Intel 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

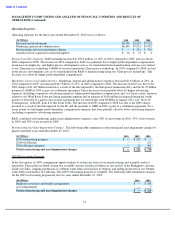

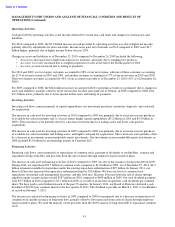

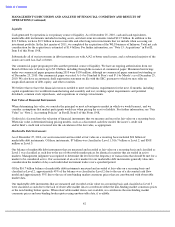

Provision for Taxes

Our provision for taxes and effective tax rate were as follows:

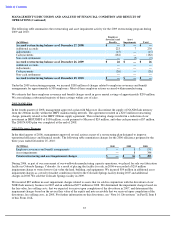

We generated a higher percentage of our profits from higher tax jurisdictions in 2010 compared to 2009, negatively impacting

our effective tax rate for 2010. The effective tax rate for 2009 was positively impacted by the reversal of previously accrued

taxes of $366 million on settlements, effective settlements, and related remeasurements of various uncertain tax positions.

These impacts were partially offset by the recognition of the EC fine of $1.447 billion in 2009, which was not tax deductible

and therefore significantly increased our effective tax rate for 2009. For further information on the EC fine, see “Note 29:

Contingencies” in Part II, Item 8 of this Form 10-K.

We generated a higher percentage of our profits from lower tax jurisdictions in 2009 compared to 2008, positively impacting

our effective tax rate for 2009. In addition, the 2009 tax rate was positively impacted by the reversal of previously accrued

taxes of $366 million on settlements, effective settlements, and related remeasurements of various uncertain tax positions

compared to a reversal of $103 million for such matters in 2008. These impacts were partially offset by the recognition of the

EC fine. In addition, our 2008 effective tax rate was negatively impacted by the recognition of a valuation allowance on our

deferred tax assets due to the uncertainty of realizing tax benefits related to impairments of our equity investments.

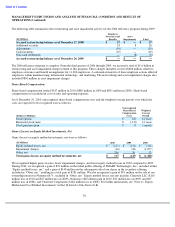

Business Outlook

Our future results of operations and the topics of other forward-looking statements contained in this Form 10-K, including this

MD&A, involve a number of risks and uncertainties—in particular:

Our business outlook incorporates financial projections and assumptions concerning the performance of McAfee, which we

expect to acquire in the first quarter of 2011, and the recently acquired WLS business of Infineon (see “Note 15: Acquisitions”

in Part II, Item 8 of this Form 10-K). Because we are required to make a number of assumptions about the future performance

of these businesses, it may be more difficult to accurately project our financial results. Some of these assumptions include the

prospects for the acquired businesses’ products and markets, the ability to retain customer relationships and key employees,

successful integration of key technologies or operations, and the potential for unexpected liabilities. In addition, as we

integrate these businesses into our operations, our understanding of the financial and operational performance of the acquired

businesses may change, which could require an update to our business outlook.

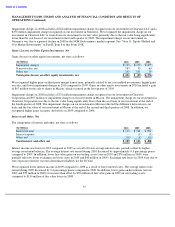

Our business outlook contains forward-looking statements and projections based upon estimates of the impact of the chipset

design issue related to our Intel 6 Series Express Chipset family (see “Note 20: Chipset Design Issue” in Part II, Item 8 of this

Form 10-K) on our future financial and operating results, including on revenue, gross margin, and inventory valuation, based

on our preliminary analysis. Among the factors related to the chipset design issue that could cause actual results to differ are

the number of units that may be affected, the impact on systems in the market, the costs that we may incur in repairing or

replacing impacted components, the extent to which customers purchase parts from our competitors as a result of our parts

shortages or otherwise, the extent of shipments of impacted chipsets for use in PC system configurations that would not be

impacted by the design issue, and the extent to which we are able to increase production of substitute or redesigned parts for

customers.

In addition to the various important factors discussed above, a number of other important factors could cause actual results to

differ materially from our expectations. See “Risk Factors” in Part I, Item 1A of this Form 10-K.

38

(Dollars in Millions)

2010

2009

2008

Income before taxes

$

16,045

$

5,704

$

7,686

Provision for taxes

$

4,581

$

1,335

$

2,394

Effective tax rate

28.6

%

23.4

%

31.1

%

•

changes in business and economic conditions;

•

revenue and pricing;

•

gross margin and costs;

•

pending legal proceedings;

•

our effective tax rate;

•

marketing, general and administrative expenses;

•

our goals and strategies;

•

new product introductions, and product defects and errata;

•

plans to cultivate new businesses;

•

R&D expenses;

•

divestitures, acquisitions, or similar transactions;

•

net gains (losses) from equity investments;

•

interest and other, net;

•

capital spending;

•

depreciation; and

•

impairment of investments.