Marks and Spencer 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

REPO RT O F THE D IRECTO RS

The directors have pleasure in submitting their report and the financial

statements of the Company and its subsidiaries for the year ended

31 March 2000.

PRINCIPAL ACTIVITIES

The principal activities of the Group are Retailing and Financial Services.

Retailing consists of the Group’s retail activities under the

Marks & Spencer, Brooks Brothers and Kings Super Markets brand

names and includes the activity of M&S D irect.

Financial Services consists of the operations of the Group’s Retail

Financial Services companies, which provide account cards, personal

loans, unit trust management, life assurance and pensions.The Group’s

Captive insurance company is also included in this segment as a

significant part of its business is generated from the provision of

related insurance services.

REVIEW OF ACTIVITIES AN D FUTURE PERFORMANCE

A review of the Group’s activities and of the future development of the

Group is contained in the Chairman’s Statement and the Chief Executive’s

Review within the Annual Review and Summary Financial Statement.

POST BALANCE SHEET EVENTS

Since the year end, the Group has announced the closure of

its Canadian operations and the rationalisation of its UK store

management. See note 31 for further details.

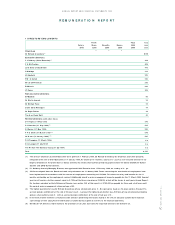

PROFIT AND DIVIDENDS

The profit for the financial year, after taxation and minority interests,

amounts to £372.1m. The directors have declared dividends as follows:

£m

O rdinary shares

Interim paid, • p per share (last year 3.7p)

Proposed final, • p per share (last year 10.7p)

Total ordinary dividends, • p per share (last year 14.4p)

The final dividend will be paid on 30 July 2000 to shareholders whose

names are on the Register of Members at the close of business on

• May 2000.

CHANGES IN SHARE CAPITAL

D uring the year ended 31 March 2000, • ordinary shares in the

Company were issued as follows:

A• under the terms of the 1984 Senior Staff Share O ption Scheme

at prices between • p and • p each.

B• under the terms of the 1987 Senior Staff Share O ption Scheme

at prices between • p and • p.

C• under the terms of the United Kingdom Employees’ Save As You

Earn Share O ption Scheme at prices between • p and • p.

SUBSTANTIAL SHAREHOLDINGS

As at 10 May 1999, the Company had been notified of the following

interests in accordance with sections 198 to 208 of the Companies

Act 1985:

(i) The Prudential Corporation and its subsidiaries were interested in

a total of 124,206,359 ordinary shares (representing approximately

4.33% of the Company’s issued ordinary share capital);and

(ii) Brandes Investment Partners, L.P. were interested in a total of

89,814,905 ordinary shares (representing approximately 3.13%

of the Company’s issued ordinary share capital).

Save as disclosed above, as at 10 May 1999, the Company had

not received notification that any other person was interested in

3% or more of the Company’s issued ordinary share capital.

CREDITOR PAYMENT POLICY

The Company’s policy concerning the payment of its trade creditors

is as follows:

In the UK, General Merchandise is automatically paid for 11

working days from the end of the week of delivery. Foods are paid for

13 working days from the end of the week of delivery (based on the

timely receipt of an accurate invoice).

UKdistribution suppliers are paid monthly, for costs incurred in

that month, based on estimated annual contracts, and payments are

adjusted quarterly to reflect any variations to estimate.

Trade creditor days of the Company for the year ended

31 March 2000 were 12.9 days (9.2 working days), based on the

ratio of Company trade creditors at the end of the year to the

amounts invoiced during the year by trade creditors.

Suppliers to overseas subsidiaries (for merchandise and distribution)

and foreign merchandise suppliers of the UK Company are paid

on average within 30 days of the receipt of invoice or delivery

documentation.

For all trade creditors, it is the Company’s policy to:

– Agree the terms of payment at the start of business with

that supplier,

– Ensure that suppliers are aware of the terms of payment,

– Pay in accordance with its contractual and other legal obligations.

UNITED KINGDOM EMPLOYEES’

PROFIT SHARING SCHEMES

The amount of profit which will be allocated this year, in the form

of ordinary shares in the Company, has been fixed at £• m

(last year £14.8m), representing • % (last year 3%) of the earnings

of • (last year 43,550) eligible employees..

These shares are now purchased in the market:• ordinary shares

were purchased by the Profit Sharing Trustees in respect of the

1998/99 allocation.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999