Marks and Spencer 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999

FIN AN CIAL REVIEW

N ext year, we plan to open a further 580,000 sq ft of new selling

space of which just over half is in the UK. The bulk of our new

overseas footage (180,000 sq ft) will be in N orth America, including

a new flagship store for Brooks Brothers at Fifth Avenue in N ew York.

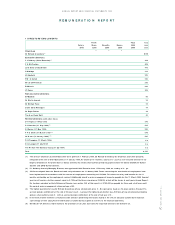

CAPITAL EXPENDITURE

Capital expenditure during the year totalled £• m, the main

components being:

The cost of Littlewoods related developments totalled £150m during

1998/99.This included the costs incurred on Littlewoods stores prior

to their opening as well as the capital element of the modernisation

of existing Marks & Spencer stores in the same locations.

Capital expenditure is expected to • next year to around £• m. O f

this, £• m is for overseas development including the purchase of the

freehold interest in our flagship store in Paris.Apart from this

purchase, expenditure overseas will be significantly • 1999/2000.

FINANCING

Additional financing was arranged as follows:

• In January 1999, a subsidiary issued a fixed rate $400m Medium

Term N ote (MTN ) in the public market, maturing in February

2004.The proceeds were swapped into a sterling obligation

with interest payments linked to an attractive rate below six

months £LIBO R.

• During the financial year the MTN programme was increased

to £1.25bn and this has been used as a flexible and cost-effective

source of funds. 25 MTN s were issued in various currencies with

a sterling equivalent of £1,054m. Maturities ranged from 6 months

to 5 years.At the end of the financial year total outstandings within

this programme equated to £1,132m.

O ther sources of finance were US$ Commercial Paper and bank

borrowings both in the London money market and by individual

overseas subsidiaries. A committed facility of $50m and uncommitted

credit facilities of £770m are in place in the UK.

D etails of the maturity profile of borrowings are given in note •

on page • .

D uring the year, both the leading credit agencies reduced the

Group’s long-term credit ratings to AA+ (Standard & Poor’s) and Aa1

(Moody’s).This is not expected to have a significant effect either on

the Group’s ability to access the international capital markets or on

the interest rates payable.

BALANCE SHEET

The Group balance sheet consolidates retailing and Financial Services

businesses which have very different characteristics.The salient figures

are disaggregated below:

Retail & Financial Services Balance Sheets 31 March 2000

Financial Total

Retailing Services Group

1999 1999 1999

£m £m £m

Fixed assets

Stocks

Loans & advances to customers

O ther debtors

N et cash/(debt)

Trade & other creditors

Net assets

Loans and advances to customers have increased to £• bn (last year

£1.9bn).W ithin this, £• bn relates to personal lending with the balance

representing storecard debt.

TREASURY POLICY AND

FINANCIAL RISK MANAGEMENT

The Board approves treasury policies, and senior management directly

controls day-to-day operations.

The Group’s Treasury uses derivatives and financial instruments

to manage risk by altering the interest rates and currency exposures

on investment, funding and foreign exchange contracts so that

the resulting exposures give greater certainty of future costs.

Transactions are only undertaken when there is an underlying

commercial justification and with counterparties which fulfil

predetermined credit criteria.The main types of instrument used

are interest rate and currency swaps, forward rate agreements and

forward currency contracts.The Group does not hedge balance sheet

and profit and loss account translation exposures.W here appropriate,

borrowings are arranged in local currencies to provide a natural

hedge against overseas assets.

Interest rate exposure for Financial Services is managed, as far as

practical, by matching maturities of borrowings and their interest basis

with the terms of the customer debt.

Currency exposure arising from exports from the UK to overseas

subsidiaries is managed by the use of forward currency contracts for

periods of approximately 10 -15 months.

The details of derivatives and other financial instruments required

by the new Financial Reporting Standard, FRS13, are shown in notes

16, 19 and 22-24 to the Accounts.

4

Capital expenditure 1999/2000

■Littlewoods related

developments • %

■O ther UK footage expansion • %

■O verseas • %

■UK IT • %

■O ther UK • %