Incredimail 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Incredimail annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR OFFER AND USE OF PROCEEDS

Not applicable.

D. RISK FACTORS

Investing in our ordinary shares involves a high degree of risk. You should consider carefully the following risk factors, as well as the other

information in this annual report before deciding to invest in our ordinary shares. Our business, financial condition or results of operations

could be affected adversely by any of these risks. The trading price of our ordinary shares could decline due to any of these risks and you might

lose all or part of your investment in our ordinary shares.

Risks Related to Our Business

We are highly dependent on Internet search based revenues.

Both our legacy business (our business before the ClientConnect Acquistion) and the ClientConnect business are very dependent on

search based revenues which are based on the acceptance and subsequent retention of search properties by the users of the software products of

these businesses. In 2013, these search based revenues accounted for 68% of the revenues related to our legacy business and 85% of

ClientConnect's revenues. In addition, the market for offering and retaining search properties is very competitive. While our strategy is to

diversify our revenue streams and limit the dependence on search based revenues, we expect this venue to continue to generate a major portion

of our revenues in the foreseeable future. Adverse changes in the search industry or our failure to retain existing users, or attract new users, as

well as generate traffic to our search properties, could adversely affect our business, financial condition and results of operations.

Our business depends heavily upon revenues generated from arrangements with search providers, including Microsoft and Google, and

any adverse change in those relationships could adversely affect our business or its financial condition and results of operations.

The vast majority of our revenues from our legacy business in 2013 were derived from search services agreements with Google Ireland

Limited ("Google"), APN LLC ("APN") and Microsoft Online Inc. ("Microsoft"), which expire on April 30, 2015, March 31, 2016 and

December 27, 2014, respectively. In 2013, our agreement with Google accounted for 46% of our legacy business revenues, the agreement with

APN accounted for 11% of our legacy business and the agreement with Microsoft accounted for 9% of our legacy business revenues. The Perion

agreement with Microsoft may be terminated by 30 days' advance notice. As a result of the ClientConnect Acquisition, we also are highly

dependent on ClientConnect's agreements with Microsoft and Google, which expire on December 31, 2014 and on August 31, 2015,

respectively. In 2013, ClientConnect's agreement with Microsoft accounted for 63% of ClientConnect's revenues, and its agreement with Google

accounted for 22% of ClientConnect's revenues.

If any of these agreements is terminated, substantially amended, or not renewed on favorable terms, we could experience a material

decrease in our search generated revenues or the profits they create and we could be forced to seek alternative search providers. There are very

few companies in the market that provide Internet search and advertising services similar to those provided by Google, Microsoft and Yahoo.

These three are the dominant players in this market, particularly on a global scale, and competitors do not offer as much coverage through

sponsored links or searches. If we fail to quickly locate, negotiate and finalize alternative arrangements, or if the alternatives do not provide for

terms that are as favorable as those provided for by these agreements, or if the alternative arrangements will not attract the same traffic as the

traffic attracted by Microsoft or Google, or if the termination by Microsoft or Google affects our ability to contract with other providers, we

would experience a material reduction in our revenues and, in turn, our business, financial condition and results of operations would be adversely

affected.

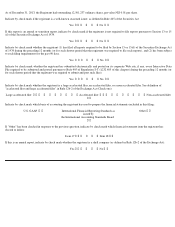

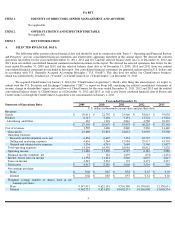

As of December 31,

2009

2010

2011

2012

2013

(in thousands)

Balance Sheet Data:

Cash and cash equivalents

$

24,368

$

16,055

$

11,260

$

21,762

$

23,364

Working capital

26,846

28,067

(27

)

(4,296

)

(2,860

)

Total assets

39,894

41,348

54,904

123,159

114,875

Total liabilities

12,892

13,196

23,083

68,449

58,305

Shareholders

’

equity

27,002

28,152

31,815

54,710

56,570

4