Lifetime Fitness 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Lifetime Fitness annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

and instruction; recreational basketball leagues through Ultimate Hoops; and other in-center events. We expect to

continue driving in-center revenue both by increasing sales of our current in-center products and services, while

introducing new products and services to our members and customers.

Our ancillary businesses includes media, athletic events and related services, health promotion programs and

training and certification programs. These businesses help grow the LIFE TIME FITNESS® brand, differentiate our

program offerings and support our membership base. Revenue from ancillary businesses grew $12.4 million, or

53.3%, to $35.7 million, which was due primarily to the acquisition of race registration and timing businesses and

other athletic events.

Our Industry

We participate in the large and growing health and wellness industry, which includes health clubs, fitness equipment,

athletics, wellness education, nutritional products, athletic apparel, spa services and other wellness-related activities.

According to International Health, Racquet & Sportclub Association (“IHRSA”), the estimated market size of the

U.S. health club industry in 2011, which is a relatively small part of the health and wellness industry, was

approximately $21.4 billion in revenue and 51.4 million members with approximately 29,960 clubs. Based on

IHRSA membership data, the number of health club members in the U.S. increased 23.9% from 41.5 million in 2007

to 51.4 million in 2011. Over this same period, total U.S. health club industry revenues increased 14.4% from $18.7

billion to $21.4 billion.

Our Sports and Athletic, Professional Fitness, Family Recreation and Spa Centers

Size and Location

Our centers have evolved since inception. All centers are centrally located in areas that offer convenient access from

residential, business and shopping districts of the surrounding community, and generally provide free and ample

parking.

Of our 105 centers as of December 31, 2012, 84 are of our large format design and 60 of those conform to our

current model center design. Our distinctive format is designed to provide efficient and inviting spaces that are

conducive to the wide range of healthy way of life programming we deliver and that accommodate each center’s

targeted capacity. Our current model centers generally target 7,500 to 11,000 memberships and our other large

format centers generally target 5,500 to 11,000 memberships. This targeted capacity is designed to maximize the

member experience based upon our historical understanding of membership usage, facility layout, the number of

individual, couple and family memberships and pricing.

Generally, the main differences between our large format centers and those that are of the current model design are

that our current model centers generally include an outdoor aquatics park, larger indoor aquatics area, larger

gymnasium, up to three additional studios and enhanced LifeSpa and LifeCafe spaces. We believe that all of our

large format centers serve as all-in-one sports and athletic, professional fitness, family recreation and spa

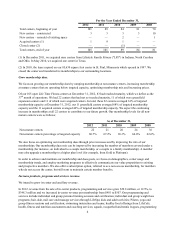

destinations. The following table provides the number and average square footage of our large format centers:

As of December 31,

2012 2011 2010 2009 2008

Large format centers – current model

Number of centers 60 57 54 51 48

Average square feet 114,000 113,000 113,000 113,000 113,000

Large format centers – other

Number of centers 24 24 24 24 24

Average square feet 95,000 95,000 95,000 95,000 95,000