Intel 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

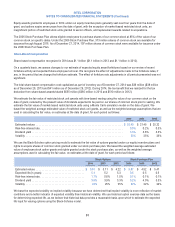

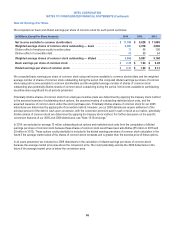

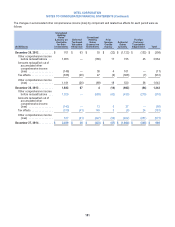

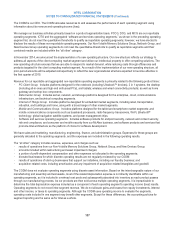

The changes in accumulated other comprehensive income (loss) by component and related tax effects for each period were as

follows:

(In Millions)

Unrealized

Holding

Gains

(Losses) on

Available-

for-Sale

Investments

Deferred

Tax Asset

Valuation

Allowance

Unrealized

Holding

Gains

(Losses) on

Derivatives

Prior

Service

Credits

(Costs)

Actuarial

Gains

(Losses)

Foreign

Currency

Translation

Adjustment Total

December 29, 2012 .......... $ 701 $ 93 $ 93 $ (32) $ (1,122) $ (132) $ (399)

Other comprehensive income

before reclassifications . . . 1,963 — (166) 17 725 45 2,584

Amounts reclassified out of

accumulated other

comprehensive income

(loss) ................. (146) — 30 4 101 — (11)

Tax effects ............... (636) (26) 47 (3) (306) (7) (931)

Other comprehensive income

(loss) ................. 1,181 (26) (89) 18 520 38 1,642

December 28, 2013 .......... 1,882 67 4 (14) (602) (94) 1,243

Other comprehensive income

before reclassifications . . . 1,029 — (589) (42) (433) (275) (310)

Amounts reclassified out of

accumulated other

comprehensive income

(loss) ................. (142) — 13 6 37 — (86)

Tax effects ............... (310) (41) 149 3 (6) 24 (181)

Other comprehensive income

(loss) ................. 577 (41) (427) (33) (402) (251) (577)

December 27, 2014 .......... $ 2,459 $ 26 $ (423) $ (47) $ (1,004) $ (345) $ 666

101