Intel 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129

|

|

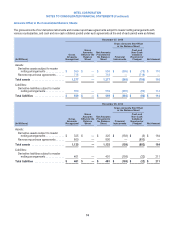

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

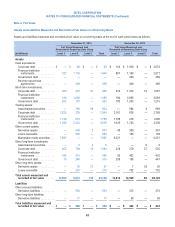

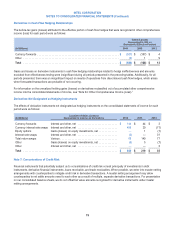

Fair Value of Derivative Instruments in the Consolidated Balance Sheets

The fair value of our derivative instruments at the end of each period were as follows:

December 27, 2014 December 28, 2013

(In Millions)

Other

Current

Assets

Other

Long-Term

Assets

Other

Accrued

Liabilities

Other

Long-Term

Liabilities

Other

Current

Assets

Other

Long-Term

Assets

Other

Accrued

Liabilities

Other

Long-Term

Liabilities

Derivatives designated as

hedging instruments:

Currency forwards ..........$6$1$497$9$ 114 $ 1 $ 118 $ 2

Total derivatives designated

as hedging instruments ... 6 1 497 9 114 1 118 2

Derivatives not designated as

hedging instruments:

Currency forwards .......... 207 — 44 — 66 — 63 —

Currency interest rate swaps . . 344 34 7 — 124 6 163 29

Embedded debt derivatives . . . —— 4 8———19

Interest rate swaps .......... 3 — 11 — 5 — 28 —

Total return swaps .......... ————48———

Other .................... 122———29— —

Total derivatives not

designated as hedging

instruments ............. 555 56 66 8 243 35 254 48

Total derivatives ...........$ 561 $ 57 $ 563 $ 17 $ 357 $ 36 $ 372 $ 50

73