Intel 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

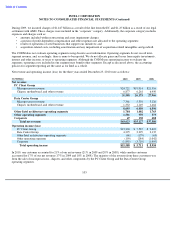

Note 28: Taxes

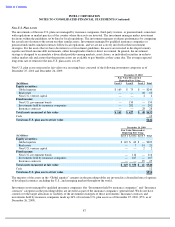

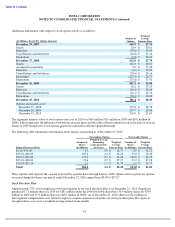

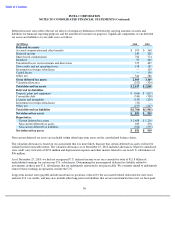

Income before taxes and the provision for taxes consisted of the following:

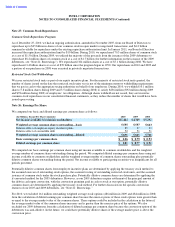

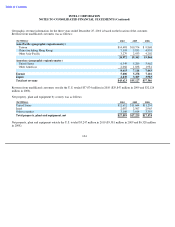

The difference between the tax provision at the statutory federal income tax rate and the tax provision as a percentage of

income before income taxes (effective tax rate) was as follows:

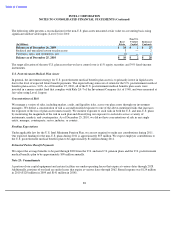

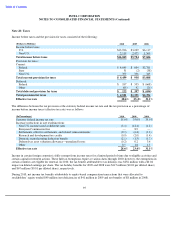

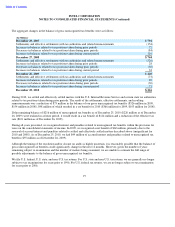

Income in certain foreign countries is fully exempt from income taxes for a limited period of time due to eligible activities and

certain capital investment actions. These full tax exemptions expire at various dates through 2020; however, the exemptions in

certain countries are eligible for renewal. In 2010, the tax benefit attributable to tax holidays was $256 million with a $0.04

impact on diluted earnings per share. The tax holiday benefits for 2009 and 2008 were $115 million ($0.02 per diluted share)

and $67 million ($0.01 per diluted share), respectively.

During 2010, net income tax benefits attributable to equity-based compensation transactions that were allocated to

stockholders’ equity totaled $40 million (net deficiencies of $41 million in 2009 and net benefits of $8 million in 2008).

95

(Dollars in Millions)

2010

2009

2008

Income before taxes:

U.S.

$

13,926

$

3,229

$

6,117

Non

-

U.S.

2,119

2,475

1,569

Total income before taxes

$

16,045

$

5,704

$

7,686

Provision for taxes:

Current:

Federal

$

4,049

$

604

$

2,781

State

51

(2

)

(38

)

Non

-

U.S.

359

336

345

Total current provision for taxes

$

4,459

$

938

$

3,088

Deferred:

Federal

$

187

$

355

$

(668

)

Other

(65

)

42

(26

)

Total deferred provision for taxes

$

122

$

397

$

(694

)

Total provision for taxes

$

4,581

$

1,335

$

2,394

Effective tax rate

28.6

%

23.4

%

31.1

%

(In Percentages)

2010

2009

2008

Statutory federal income tax rate

35.0

%

35.0

%

35.0

%

Increase (reduction) in rate resulting from:

Non

-

U.S.

income taxed at different rates

(3.4

)

(12.4

)

(4.2

)

European Commission fine

—

8.9

—

Settlements, effective settlements, and related remeasurements

(0.3

)

(6.4

)

(1.3

)

Research and development tax credits

(0.9

)

(2.0

)

(1.4

)

Domestic manufacturing deduction benefit

(2.1

)

(1.5

)

(1.7

)

Deferred tax asset valuation allowance

—

unrealized losses

(0.2

)

0.2

3.4

Other

0.5

1.6

1.3

Effective tax rate

28.6

%

23.4

%

31.1

%