Marks and Spencer 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT AND FIN ANCIAL STATEMENTS 1999

8

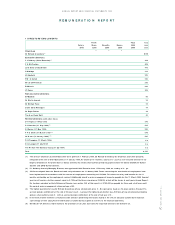

REMUN ERATIO N REPO RT

STRATEGY

Marks & Spencer operates in an international trading environment

and it is an essential part of our strategy that we continue to attract,

train, develop and retain talent at all levels within the Company.

The level of remuneration and benefits we are able to offer is a key

factor in successfully achieving this objective.

The Company sets out to provide highly competitive salaries and

benefits for all its employees consistent with its growth and strategy.

The Board has adopted the principles of good governance

relating to directors’ remuneration as set out in the Combined Code.

This Remuneration Report follows the provisions in Schedule B to

the Code.

REMUN ERATION COMMITTEE

The Remuneration Committee comprises Brian Baldock (Chairman),

Sir Martin Jacomb, Sir Michael Perry, Dame Stella Rimington and

Sir Ralph Robins. It recommends to the Board the Company’s

framework for rewarding its senior management, ie executive

directors, divisional directors and executives.The Committee’s

approach is consistent with the Company’s overall philosophy that

all staff should be appropriately rewarded and it keeps itself informed

of the developments in best practice in the field of remuneration.

REMUN ERATION POLICY

The policy of the Company aims to align the interests of all staff as

closely as possible with the interests of shareholders in promoting

the Company’s progress. Schemes encouraging employees at all levels

to acquire and hold shares in the Company are an important element

of that policy. Share ownership remains very popular within the

Company, illustrated by the fact that over 42,000 staff hold

approximately 30 million shares in their own right and 33,000 staff

hold options on 61 million shares under the SAYE scheme.

The responsibility of the Remuneration Committee is to reward

senior management competitively taking account of both Company

and individual performance.The total remuneration is made up of

three major components: salary and benefits, annual bonus scheme

and a long-term incentive in the form of a Senior Staff Share O ption

Scheme.The performance related elements form a significant

proportion of the total package.Targets required to meet the

thresholds of payment under both the bonus and share option

schemes are considered to be challenging and motivating.

SALARY AND BEN EFITS

Salary should be competitive and appropriate reviews should take

place, normally annually, reflecting market conditions and personal

performance. In making recommendations on the framework the

Remuneration Committee uses information available in specific

published job-matched surveys of similar companies and annual

reports.As appropriate, specific surveys are commissioned to

supplement the published information.

The salaries of the Chairman, Chief Executive, executive directors

and divisional directors, are set by the Remuneration Committee in

June of each year after reviewing Company and market conditions and

the performance of the individual. In the cases of the executive

directors and divisional directors, the Committee is assisted by the

Chief Executive in this review.

In July 1998 a repositioning exercise was carried out in order

to correct identified anomalies resulting from a comparative review

of salaries.

Senior management working in the United Kingdom are entitled

to a company car and fuel.

ANN UAL BONUS SCHEME

Bonus payments are based upon actual achievement against

challenging Group performance targets set in the annual operating

plan approved by the Board.The Group introduced an annual bonus

scheme for executive directors and divisional directors in 1988, which

was extended in 1995 to include executives.The bonus ranges from

0% to a maximum of 30% of participants’ salary when target levels

are exceeded.The bonus does not form part of pensionable salary,

nor is it eligible for profit sharing. N o bonus was earned by

participants in the year under review due to Company performance

being below set targets.

The Company does not have a long-term bonus scheme.

SENIOR STAFF SHARE OPTION SCHEME

W e have looked at alternatives to the share option scheme and after

consideration we believe we have a scheme that is readily understood

by the participants, fits the culture of the business and has historically

delivered an appropriate level of reward.The Remuneration

Committee has imposed performance criteria for the exercise of

all options granted since 1996. D etails of the share schemes are

given in section 5 of this report.

SENIOR MANAGEMENT RESTRUCTURE

D uring the year the non-executive directors have participated in the

senior management succession plans and the subsequent restructure.

Four executive directors, J K O ates, D K Hayes, C Littmoden and

S JSacher are leaving the business.

The existing policy for Early Retirement Pension, details of which

are in section 3(ii), facilitated the implementation of the new

Business structure.

SERVICE CONTRACT

N o director has a Service Contract with the Company or any of

its subsidiaries.

NON-EXECUTIVE DIRECTORS

The remuneration of non-executive directors is determined by the

Chief Executive together with the executive directors. N on-executive

directors are not invited to participate in the Company’s Profit

Sharing, Save As You Earn or Senior Staff Share O ption Schemes.

They do not participate in the annual bonus scheme or the Early

Retirement Plan.Their fees are non-pensionable. N o increase in fees

was made in the year under review.