Marks and Spencer 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999

FIN AN CIAL REVIEW

(ii) Pension fund

This year’s triennial valuation of the UK pension fund has confirmed

that the annual pension cost has increased by approximately

£• m per annum, the amount estimated and provided for in the

1998/99 accounts (see note • on page • for further details).This

increase is mainly due to the abolition of recoverable ACT.

(iii) D epreciation

D epreciation charges have increased by • % to £• m

(last year £193m). Although this relates in part to the investment

programme, a significant proportion of the increase relates to

the following:

• As a result of the publication of FRS15,‘Tangible Fixed

Assets’, the Board has reviewed the Group’s accounting policy

in respect of properties and their cost of fit out and has

amended it as follows:

(a) Freehold and long-leasehold buildings are depreciated down

to their estimated residual value over their estimated remaining

economic lives (no depreciation was charged previously on

grounds of immateriality – see note • on page • ).

(b) Fit out, which was previously accounted for on a replacement

basis, has been identified separately from buildings and is

depreciated over periods ranging from 10-25 years depending

on its nature. In accordance with FRS15 this change has been

dealt with as a prior year adjustment.

The effect of the above changes is to increase the depreciation

charge for the year by £• m (last year £37.4m) and reduce the

charge for repairs and renewals by £• m (last year £18.3m).

The net effect on the UK is to decrease operating profits for

the years ended 31 March 2000 and March 1999 by £• m

and £• m respectively.

• As part of our strategy to develop and implement revised

store formats we have charged accelerated depreciation on

certain items of store equipment which are to be replaced next

year. This has resulted in an additional £• m depreciation charge.

– OVERSEAS RETAIL

A full analysis of sales and operating profits is given in the segmental

analysis on page • .The movements in exchange rates used for

translation, compared to the same period last year, have reduced

overseas sales by £• m and overseas operating profit by £• m.

Europe has made an operating loss of £• m before impairment

(see below) compared to a loss of £• m last year. This result includes

the additional cost of £• m (last year £2.0m) following the adoption of

FRS 15.The strength of sterling has led to an increase in the cost of

UK sourced M&S merchandise.This has reduced European margins by

approximately £• m.

O perating profit in the Americas is £• m below last year. W ithin this,

Brooks Brothers has been affected by the recession in Japan.

The operating loss in the Far East of £• m is £• m below last year’s

operating profit, reflecting the poor state of economies across the

region.

Closure of Canadian operations

As part of the Company’s ongoing strategic review, the Group

announced (in April 1999) the closure of its Canadian operations

which will cease trading during the financial year ending 31 March

2000.The total cost of closure, which will be included in the results

for next year, is estimated at £• m, excluding goodwill of £• m

previously written off to reserves.

– FINANCIAL SERVICES

This profit centre consists of five different business units:

Marks & Spencer Store Cards

Personal Lending

Unit Trusts

Life Assurance

MS Insurance in Guernsey

The overall results are given in the segmental analysis on page • .

The first four of the five businesses are based in Chester and

managed as a single business with four profit centres (the results for

the Life Assurance company being aggregated on an Embedded Value

basis).The Guernsey Captive insurance company derives the majority

of its underwriting business from the Chester-based activities.

The scale and value of current business levels is indicated below:

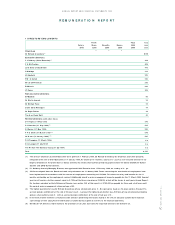

Account Personal Unit Life

Cards Lending Trusts Assurance

N umber of accounts/

policy holders

(000s) 1999

1998 5,166 548 171 30

Value of customer

outstandings/funds

under management

(£m) 1999

1998 652 1,283 1,101 n/a

The credit activities are carried out within Marks and Spencer Financial

Services Limited, a bank regulated by the FSA.The Unit Trust, Life

Assurance and Corporate PEP/ISA businesses are carried out by

companies regulated by IMRO, PIA and the FSA.

EX CEPTIONAL ITEMS

– Business restructuring

W e have charged £• m against the profits of the UK Retail profit

centre in respect of job losses at head office as a result of business

restructuring.This includes £• m in relation to the rationalisation

of senior management.The balance of £• m relates to head office

job losses at other levels.

2