bonuses, were £2,769m, an increase of

1.0%. Despite the pressure of increased

volumes, depreciation and inflation on

our cost base, through prudent cost

management we delivered savings of 5.3%

representing an underlying saving of £145m.

In addition, due to our significant

outperformance against our plan we have

paid a bonus of £81m to be shared by

employees across M&S.

Balance sheet management

Throughout 2009/10 we have remained

focused on improving our cash flows.

We reduced capital expenditure to £389m,

down from £652m in 2008/09 and have a

working capital inflow of £78m.

As a result we have generated a net

cash inflow of £412m after tax and dividend.

Focus on cash flow management has

enabled us to further reduce our net debt to

£2.1bn, from £2.5bn in 2008/09.

Last year we took decisive action to give us the strength and flexibility we needed

to navigate the recession. As a result we have emerged in a stronger position and

delivered an improved performance, with an adjusted 52 week profit before tax of

£632.5m up 4.6% from £604.4m in 2008/09. Whilst we have tackled the short-term

issues caused by the downturn we have remained focused on our long-term

strategy. Over the last 12 months, we have continued to invest in M&S, building

a platform for future growth through Project 2020.

Ian Dyson Group Finance and Operations Director

INNOVATION

Right: Click to watch In December we launched

our iViewer TV – a British high street first. Viewers

can get BBC iPlayer straight to their screen with the

touch of a button. The TV also doubles as a digital

photoframe.

Since its opening in 2008, our furniture

supplier’s first UK eco factory – the 150,000

sq ft Westbridge Furniture factory in Holywell,

Wales – has reduced its CO2 emissions by

48%, energy use by 56% and water

consumption by 30%. The factory is also

on target to send no waste to landfill by 2012.

At the same time it produces some of the

most stylish pieces in the M&S range.

For more information about Plan A see

p36 or visit marksandspencer.com/plana

PLAN A: UK ECO FACTORY

Underlying cost savings

£145m

Group capital expenditure

£389m

Net debt

£ 2.1bn

* 52 weeks.