Marks and Spencer 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marks & Spencer

AN N UAL REPO RT AN D FIN AN CIAL STATEMEN TS 1999

Table of contents

-

Page 1

Marks & Spencer A N N U A L REPO RT A N D FIN A N C IA L STAT EM EN T S 19 9 9 -

Page 2

Marks & Spencer T his publicat ion includes t he Financial Review, t he Cor por at e Gover nance St at em ent , t he Rem uner at ion Repor t , t he D irect or s' Repor t , t he Financial St at em ent s and t he A udit or s' Repor t for t he year ended 31 M arch 1999. T he Chair m an's St at em ent ... -

Page 3

... mail order business net of revenues generated. • £• m on the installation of Point-of-Sale equipment in UK and European stores. The new Point-of-Sale tills are Year 2000 compliant and have M A R KS A N D SP EN C ER p . l . c . £m 478.9 (14.6) 110.7 25.5 600.5 Profit on ordinary activities... -

Page 4

... majority of its underwriting business from the Chester-based activities. The scale and value of current business levels is indicated below: Account Cards Personal Lending Unit Life Assets', the Board has reviewed the Group's accounting policy in respect of properties and their cost of fit out and... -

Page 5

...N ew store openings account for a further • sq ft including Bluewater in Kent (146,000 sq ft), N ewton Breda in N orthern Ireland (34,000 sq ft) and Covent Garden, London (19,000 sq ft).The resulting shape of the UK chain is shown below: EARN IN GS PER SH ARE An adjusted earnings per share figure... -

Page 6

... N orth America, including a new flagship store for Brooks Brothers at Fifth Avenue in N ew York. the Group's ability to access the international capital markets or on the interest rates payable. BALAN CE SH EET The Group balance sheet consolidates retailing and Financial Services businesses which... -

Page 7

... and our analysis has confirmed this. O ur strategy, therefore, has been to manage the risk of failure to an acceptable level.The objectives of the programme are: • • W here necessary modify or replace IT systems Identify and solve problems which could arise from computer chips embedded in... -

Page 8

... The annual operating and budgetary plans for each operating area are reviewed by the relevant executive directors prior to submission Remuneration Committee: comprises five non-executive directors. It is chaired by Brian Baldock and meets at least four 6 times per year. The Remuneration Report to... -

Page 9

... year-end forecasts H alf-yearly reviews by the Board of the Group capital plan Clearly defined capital investment control guidelines and procedures set by the Board - Regular reporting of legal and accounting developments to the Board. The Group's control systems address key business and financial... -

Page 10

... directors are not invited to participate in the Company's Profit Sharing, Save As You Earn or Senior Staff Share O ption Schemes. They do not participate in the annual bonus scheme or the Early Retirement Plan.Their fees are non-pensionable. N o increase in fees was made in the year under review... -

Page 11

...of staff, executive directors performing their duties mainly in the UK are allocated a profit share based on a percentage of their salary. Further information on profit sharing is given in note 9C to the financial statements. Benefits for UK directors relate mainly to the provision of cars, fuel and... -

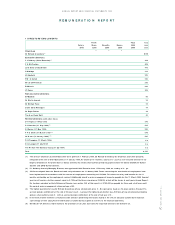

Page 12

...U N ER A T I O N R EP O RT (7) (8) A bonus is not payable for the year under review as the Group performance targets were not achieved. (Last year no bonus was paid). Expatriate directors carrying out their duties overseas have their remuneration adjusted to take account of local living costs.This... -

Page 13

... ER A T I O N R EP O RT 3 DIRECTORS' PEN SION IN FORMAT ION (CO N TIN UED ) Age at 31 March 2000 Years of service at 31 March 2000 Increase in transfer value in excess of inflation(1) during the year ended 31 March 2000 £000 Increase in pension earned in excess of inflation(1) during the year... -

Page 14

...in 1987 and 1997. The Scheme is open to all employees, including executive directors, who have completed two years' service and who open an approved savings contract. Inland Revenue rules limit the maximum amount which can be saved to £250 per month.W hen the savings contract is started options are... -

Page 15

...9 R EM U N ER A T I O N R EP O RT 5 LON G-T ERM BEN EFIT S (CO N TIN UED ) (ii) a Senior Staff Share O ption Scheme, approved by shareholders in 1997, which is open to executive directors, divisional directors and executives.The Company has operated this type of scheme for over 20 years, following... -

Page 16

...9 9 9 R EM U N ER A T I O N R EP O RT 5 LON G-T ERM BEN EFIT S (CO N TIN UED ) Granted At 1 April 1999 during the year Exercised/ lapsed during the year O ption Exercise price (pence) O ption period At 31 March 2000 price (pence) Lord Stone of Blackheath Exercisable N ot exercisable SAYE 96,335... -

Page 17

...O RT A N D F I N A N C I A L S T A T E M E N T S 1 9 9 9 R EM U N ER A T I O N R EP O RT 5 LON G-T ERM BEN EFIT S (CO N TIN UED ) Granted At 1 April 1999 during the year Exercised/ lapsed during the year O ption Exercise price (pence) O ption period At 31 March 2000(3) price (pence) C Littmoden... -

Page 18

... Further information regarding employee share option schemes is given in note 9D.There has been no change in the directors' interests in shares or options granted by the Company and its subsidiaries between the end of the financial year and one month prior to the notice of the Annual General Meeting... -

Page 19

... D AU DITORS The directors are responsible for preparing the Annual Report, including, as described on page • , the financial statements. O ur responsibilities, as independent auditors, are established by statute, the Auditing Practices Board, the Listing Rules of the London Stock Exchange and our... -

Page 20

... the Marks & Spencer, Brooks Brothers and Kings Super Markets brand names and includes the activity of M&S D irect. Financial Services consists of the operations of the Group's Retail Financial Services companies, which provide account cards, personal loans, unit trust management, life assurance... -

Page 21

...' Profit Sharing and Savings-Related Share O ption Schemes, membership of which is service-related. EQUAL OPPORT U N IT IES The Group is committed to an active Equal O pportunities Policy from recruitment and selection, through training and development, appraisal and promotion to retirement... -

Page 22

...1999 N otes 2000 £m As restated £m PROFIT AT T RIBU TABLE TO SH AREH OLDERS Exchange differences on foreign currency translation Unrealised surpluses on revaluation of investment properties 26 26 372.1 15.0 34.1 421.2 26 TOTAL RECOGN ISED GAIN S AN D LOSSES RELAT IN G TO T H E YEAR Prior year... -

Page 23

... reserve Profit and loss account 25 717.7 358.5 531.0 3,276.7 26 4,883.9 13.3 4,897.2 717.7 358.5 533.2 2,886.5 4,495.9 - 4,495.9 M A R KS A N D SP EN C ER p . l . c . SH AREH OLDERS' FU N DS (all equity) Minority interests (all equity) TOTAL CAPITAL EMPLOYED APPRO VED BY TH E BO ARD • May 2000... -

Page 24

...D DISPOSALS EQU IT Y DIVIDEN DS PAID Cash outflow before management of liquid resources and financing 29B 29.0 29C (345.9) 29D (628.1) 29E 1.0 (412.6) (884.3) MAN AGEMEN T OF LIQU ID RESOU RCES AN D FIN AN CIN G Management of liquid resources Financing 29F 29G 180.6 505.0 685.6 (DECREASE... -

Page 25

... of monthly exchange rates for sales and profits.The balance sheets of overseas subsidiaries are translated at year-end exchange rates.The resulting exchange differences are dealt with through reserves and reported in the consolidated statement of total recognised gains and losses. Transactions... -

Page 26

... the year comprise store sales and related costs for the 52 weeks to • March 2000 (last year 52 weeks to 27 March 1999). All other activities are for the year to 31 March 2000. 2. Segmental information A CLASSES OF BU SIN ESS The Group has two classes of business: Retailing and Financial Services... -

Page 27

... ) UK retail turnover including VAT comprises clothing, footwear and gifts £• m (last year £4,196.0m); home furnishings £• m (last year £308.0m) and foods £• m (last year £2,787.6m).VAT on UK retail turnover was £• m (last year £690.5m). O perating profit includes pre-opening costs... -

Page 28

... Price W aterhouse are disclosed as they are predecessor partnerships of PricewaterhouseCoopers. Fees paid for non-audit services are principally for taxation advice. (4) O ther costs for last year are stated after crediting £• m received in respect of VAT overpaid on sales of earlier accounting... -

Page 29

...- 165.7 O verseas taxation 2.8 168.5 D eferred taxation (see note 21) Current year Prior years 9.1 (1.5) 7.6 176.1 1999 £m £m £m 6. Profit for the financial year As permitted by Section 230 of the Companies Act 1985, the profit and loss account of the Company is not presented as part of these... -

Page 30

... fixed asset provision (Profit)/loss on disposal of property Diluted p 1999 As restated Basic D iluted p p 13.0 2.2 (0.2) 15.0 12.9 2.2 (0.2) 14.9 IIMR earnings per share 9. Employees The average number of employees of the Group during the year was: 2000 UK stores UK head office Financial... -

Page 31

... of funded defined benefit pension schemes throughout the world. The latest actuarial valuation of the UK Scheme was carried out at 1 April 1999 by an independent actuary using the projected unit method. The key assumptions adopted were: Price inflation Rate of increase in salaries Rate of increase... -

Page 32

... the Maximum O ption Value which is limited to four times remuneration on exercise (further details are set out in the Remuneration Report on page • ). O utstanding options granted under all senior option schemes are as follows: 2000 N umber of shares 1999 O ption price O ption dates Options... -

Page 33

... Land & buildings £m Total £m Land & buildings £m Total £m Cost or valuation As previously reported Reclassification of fit out (see 11B) Prior year adjustment (see 11B) At 1 April 1999 as restated 3,037.9 Additions Transfers D isposals Revaluation surplus D ifferences on exchange 2,545... -

Page 34

... new policy been in place in previous years. As a consequence of the prior year adjustment, the net book value of Group tangible fixed assets as at 31 March 1998 has been reduced by £210.9m with a corresponding reduction in the profit and loss account reserve.The effect of this on reported profits... -

Page 35

... Kong) Limited Marks and Spencer Retail Financial Services H oldings Limited Marks and Spencer Financial Services Limited Marks and Spencer Unit Trust Management Limited Marks and Spencer Savings and Investments Limited Marks and Spencer Life Assurance Limited MS Insurance Limited St Michael Finance... -

Page 36

...m (last year £84.7m) of non-financial assets which have been excluded from the analysis in note 16. - - - - 15.6 81.0 96.6 14. Current asset investments TH E GRO UP 2000 £m Listed investments: Government securities Listed in the United Kingdom Listed overseas Unlisted investments 1999 £m 2000... -

Page 37

...Group's financial assets is set out below.There are no financial assets other than short-term debtors excluded from this analysis. A IN T EREST RAT E AN D CU RREN CY AN ALYSIS TH E GRO UP Fixed rate £m 2000 N on interest Floating rate bearing £m £m Total £m 1999 Total £m Currency Sterling... -

Page 38

...exposure of the Group's financial liabilities are set out below.There are no financial liabilities other than short-term creditors excluded from this analysis. TH E GRO UP Fixed rate £m Floating rate £m 2000 Total £m 1999 Floating rate £m Currency Sterling US dollar O ther 1,289.0 203.6 181... -

Page 39

... 2000 Total at 31 March 2000 Total at 31 March 1999 54.4 51.8 The £• m provision for post-retirement health benefits represents the estimated value of the Company's subsidy of the Marks & Spencer H ealth Insurance Scheme, in so far as it relates to private medical benefits for retired employees... -

Page 40

...values closely approximate book values. Fixed asset investments comprise listed securities held by a subsidiary. Interest rate swaps and forward foreign currency contracts have been marked to market to produce a fair value figure. FTSE 100 put options provide no loss guarantees on certain Unit Trust... -

Page 41

... the Marks and Spencer United Kingdom Employees' Save As You Earn Share O ption Scheme.The Company provided £• m to the Q UEST for this purpose.The cost of this contribution has been transferred by the Company directly to the profit and loss account reserve (see note 26). 26. Shareholders' funds... -

Page 42

...19 9 9 N O T ES T O T H E FI N A N C I A L ST A T EM EN T S 26. Shareholders' funds (CO N TIN UED ) TH E GRO UP 2000 £m 1999 As restated £m TH E CO MPAN Y 1999 2000 As restated £m £m Profit and loss account reserve: At 1 April as previously stated Prior year adjustment (see notes 11B and... -

Page 43

... A L S T A T E M E N T S 19 9 9 N O T ES T O T H E FI N A N C I A L ST A T EM EN T S 29. Analysis of cash flows given in the cash flow statement TH E GRO UP 2000 £m 1999 As restated £m A EX CEPT ION AL OPERAT IN G CASH FLOW S UK restructuring costs paid VAT recovered from H M Customs & Excise... -

Page 44

..., Marks & Spencer Canada Inc, will cease to operate during the financial year ending 31 March 2000.The total cost of closure is estimated to be £25m, excluding goodwill of £24.4m previously written off to reserves. O n 10 Ma 1999, the Group announced the rationalisation of its UK store management... -

Page 45

... rates The principal foreign exchange rates used in the financial statements are as follows (local currency equivalent of £1): SALES AVERAGE RATE 2000 1999 PRO FIT AVERAGE RATE 2000 1999 BALAN CE SH EET RATE 2000 1999 Republic of Ireland France Belgium Germany The N etherlands Spain United States... -

Page 46

...Restated for 1998 and prior years for the change in accounting policy relating to the depreciation of fit out. Restated for 1997 and prior years to include turnover and operating profit by destination, the results of the Captive insurance company within turnover and cost of sales and the results of... -

Page 47

... R EN D ED 3 1 M A R C H 2000 £m 52 weeks 1999 £m 52 weeks 1998 £m 52 weeks 1997 £m 52 weeks 1996 £m 52 weeks CASH FLOW (1)(2) N et cash inflow from operating activities Returns on investments and servicing of finance Taxation Capital expenditure and financial investment Acquisitions and... -

Page 48

www.marks-and-spencer.co.uk DEFG