JetBlue Airlines 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 31

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

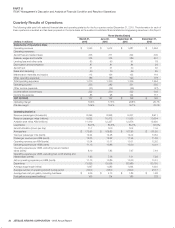

Although we experienced revenue growth in 2015, this trend may not

continue. We expect our expenses to continue to increase as we acquire

additional aircraft, as our fleet ages and as we increase the frequency of

flights in existing markets as well as enter into new markets. Accordingly,

the comparison of the financial data for the quarterly periods presented

may not be meaningful. In addition, we expect our operating results to

fluctuate significantly from quarter-to-quarter in the future as a result of

various factors, many of which are outside our control. Consequently, we

believe quarter-to-quarter comparisons of our operating results may not

necessarily be meaningful and you should not rely on our results for any

one quarter as an indication of our future performance.

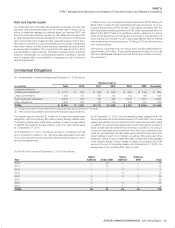

Liquidity and Capital Resources

The airline business is capital intensive. Our ability to successfully execute

our profitable growth plans is largely dependent on the continued availability

of capital on attractive terms. In addition, our ability to successfully operate

our business depends on maintaining sufficient liquidity. We believe we

have adequate resources from a combination of cash and cash equivalents,

investment securities on-hand and two available lines of credit. Additionally,

as of December31, 2015, we had 61 unencumbered aircraft and 33

unencumbered spare engines which we believe could be an additional

source of liquidity, if necessary.

We believe a healthy liquidity position is a crucial element of our ability

to weather any part of the economic cycle while continuing to execute

on our plans for profitable growth and increased returns. Our goal is to

continue to be diligent with our liquidity, maintaining financial flexibility and

allowing for prudent capital spending.

As of December31, 2015, we had unrestricted cash and cash equivalents

of $318 million and short-term investments of $558 million. We believe

our current level of unrestricted cash, cash equivalents and short-term

investments of approximately 14% of trailing twelve months revenue,

combined with our approximately $600 million in available lines of credit

and portfolio of unencumbered assets, provides us with a strong liquidity

position and the potential for higher returns on cash deployment. We

believe we have taken several important actions during 2015 in solidifying

our strong balance sheet and overall liquidity position.

Our highlights for 2015 included:

•

Reduced our overall debt balance by $390 million, including $132 million

of debt prepayments related to aircraft and facilities.

•

Increased the number of unencumbered aircraft from 39 as of

December31, 2014, to 61 as of December31, 2015. This was principally

accomplished by paying cash for the delivery of 12 Airbus A321 aircraft,

buying out the leases on six of our aircraft, and prepaying debt.

•

As a result of these 2015 highlights, our net debt to earnings before

interest, taxes, depreciation, amortization and rent (EBITDAR) ratio

improved from 2.5x in 2014 to 1.1x in 2015.

Analysis of Cash Flows

We had cash and cash equivalents of $318 million as of December 31, 2015.

This compares to $341 million and $225 million as of December 31, 2014

and 2013, respectively. We held both short and long term investments in

2015, 2014 and 2013. Our short-term investments totaled $558 million

as of December 31, 2015 compared to $367 million and $402 million as

of December 31, 2014 and 2013, respectively. Our long-term investments

totaled $49 million as of December31, 2015 compared to $60 million and

$114 million as of December 31, 2014 and 2013, respectively.

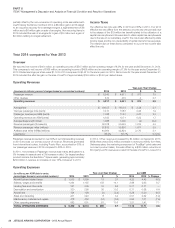

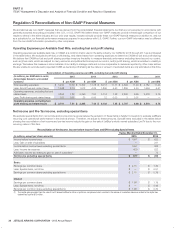

Operating Activities

Cash flows provided by operating activities totaled $1,598 million in 2015

compared to $912 million in 2014 and $758 million in 2013. There was

a $686 million increase in cash flows from operating activities in 2015

compared to 2014. During 2015 we saw a 9.5% increase in capacity, a

0.8% increase in average fares and a 35.7% decrease in the price of fuel

which all helped to improve operating cash flows. The $154 million increase

in cash flows from operations in 2014 compared to 2013 was primarily a

result of a 2% increase in average fares, a 5% increase in capacity and a

decrease of 5% in fuel prices. We additionally recognized a gain on sale

of our subsidiary, LiveTV, of $241 million during 2014. As of December31,

2015, our unrestricted cash, cash equivalents and short-term investments

as a percentage of trailing twelve months revenue was approximately

14%. We rely primarily on cash flows from operations to provide working

capital for current and future operations.

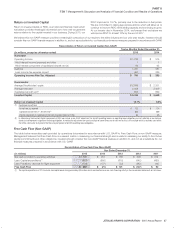

Investing Activities

During 2015, capital expenditures related to our purchase of flight equipment

included $104 millionfor flight equipment deposits, $450 million for the

purchase of 12 new Airbus A321 aircraft and $110 million for the buyout of

six aircraft leases, $120million for spare part purchases, and $29 million for

flight equipment work-in-progress. Other property and equipment capital

expenditures also included ground equipment purchases and facilities

improvements for $128 million. Investing activities also included the net

purchase of $187 million in investment securities.

During 2014, capital expenditures related to our purchase of flight equipment

included $127million for flight equipment deposits, $298 million for the

purchase of seven new Airbus A321 aircraft, $33million for spare part

purchases, $79 million for flight equipment work-in-progress, and $1 million

relating to other activities. Capital expenditures also included the purchase of

the Slots at Reagan National for $75 million, other property and equipment

including ground equipment purchases and facilities improvements for

$224 million and LiveTV in-flight entertainment equipment inventory for

$20 million. Investing activities also included the proceeds from the sale

of LiveTV for $393 million and the net proceeds of $81 million from the

sale of investment securities.

During 2013, the capital expenditure for seven new Embraer E190 aircraft,

three new Airbus A320 aircraft and four new Airbus A321 aircraft was $365

million. We additionally paid $22 million for flight equipment deposits and

$54 million for spare parts. Capital expenditures for other property and

equipment, including ground equipment purchases, facilities improvements

and LiveTV in-flight entertainment equipment inventory were $196 million.

LiveTV sold its investment in the Airfone business with proceeds of $8

million. Investing activities also include the net sale of $161 million in

investment securities.

We currently anticipate 2016 capital expenditures to be between $820 million

and $920 million, including approximately $670 million to $720 million for

aircraft and predelivery deposits. The remaining capital expenditures of

approximately $150 million to $200 million relate to non-aircraft projects

such as the customer technology refresh, the expansion of our facilities

at Boston and updates to our IT infrastructure.

Financing Activities

Financing activities during 2015 consisted ofthe scheduled repayment

of $196 million relating to debt and capital lease obligations. We prepaid

$100 million of outstanding principal relating to 10 Airbus A320 aircraft. As

a result,fouraircraft became unencumbered andsixhave lower principal

balances. We also prepaid the outstanding balance of $32 million on a

special facility revenue bond for JFK that was issued by the New York

City Industrial Development Agency in December 2006. In addition, we

acquired $241 million in treasury shares of which $150 million related

to our accelerated share repurchase in June 2015. During the period,