Intel 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

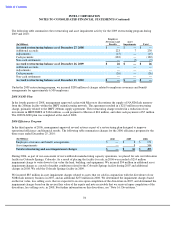

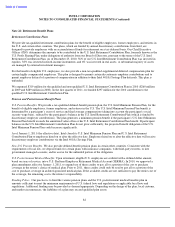

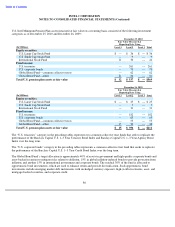

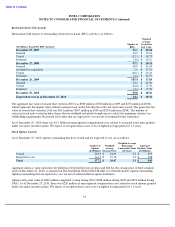

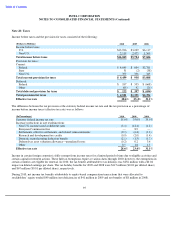

The following table presents a reconciliation for the non-U.S. plan assets measured at fair value on a recurring basis using

significant unobservable inputs (Level 3) for 2010:

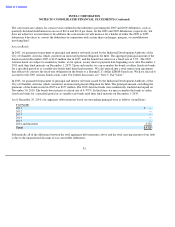

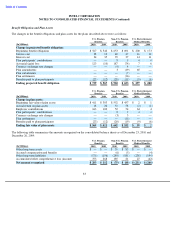

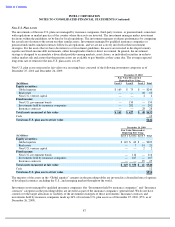

The target allocation of the non-U.S. plan assets that we have control over is 61% equity securities and 39% fixed-income

instruments.

U.S. Postretirement Medical Plan Assets

In general, the investment strategy for U.S. postretirement medical benefits plan assets is to primarily invest in liquid assets

due to the level of expected future benefit payments. The expected long-

term rate of return for the U.S. postretirement medical

benefits plan assets is 3.0%. As of December 25, 2010, all of the U.S. postretirement medical benefits plan assets were

invested in a money market fund that complies with Rule 2A-7

of the Investment Company Act of 1940, and were measured at

fair value using Level 1 inputs.

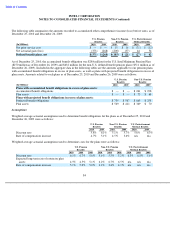

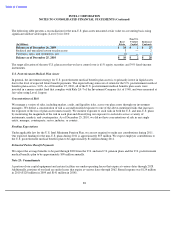

Concentrations of Risk

We manage a variety of risks, including market, credit, and liquidity risks, across our plan assets through our investment

managers. We define a concentration of risk as an undiversified exposure to one of the above-mentioned risks that increases

the exposure of the loss of plan assets unnecessarily. We monitor exposure to such risks in both the U.S. and non-U.S. plans

by monitoring the magnitude of the risk in each plan and diversifying our exposure to such risks across a variety of

instruments, markets, and counterparties. As of December 25, 2010, we did not have concentrations of risk in any single

entity, manager, counterparty, sector, industry, or country.

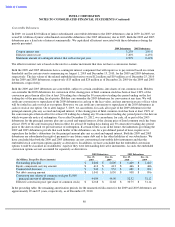

Funding Expectations

Under applicable law for the U.S. Intel Minimum Pension Plan, we are not required to make any contributions during 2011.

Our expected funding for the non-U.S. plans during 2011 is approximately $55 million. We expect employer contributions to

the U.S. postretirement medical benefits plan to be approximately $1 million during 2011.

Estimated Future Benefit Payments

We expect the average benefits to be paid through 2020 from the U.S. and non-U.S. pension plans and the U.S. postretirement

medical benefits plan to be approximately $90 million annually.

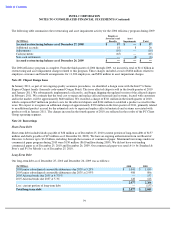

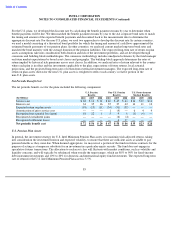

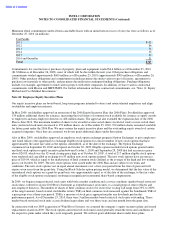

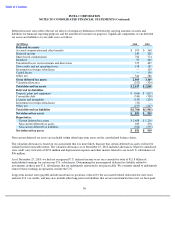

Note 23: Commitments

A portion of our capital equipment and certain facilities are under operating leases that expire at various dates through 2028.

Additionally, portions of our land are under leases that expire at various dates through 2062. Rental expense was $124 million

in 2010 ($120 million in 2009 and $141 million in 2008).

88

Non

-

U.S.

Real

Venture

Insurance

(In Millions)

Estate

Capital

Contracts

Balance as of December 26, 2009

$

14

$

2

$

25

Realized and unrealized return on plan assets

3

—

2

Purchases, sales, and settlements, net

(7

)

—

1

Balance as of December 25, 2010

$

10

$

2

$

28