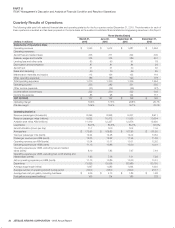

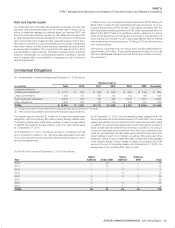

JetBlue Airlines 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 37

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

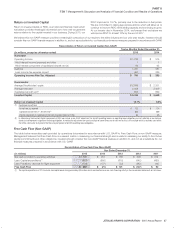

Return on Invested Capital

Return on invested capital, or ROIC, is an important financial metric which

we believe provides meaningful information as to how well we generate

returns relative to the capital invested in our business. During 2015, our

ROIC improved to 13.7%, primarily due to the reduction in fuel prices.

We are committed to taking appropriate actions which will allow us to

continue to improve ROIC while adding capacity and continuing to grow.

At our Investor day in November 2014, we forecast that we believe we

will improve ROIC to at least 10% by the end of 2017.

We believe this non-GAAP measure provides a meaningful comparison of our results to the airline industry and our prior year results. Investors should

consider this non-GAAP financial measure in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP.

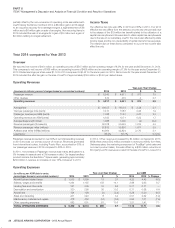

Reconciliation of Return on Invested Capital (Non-GAAP)

(in millions, except as otherwise noted)

Twelve Months Ended December 31,

2015 2014

Numerator

Operating Income $ 1,216 $ 515

Add: Interest income (expense) and other 1 1

Add: Interest component of capitalized aircraft rent (a) 64 65

Subtotal 1,281 581

Less: Income tax expense impact 491 226

Operating Income After Tax, Adjusted $ 790 $ 355

Denominator

Average Stockholders’ equity $ 2,869 $ 2,331

Average total debt 2,038 2,409

Capitalized aircraft rent(1) 853 869

Invested Capital $ 5,760 $ 5,609

Return on Invested Capital 13.7% 6.3%

(1) Capitalized Aircraft Rent

Aircraft rent, as reported $ 122 $ 124

Capitalized aircraft rent (7 * Aircraft rent)(2) 853 869

Interest component of capitalized aircraft rent (Imputed interest at 7.5%) 64 65

(2) In determining the Invested Capital component of ROIC we include a non-GAAP adjustment for aircraft operating leases, as operating lease obligations are not reflected on our balance

sheets but do represent a significant financing obligation. In making the adjustment we used a multiple of seven times our aircraft rent as this is the multiple which is routinely used within

the airline community to represent the financing component of aircraft operating lease obligations.

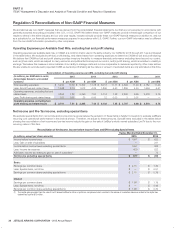

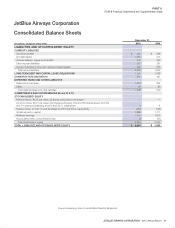

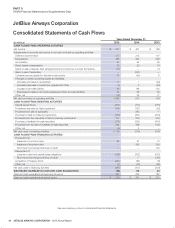

Free Cash Flow (Non-GAAP)

The table below reconciles cash provided by operations determined in accordance with U.S. GAAP to Free Cash Flow, a non-GAAP measure.

Management believes that Free Cash Flow is a relevant metric in measuring our financial strength and is useful in assessing our ability to fund future

capital commitments and other obligations. Investors should consider this non-GAAP financial measure in addition to, and not as a substitute for, our

financial measures prepared in accordance with U.S. GAAP.

Reconciliation of Free Cash Flow (Non-GAAP)

(in millions)

Year Ended December 31,

2015 2014 2013 2012 2011

Net cash provided by operating activities $ 1,598 $ 912 $ 758 $ 698 $ 614

Less: Capital expenditures(1) (837) (806) (615) (542) (480)

Less: Predelivery deposits for flight equipment (104) (127) (22) (283) (44)

Free Cash Flow $ 657 $ (21) $ 121 $ (127) $ 90

(1) The capital expenditures in 2014 includes two capital leases for approximately $76 million which are classified as a non-cash financing activity in the consolidated statements of cash flows.