Huntington National Bank 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

customers with new residential mortgages and consumer loans. Automobile Finance, where we have an over 50-

year legacy and distinct expertise, originated a record $4 billion of automobile loans and made great progress

with our expansion into the New England and northern Midwest markets. Small businesses are a critical priority

for us. We were once again the No. 1 Small Business Administration lender across our six-state footprint and

ranked “Highest in Customer Satisfaction with Small Business Banking” according to J.D. Power and Associates.

Our “Fair Play” banking philosophy implemented in 2010 aligns with the spirit of many of the new

consumer banking regulations. Other banks continue to add fees and reduce convenience, while we believe the

path to long-term relationships with our customers is through a superior level of service built around simple

products that are easy to understand. As shown by being named one of the Best Banks in America 2012 by

MONEY Magazine and the nearly 10% increase in the percentage of both consumer and commercial customers

with 4+ products and services over the past two years, customers agree. Looking forward, we believe these deep

relationships will assist us over the next several years, as we navigate a considerable amount of new regulation

that has yet to be finalized and implemented. Whether it is the final Basel III capital and liquidity standards, new

rules set forth by the Consumer Financial Protection Bureau, or moving from the Federal Reserve Board Capital

Plan Review (CapPR) to its Comprehensive Capital Analysis and Review (CCAR), we will continue to adapt and

drive our financial performance consistent with our long-term strategies.

2012 Performance Recap

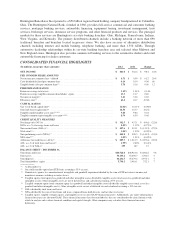

Net income increased 18% to the record level of $641.0 million and earnings per common share increased to

$0.71, or 20% growth from the prior year and above our long-term goal of 6%-8%. Profitability, as measured by

our return on average assets (ROA) and return on average tangible common equity, increased to 1.15% and

13.5%, respectively. Since we established our long-term goals in 2010, 2012 was the first year that the ROA was

within our targeted range of 1.10%-1.35%.

Fully-taxable equivalent total revenue increased $204.1 million, or 8%, from 2011 as noninterest income

increased $117.2 million, or 12%, and net interest income increased $86.8 million, or 5%, from the prior year.

The increase in noninterest income was driven by a $107.7 million, or 129%, increase in mortgage banking

income, a $26.2 million, or 82%, increase in gain on sale of loans, an $18.7 million, or 8%, increase in service

charges on deposit accounts, an $11.6 million, or 32%, increase in capital market fees, and an $11.2 million

bargain purchase gain related to the acquisition of Fidelity Bank. These positive impacts were offset partially by

a $29.4 million, or 26%, decrease in electronic banking income, which was negatively impacted by over $55

million from the Durbin amendment, and a $16.0 million, or 11%, decrease in other income, reflecting a $16.5

million, or 62%, decrease in automobile operating lease income. We continue to make progress in shifting the

overall mix of total revenue towards our goal of 40% as noninterest income was 38.8% of total revenue, up from

37.4% in 2011.

Net interest income increased $86.8 million, or 5%, in 2012. This reflected a $2.1 billion, or 4%, increase in

average earning assets and a 3 basis point increase in the NIM to 3.41%. The increase in the NIM reflected the

positive impact of a 29 basis point decline in total deposit costs that were offset partially by a 24 basis point

decline in the yield on earnings assets and a 2 basis point decrease related to non-deposit funding and other items.

Average noninterest bearing deposits increased $3.5 billion, or 41%, and represented 27% of total deposits.

The $2.1 billion, or 4%, increase in average earning assets was driven by the $1.9 billion, or 10%, increase

in average total commercial loans and $0.8 billion increase in average loans held for sale. Those were offset

partially by a $0.6 billion, or 3%, decrease in average consumer loans including a $1.4 billion, or 23%, decrease

in automobile loans, reflecting $2.5 billion of automobile loans sold throughout the year.

For the year, average total core deposits increased $3.1 billion, or 8%, reflecting a $3.8 billion, or 27%,

increase in total demand deposits and a $0.6 billion, or 4%, increase in money market deposits. These were offset

2