Marks and Spencer 1999 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999

FIN AN CIAL REVIEW

The business has been restructured around three major profit centres:

UKRetail

O verseas Retail

Financial Services

For the purposes of internal assessment and performance

measurement, a separate property division is being established to

allow the rent or own decisions to be evaluated separately from

the retailing result.

For this purpose, internal charges will be made on the profit

centres to reflect market rental values.W here held, investment

properties will continue to be evaluated by reference to their open

market value.

The contribution which the profit centres make to the Group

return will be based on the Value Created over the Group’s weighted

average cost of capital (W ACC). For the purposes of assessing

performance in 2000/2001, the Group’s W ACC will be taken as • %.

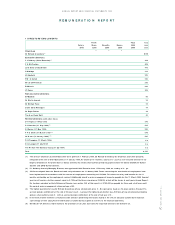

GROUP SUMMARY

2000 1999

As restated

Summary of results £m £m

Turnover (ex VAT) 8,224.0

O perating profit (before exceptional items) 600.5

Exceptional operating (charges)/income (88.5)

O perating profit (after exceptional items) 512.0

Profit on ordinary activities before tax 546.1

Basic earnings per share 13.0p

Adjusted earnings per share (see below) 15.8p

D ividend per share 14.4p

2000 1999

Group turnover £m £m

UK Retail 6,601.1

O verseas Retail 1,274.3

Financial Services 348.6

Total 8,224.0

O perating profit (before exceptional items) has fallen to £• m. It

can be analysed as follows:

2000 1999

Operating profit As restated

(before exceptional items) £m £m

UK Retail 478.9

O verseas Retail (14.6)

Financial Services 110.7

Excess interest (see below) 25.5

Total 600.5

Profit on ordinary activities before tax is shown after charging £• m for

exceptional items (last year, income of £88.5m) and a net additional

cost of £• m (last year, £21.1m) following the early adoption of FRS15,

‘Tangible Fixed Assets’. Adjusting for this additional charge gives a profit

before tax and exceptional items of £• m (last year £655.7m) which

compares to the forecast range of £• m-£• m set out in the Trading

Statement published in January.

REVIEW OF PERFORMANCE BY BUSINESS SEGMENT

– UK RETAIL

Sales

An analysis of the • % fall in UK retail sales (including VAT) for the year

is given below, divided between the three product groups and the

four reporting periods for the year:

15 weeks 11 weeks

First Second to to

quarter quarter • Jan • March Total

Inc % Inc % Inc % Inc % Inc %

Clothing, footwear

& gifts

Home furnishings

Foods

Total

Like for like sales

Expressed on a like-for-like basis, total sales are • % below last year,

representing a • % decrease in clothing and home furnishings and

a • % decrease in foods. (Like-for-like sales have been calculated by

comparing total sales with new and developed stores excluded, and

sales deflected from existing stores added back.)

Cost of sales

A significant shortfall from expected sales, and the subsequent margin

impact to clear the goods, led to a contribution £• m below

last year.

Operating expenses

(i) Investment programme

The net adverse impact on profits of the investment

programme announced in 1997/98 has been estimated as

£• m (last year £90m).This comprises:

• £• m (net of additional revenues generated) relating to

the redevelopment of the Littlewoods stores acquired in

February 1998 and the accompanying modernisation of the

existing Marks & Spencer stores in the same locations.

• £• m loss of interest income.

• £• m on the development of the clothing mail order

business net of revenues generated.

• £• m on the installation of Point-of-Sale equipment in UK

and European stores.

The new Point-of-Sale tills are Year 2000 compliant and have

the facility to allow transactions in multiple currencies, including

the euro.

1

MARKS AN D SPEN CER p.l.c.