Marks and Spencer 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

MARKS AN D SPEN CER p.l.c.

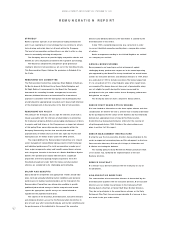

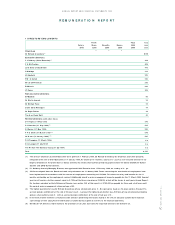

3 DIRECTORS’ PEN SION INFORMATION (CO N TIN UED )

Increase in transfer Increase in pension

value in excess of earned in excess

Years of inflation(1) during of inflation(1) during

Age at service at the year ended the year ended Accrued entitlement at year end

31 March 2000 31 March 2000 31 March 2000 31 March 2000 31 March 2000(2) 31 March 1999

£000 £000 £000 £000

Sir Richard Greenbury(3) 63 46 465

P L Salsbur y 50 29 227

PG McCracken 51 24 183

Lord Stone of Blackheath 57 32 230

R Aldridge 53 26 137

JR Benfield 50 29 138

R W C Colvill 59 15 89

Mrs C E M Freeman 47 25 97

BSMorris 52 29 69

JT Rowe 52 25 123

D KH ayes 51 30 135

SJSacher 59 32 166

PP D Smith 59 33 153

JKO ates(4) 57 15 302

(1) Inflation has been assumed to be equivalent to the actual rate of price inflation which was • % for the year to 30 September 1999.This

measurement date accords with the Stock Exchange Listing Rules.

(2) The pension entitlement shown above is that which would be paid on retirement based on service to 31 March 1999, except for J K O ates

who retired on 31 January 1999 and service is calculated to this date.At State Pension Age this will be reduced by a proportion of the

Basic State Pension.

(3) Sir Richard Greenbury has accrued no further benefit in the scheme since taking a lump sum in July 1997.This year’s accrued entitlement

has increased over last year due to two factors (i) the pension, having been deferred has, in line with normal practice, been increased by

a late retirement factor, (ii) a notional increase has been applied in line with the pension increase for all current pensions.

(4) Although J K O ates retired on 31 January 1999, he has yet to elect to commence drawing a pension.Therefore the amounts shown above

are calculated on the assumption that payment of his pension is deferred until aged 60.

(5) The greater part of the actuarial increase in the transfer value in respect of P P D Smith relates to the effect, on the year, of his full pension

being paid immediately following his retirement at 31 March 1999. For the directors retiring on 31 May 1999, a similar effect is likely to be

shown next year should they choose to draw their pension immediately.

(6) C Littmoden is not shown in the above table because he has ceased to accrue benefits in the UK Scheme during his time in N orth America.

His accrued entitlement at the time of his transfer to N orth America was £• .

(7) The pension entitlement shown excludes any additional pension purchased by the member’s Additional Voluntary Contributions.

(ii) Early Retirement Plan

The Board recognises the need to maintain a proper flow of succession to senior management positions. It has therefore decided that although

the Company’s Pension Scheme is administered assuming a normal retirement age of 65 for all staff, senior management should have a contractual

retirement age of 60.To meet the same successional needs, it may be appropriate to ask a member of senior management to retire before the

age of 60.To facilitate the smooth implementation of this process the Company has established an Early Retirement Plan for senior management.

W here such a request is made by the Company the Remuneration Committee may, at its discretion, offer an unfunded Early Retirement Pension,

separate from the Company pension, which will be payable from the date of retirement to age 60.To ensure that early retirement does not confer

an advantage over continued employment the value of the Early Retirement Pension may not exceed the value of the individual’s total net salary

less net Company pension from actual date of retirement to age 60. Each Early Retirement Pension must be approved individually by the

Remuneration Committee.The Early Retirement Pension is fully taxable; it is normally fully commutable at the election of the recipient.

REMUN ERATIO N REPO RT

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999