Intel 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

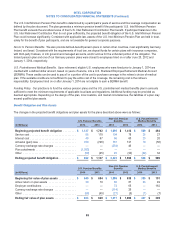

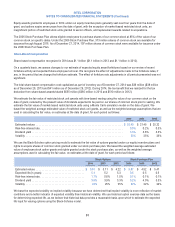

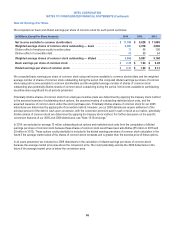

Note 20: Gains (Losses) on Equity Investments, Net

The components of gains (losses) on equity investments, net for each period were as follows:

(In Millions) 2014 2013 2012

Share of equity method investee losses, net ..................................... $ (69) $ (69) $ (81)

Impairments .............................................................. (146) (123) (154)

Gains on sales, net ........................................................ 422 515 183

Dividends ................................................................ 57 46 —

Other, net ................................................................ 147 102 193

Total gains (losses) on equity investments, net ................................ $ 411 $ 471 $ 141

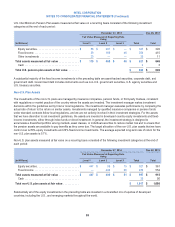

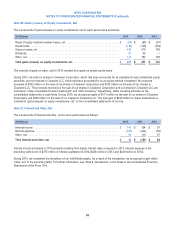

The majority of gains on sales, net for 2014 resulted from gains on private equity sales.

During 2013, we sold our shares in Clearwire Corporation, which had been accounted for as available-for-sale marketable equity

securities, and our interest in Clearwire LLC, which had been accounted for as an equity method investment. We received

proceeds of $142 million on the sale of our shares in Clearwire Corporation and $328 million on the sale of our interest in

Clearwire LLC. The proceeds received on the sale of our shares in Clearwire Corporation and our interest in Clearwire LLC are

included in “sales of available-for-sale investments” and “other investing,” respectively, within investing activities on the

consolidated statements of cash flows. During 2013, we recognized gains of $111 million on the sale of our shares in Clearwire

Corporation and $328 million on the sale of our interest in Clearwire LLC. The total gain of $439 million on these transactions is

included in “gains (losses) on equity investments, net” on the consolidated statements of income.

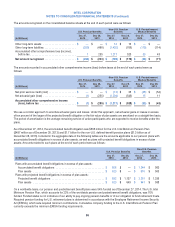

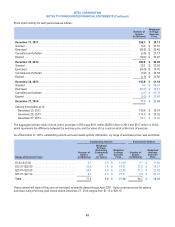

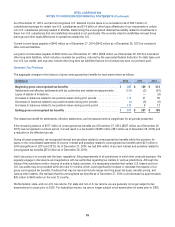

Note 21: Interest and Other, Net

The components of interest and other, net for each period were as follows:

(In Millions) 2014 2013 2012

Interest income ........................................................... $ 141 $ 104 $ 97

Interest expense .......................................................... (192) (244) (90)

Other, net ................................................................ 94 (11) 87

Total interest and other, net ................................................ $43$ (151) $ 94

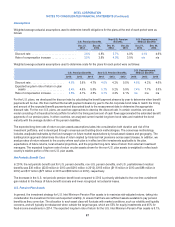

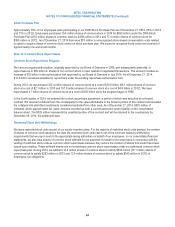

Interest income increased in 2014 primarily resulting from higher interest rates compared to 2013. Interest expense in the

preceding table is net of $276 million of interest capitalized in 2014 ($246 million in 2013 and $240 million in 2012).

During 2014, we completed the divestiture of our Intel Media assets. As a result of the transaction, we recognized a gain within

“other, net” in the preceding table. For further information, see “Note 9: Divestitures” in the Notes to the Consolidated Financial

Statements of this Form 10-K.

95