Huntington National Bank 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Huntington Bancshares Incorporated is a $56 billion regional bank holding company headquartered in Columbus,

Ohio. The Huntington National Bank, founded in 1866, provides full-service commercial and consumer banking

services, mortgage banking services, automobile financing, equipment leasing, investment management, trust

services, brokerage services, insurance service programs, and other financial products and services. The principal

markets for these services are Huntington’s six-state banking franchise: Ohio, Michigan, Pennsylvania, Indiana,

West Virginia, and Kentucky. The primary distribution channels include a banking network of more than 690

traditional branches and branches located in grocery stores. We also have an array of alternative distribution

channels including internet and mobile banking, telephone banking, and more than 1,350 ATMs. Through

automotive dealership relationships within its six-state banking franchise area and selected other Midwest and

New England states, Huntington also provides commercial banking services to the automotive dealers and retail

automobile financing for dealer customers.

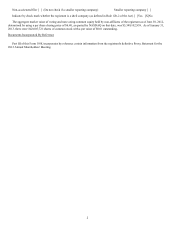

CONSOLIDATED FINANCIAL HIGHLIGHTS

(In millions, except per share amounts) 2012 2011 Change

NET INCOME $ 641.0 $ 542.6 $ 98.4 18%

PER COMMON SHARE AMOUNTS

Net income per common share – diluted .............................................. $ 0.71 $ 0.59 $ 0.12 20%

Cash dividend declared per common share ............................................ 0.16 0.10 0.06 60

Tangible book value per common share(1) ............................................. 5.78 5.18 0.60 12

PERFORMANCE RATIOS

Return on average total assets ...................................................... 1.15% 1.01% 0.14%

Return on average tangible common shareholders’ equity ................................ 13.5 12.7 0.80

Net interest margin(2) ............................................................. 3.41 3.38 0.03

Efficiency ratio(3) ................................................................ 63.4 63.7 (0.30)

CAPITAL RATIOS

Tier 1 risk-based capital ratio(1) ..................................................... 12.02% 12.11% (0.09)%

Total risk-based capital ratio(1) ..................................................... 14.50 14.77 (0.27)

Tangible equity/tangible assets ratio(1)(4)(8) ............................................ 9.46 9.02 0.44

Tangible common equity/tangible asset ratio(1)(5)(8) ...................................... 8.76 8.30 0.46

CREDIT QUALITY MEASURES

Net charge-offs (NCOs) ........................................................... $ 342.5 $ 437.1 $ (94.6) (22)%

NCOs as a % of average loans and leases ............................................. 0.85% 1.12% (0.27)%

Non-accrual loans (NALs)(1) ....................................................... $ 407.6 $ 541.1 $ (133.5) (25)%

NAL ratio(1)(6) ................................................................... 1.00% 1.39% (0.39)%

Non-performing assets (NPAs)(1) ................................................... $ 445.8 $ 590.3 $ (144.5) (24)%

NPA ratio(1)(7) ................................................................... 1.09% 1.51% (0.42)%

Allowance for credit losses (ACL)(1) ................................................. $ 809.7 $ 1,013.3 $ (203.6) (20)%

ACL as a % of total loans and leases(1) ............................................... 1.99% 2.60% (0.61)%

ACL as a % of NALs(1) ........................................................... 199 187 12

BALANCE SHEET – DECEMBER 31,

Total loans and leases ............................................................ $40,728.4 $38,923.8 $1,804.6 5%

Total assets .................................................................... 56,153.2 54,450.7 1,702.5 3

Total deposits ................................................................... 46,252.7 43,279.6 2,973.1 7

Total shareholders’ equity ......................................................... 5,790.2 5,418.1 372.1 7

(1) At December 31.

(2) On a fully-taxable equivalent (FTE) basis assuming a 35% tax rate.

(3) Noninterest expense less amortization of intangibles and goodwill impairment divided by the sum of FTE net interest income and

noninterest income excluding securities losses.

(4) Tangible equity (total equity less goodwill and other intangible assets) divided by tangible assets (total assets less goodwill and other

intangible assets). Other intangible assets are net of deferred tax and calculated assuming a 35% tax rate.

(5) Tangible common equity (total common equity less goodwill and other intangible assets) divided by tangible assets (total assets less

goodwill and other intangible assets). Other intangible assets are net of deferred tax and calculated assuming a 35% tax rate.

(6) NALs divided by total loans and leases.

(7) NPAs divided by the sum of total loans and leases, impaired loans held-for-sale, and net other real estate.

(8) Tangible equity, tangible common equity, and tangible assets are non-GAAP financial measures. Additionally, any ratios utilizing these

financial measures are also non-GAAP. These financial measures have been included as they are considered to be critical metrics with

which to analyze and evaluate financial condition and capital strength. Other companies may calculate these financial measures

differently.