Marks and Spencer 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999

FIN AN CIAL REVIEW

– Impairment of European Fixed Assets

Following the recent deterioration in the performance of our

European business we reviewed the book values of our European

properties in accordance with FRS11,‘Impairment of Fixed Assets

and Goodwill’.This resulted in a provision of £• m being made

against the value of European properties in the first half of the year.

– Recovery of overpaid VAT

£• m was received last year in respect of VAT overpaid on sales in

earlier accounting periods. This followed the Court of Appeal decision

in a case brought by Littlewoods Home Shopping.

INTEREST

N et interest income • to £• m from £27.9m last year. This was caused

by the fall in sterling interest rates and a reduction in average sterling

cash balances (including interest-bearing investments) to £• m (last

year £820m).

Interest payments on intra group and external borrowings for

the Financial Services business are charged to that business as cost

of sales.The operating profit for Financial Services is shown in the

segmental analysis on page • .The total interest cost incurred by

Financial Services was £• m. In the consolidated accounts, the excess

of intra group interest over third party interest payable, has been

added back in the segmental analysis to arrive at total operating profit.

TAXATION

The Group tax charge for the year is £• m, giving an effective rate of

• % after exceptional charges.This is an increase on the previous year’s

rate of • %.The increase results from exceptional charges and

unrelieved losses arising overseas, both of which are not allowable for

UK tax purposes.The amount is offset by capital allowances in excess

of depreciation and a reduction in the rate applicable to deferred tax.

EARN INGS PER SHARE

An adjusted earnings per share figure of • p (last year 15.8p)

has been calculated to give a clearer understanding of the trading

performance of the Group. It excludes the effect of the exceptional

items noted above. D etails of the calculation are given in note •

on page • .

CASH FLOW

The analysis of the increase in net debt shows the operating cash

flows within retailing and Financial Services activities.The cash outflow

from Financial Services operating activities includes a £• m increase in

loans and advances to customers.

O f the resulting net debt of £• m, £• m relates to Financial

Services. (See Balance Sheet commentary on page • .)

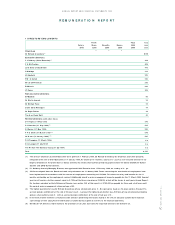

Cash flow analysis £m

Net debt at 31 March 1999 (1,182)

Cash inflow from retail operating activities

Cash outflow from Financial Services

operating activities

Capital expenditure (net of disposals)

D ividends

Tax

O ther non-operating cash inflows

Increase in net debt

Net debt at 31 March 2000

NEW FOOTAGE

D uring 1999/2000 there was an unprecedented increase in footage

both in the UK and overseas.Total worldwide footage increased

by • million sq ft as shown below:

Total UK footage increased by nearly • million sq ft. O f this additional

footage, • sq ft related to the opening of 16 of the 19 Littlewoods

stores, which were acquired during 1998. N ew store openings account

for a further • sq ft including Bluewater in Kent (146,000 sq ft),

N ewton Breda in N orthern Ireland (34,000 sq ft) and Covent Garden,

London (19,000 sq ft).The resulting shape of the UK chain is shown

below:

N ine European stores were opened. Four new stores in Germany –

D ortmund, Essen,W uppertal and Frankfurt – added around 150,000

sq ft. W e also opened stores in Spain, France, Eire and Luxembourg.

Brooks Brothers US opened 19 new stores, resulting in net

additional footage of around 100,000 sq ft.

O n average, we traded on 6.7% more footage in the UK in

1998/99 and on an additional 12.2% footage overseas.

3

MARKS AN D SPEN CER p.l.c.

Worldwide footage expansion 1999/2000

• million sq ft

■Littlewoods stores • %

■O ther UK footage development • %

■Continental Europe • %

■Republic of Ireland • %

■N orth America • %

■Hong Kong • %

UK shape of the chain (based on footage)

■D epartmental stores • %

■Regional centres • %

■High street • %

■Small • %