Intel 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

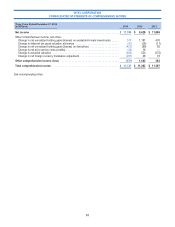

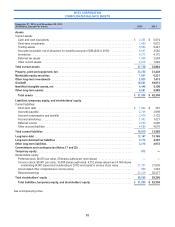

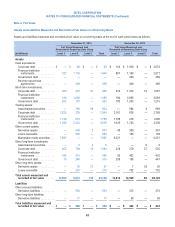

INTEL CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Common Stock and Capital

in Excess of Par Value Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings Total

Three Years Ended December 27, 2014

(In Millions, Except Per Share Amounts)

Number of

Shares Amount

Balance as of December 31, 2011 ..... 5,000 $ 17,036 $ (781) $ 29,656 $ 45,911

Components of comprehensive income,

net of tax:

Net income ...................... — — — 11,005 11,005

Other comprehensive income (loss) . . . — — 382 — 382

Total comprehensive income ...... 11,387

Proceeds from sales of common stock

through employee equity incentive

plans, net excess tax benefit, and

other ........................... 148 2,257 — — 2,257

Share-based compensation ........... — 1,108 — — 1,108

Repurchase of common stock ......... (191) (592) — (4,173) (4,765)

Restricted stock unit withholdings ...... (13) (345) — — (345)

Cash dividends declared ($0.87 per share

of common stock) ................. — — — (4,350) (4,350)

Balance as of December 29, 2012 ..... 4,944 19,464 (399) 32,138 51,203

Components of comprehensive income,

net of tax:

Net income ...................... — — — 9,620 9,620

Other comprehensive income (loss) . . . — — 1,642 — 1,642

Total comprehensive income ...... 11,262

Proceeds from sales of common stock

through employee equity incentive

plans, net tax deficiency, and other . . . 130 1,593 — — 1,593

Share-based compensation ........... — 1,117 — — 1,117

Repurchase of common stock ......... (94) (345) — (1,802) (2,147)

Restricted stock unit withholdings ...... (13) (293) — — (293)

Cash dividends declared ($0.90 per share

of common stock) ................. — — — (4,479) (4,479)

Balance as of December 28, 2013 ..... 4,967 21,536 1,243 35,477 58,256

Components of comprehensive income,

net of tax:

Net income ...................... — — — 11,704 11,704

Other comprehensive income (loss) . . . — — (577) — (577)

Total comprehensive income ...... 11,127

Proceeds from sales of common stock

through employee equity incentive

plans, net excess tax benefit, and

other ........................... 125 1,787 — — 1,787

Share-based compensation ........... — 1,140 — — 1,140

Temporary equity reclassification ....... — (912) — — (912)

Repurchase of common stock ......... (332) (1,438) — (9,354) (10,792)

Restricted stock unit withholdings ...... (12) (332) — — (332)

Cash dividends declared ($0.90 per share

of common stock) ................. — — — (4,409) (4,409)

Balance as of December 27, 2014 ..... 4,748 $ 21,781 $ 666 $ 33,418 $ 55,865

See accompanying notes.

54