JetBlue Airlines 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2015Annual Report 27

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

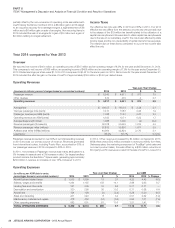

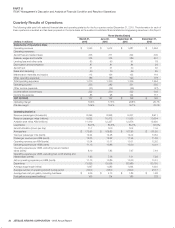

Operating Expenses

(in millions; per ASM data in cents;

percentages based on unrounded numbers)

Year-over-Year Change per ASM

2015 2014 $ % 2015 2014 % Change

Aircraft fuel and related taxes $ 1,348 $ 1,912 $ (564) (29.5) 2.74 4.25 (35.6)

Salaries, wages and benefits 1,540 1,294 246 19.1 3.13 2.88 8.8

Landing fees and other rents 342 321 21 6.7 0.70 0.71 (2.5)

Depreciation and amortization 345 320 25 7.7 0.70 0.71 (1.6)

Aircraft rent 122 124 (2) (1.8) 0.25 0.28 (10.3)

Sales and marketing 264 231 33 14.3 0.54 0.51 4.4

Maintenance, materials and repairs 490 418 72 17.3 0.99 0.93 7.1

Other operating expenses 749 682 67 9.8 1.51 1.51 —

TOTAL OPERATING EXPENSES $ 5,200 $ 5,302 $ (102) (1.9) 10.56 11.78 (10.4)

Aircraft Fuel and Related Taxes

Aircraft fuel and related taxes represents 26% of our total operating

expenses in 2015 compared to 36% in 2014. The average fuel price

decreased 35.6% in 2015 to $1.93 per gallon. This was partially offset by

an increase in our fuel consumption of approximately 61 million gallons.

Additional fuel consumption was mainly due to our increase in capacity

and lower flight cancellations during the first quarter of 2015 compared to

flight cancellations during the first quarter of 2014 as a result of the harsh

winter weather. Based on our expected fuel volume for 2016, a 10%per

gallon increase in the cost of aircraft fuel would increase our annual fuel

expense by approximately $120 million.

In 2015, we recorded fuel hedge losses of $126 million compared to $30

million in fuel hedge losses in 2014 which was recorded in Aircraft fuel

and related taxes. Fuel derivatives not qualifying as cash flow hedges

resulted in a gain of $2 million in 2014 which were recorded in Interest

income and other. Accounting ineffectiveness on fuel derivatives classified

as cash flow hedges resulted in losses of less than $1 million in both

2015 and 2014 and were recorded in Interest income and other. We

are unable to predict what the amount of ineffectiveness will be related

to these instruments, or the potential loss of hedge accounting which is

determined on a derivative-by-derivative basis, due to the volatility in the

forward markets for these commodities.

Salaries, Wages and Benefits

Salaries, wages and benefits represent approximately 30% of our total

operating expenses in 2015 compared to 24% in 2014. The increase in

salaries, wages and benefits was primarily driven by profit sharing and

an increase in our headcount. Our profit sharing is calculated as 15%

of adjusted pre-tax income, reduced by Retirement Plus contributions

and special items. Profit sharing increased by $126 million in 2015

compared to 2014, primarily driven by increased revenues and lower

aircraft fuel and related taxes. During 2015, the average number of full-

time equivalent employees increased by 9% and the average tenure of

our Crewmembers increased to 6.3 years. Retirement Plus contributions,

which equate to 5% of all of our eligible Crewmembers wages, increased

by $5 million and our 3% retirement contribution for a certain portion

of our FAA-licensed Crewmembers, which we refer to as Retirement

Advantage, increased by approximately $1 million. The increasing tenure

of our Crewmembers, rising healthcare costs and efforts to maintain

competitiveness in our overall compensation packages will continue to

pressure our costs in 2016.

We agreed to provide our pilots with a 20% pay increase in their base rate

over three years starting in 2014. In January 2014, the FAA’s rule amending

the FAA’s flight, duty, and rest regulations became effective. Among other

things, the new rule requires a ten hour minimum rest period prior to a

pilot’s flight duty period; mandates a pilot must have an opportunity for

eight hours of uninterrupted sleep within the rest period; and imposes new

pilot “flight time” and “duty time” limitations based upon report times, the

number of scheduled flight segments, and other operational factors. We

have hired additional pilots to address the requirements of the new rule.

Landing Fees and Other Rents

Landing fees and other rents include landing fees, which are at a premium

in the heavily trafficked northeast corridor of the U.S. where approximately

80% of our operations center. Other rents primarily consist of rent for

airports in our 93 BlueCities.

Landing fees and other rents increased $21 million, or 6.7%, in 2015

primarily due to increased departures.

Depreciation and Amortization

Depreciation and amortization primarily include depreciation for our owned

and capital leased aircraft, engines, and in-flight entertainment systems.

Depreciation and amortization increased $25 million, or 7.7%, primarily due

to an average of 149 owned and capital leased aircraft in 2015 compared

to 137 in 2014. Additionally, depreciation expense increased in 2015 due

to the completion of our international arrivals facility, T5i, and additional

gates at T5, which was completed in November 2014.

Sales and Marketing

In 2015, Sales and marketing increased $33 million, or 14.3%, primarily due

to increased sales distribution costs associated with increased revenues.

Maintenance, Materials and Repairs

Maintenance, materials and repairs are generally expensed when incurred

unless covered by a long-term flight hour services contract. The average

age of our aircraft in 2015 was 8.3 years which is relatively young compared

to our competitors. However, as our fleet ages our maintenance costs will

increase significantly, both on an absolute basis and as a percentage of

our unit costs, as older aircraft require additional, more expensive repairs

over time. We had an average of 11.7 additional total operating aircraft

in 2015 compared to 2014.

In 2015, Maintenance, materials and repairs increased by $72 million, or

17.3% compared to 2014, primarily driven by increased flight hours on

our engine flight-hour based maintenance repair agreements and by the

number of airframe heavy maintenance repairs.

Other Operating Expenses

Other operating expenses consist of the following categories: outside

services (including expenses related to fueling, ground handling, skycap,

security and janitorial services), insurance, personnel expenses, cost of

goods sold to other airlines by LiveTV when LiveTV was a subsidiary of

JetBlue, professional fees, on-board supplies, shop and office supplies, bad

debts, communication costs and taxes other than payroll and fuel taxes.

In 2015, Other operating expenses increased by $67 million, or 9.8%,

compared to 2014, primarily due to an increase in airport services and

passenger on-board supplies resulting from increased passengers flown,