JetBlue Airlines 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 25

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

ITEM7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations

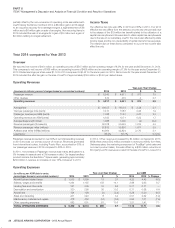

Overview

In 2015, we experienced the continuation of uncertain economic conditions and the persistent competitiveness of the airline industry. Even with these

external factors, 2015 was the most profitable years in our history and is our fourth consecutive year of net income growth. We generated operating

revenue growth of almost 10.3% year-over-year and reported our highest ever net income which benefited significantly from a rapid decline in fuel prices.

We are committed to delivering a safe and reliable JetBlue Experience for our customers as well as increasing returns for our shareholders. We believe our

continued focus on cost discipline, product innovation and network enhancements, combined with our service excellence, will drive our future success.

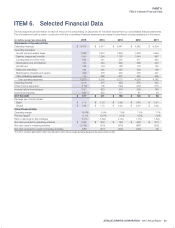

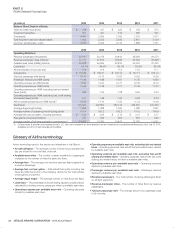

2015 Financial Highlights

•

We reported our highest ever net income of $677 million, an increase

of $276 million compared to 2014. This increase was principally driven

by higher passenger revenue and a reduction in aircraft fuel expenses,

partially offset by an increase in controllable costs.

•

We generated over $6.4 billion in operating revenue, an increase of $599

million compared to 2014 due primarily to a9.4%increasein revenue

passengers as well as a0.8%increasein the average fare.

•

Operating margin increased by 10.1 points to 19.0% and we improved

our return on invested capital, or ROIC, by 7.4 points to 13.7% primarily

driven by higher revenue, a reduction in aircraft fuel expenses and

continued balance sheet improvement.

•Our earnings per diluted share were $1.98, the highest in our history.

•

We generated $1.6 billion in cash from operations. The significant

amount of cash we generated provided the opportunity to pay cash for

all 2015 aircraft deliveries, reduce existing debt balances and execute

share repurchases.

•

Operating expenses per available seat mile decreased 10.4% to 10.56

cents, primarily driven by a reduction in aircraft fuel expenses. Excluding

fuel, profit sharing and related taxes our cost per available seat mile

increased 0.5% in 2015.

Company Initiatives

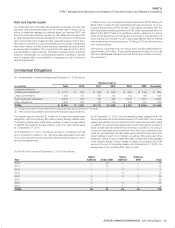

Strengthening of our Balance Sheet

Throughout 2015 we continued to focus on strengthening our balance

sheet. We ended the year with unrestricted cash, cash equivalents and

short-term investments of $876 million and undrawn lines of credit of

approximately $600 million. At year end 2015 unrestricted cash, cash

equivalents and short-term investments was approximately 14% of

trailing twelve months revenue. We reduced our overall debt and capital

lease obligations by $390 million which includes a prepayments of $100

million of outstanding principal relating to 10 Airbus A320 aircraft. As a

result,fouraircraft became unencumbered andsixhave lower principal

balances. During June 2015, we also prepaid the full$32 millionprincipal

outstanding on a special facility revenue bond for our hanger at JFK issued

by the New York City Industrial Development Agency in December 2006.

We have increased the number of unencumbered aircraft and spare

engines in 2015 bringing total unencumbered aircraft to 61 and spare

engines to 33 as of December31, 2015. In 2015, the holders of our 5.5%

Convertible Debentures due 2038 (Series B) converted their securities into

approximately 15.2 million shares of our common stock. During 2015,

we acquired approximately 9.8 million shares of our common stock for

approximately $227 million under our share repurchase program.

Aircraft

During 2015, we took delivery of 12 Airbus A321 aircraft. In November

2014, we amended our purchase agreement with Airbus deferring 13

Airbus A321 aircraft deliveries and eight Airbus A320 aircraft deliveries

from 2016-2020 to 2020-2023. Of these deferrals, ten Airbus A321 aircraft

deliveries were converted to Airbus A321 new engine option (A321neo) and

five Airbus A320neo aircraft deliveries were converted to Airbus A321neo

aircraft. We additionally converted three Airbus A320 aircraft deliveries in

2016 to Airbus A321 aircraft.

Airport Infrastructure Investments

In November 2015, we unveiled Phase I of our $50 million Terminal C

upgrade at Boston Logan International Airport. This upgrade included

new kiosks and ticket counters. Twenty-five kiosks and thirty check-in

counters are in use in the North Pod of the terminal. Phase II of the

upgrade has begun on the South Pod which is aimed to mirror the check-

in experience of the North Pod. Updated digital flight information displays

and a connector between Terminal C and international flights at Terminal

E are also expected to be completed by April 2016.

Network

As part of our ongoing network initiatives and route optimization efforts we

continued to make schedule and frequency adjustments throughout 2015.

We added six new BlueCities to our network: Cleveland, OH; Reno-Tahoe,

NV; St. George’s, Grenada; Mexico City, Mexico; Antigua and Barbuda;

and Albany, NY. We also added new routes between existing BlueCities.

Outlook for 2016

We believe we will improve our return for shareholders in 2016 as we

implement more of the revenue initiatives first outlined publicly at our

Investor Day in November 2014. Specifically, in 2016 we expect to derive

additional value from Fare Options, a new credit card agreement, and our

A321 Cabin Restyling program. We plan to add new destinations and route

pairings based upon market demand, having previously announced four

new BlueCities for the first half of 2016. We are continuously looking to

expand our other ancillary revenue opportunities, improve our TrueBlue®

loyalty program and deepen our portfolio of commercial partnerships. As in

the past, we intend to invest in infrastructure and product enhancements

which we believe will enable us to reap future benefits. We also remain

committed to strengthening the balance sheet.

For the full year 2016, we estimate our operating capacity will increase by

approximately 8.5% to 10.5% over 2015 with the addition of 10 Airbus A321

aircraft to our operating fleet. We are expecting our cost per available seat

mile, excluding fuel, profit sharing and related taxes, for 2016 to increase by

between approximately 0.0% to 2.0% over the level in 2015.