Harris Teeter 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

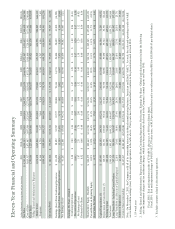

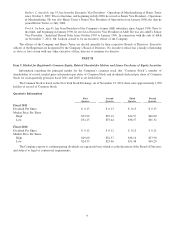

Comparison of Total Cumulative Shareholder Return for Five-Year Period Ending October 2, 2011

The following graph presents a comparison of the yearly percentage change in the Company’s cumulative total

shareholders’ return on Common Stock with the (i) Standard & Poor’s 500 Index, (ii) Standard & Poor’s Midcap 400 Index,

(iii) Standard & Poor’s Food Retail Index, and (iv) Standard & Poor’s Apparel, Accessories & Luxury Goods Index for the

five-year period ended October 2, 2011.

Cumulative Total Return

9/30/06 9/30/07 9/30/08 9/30/09 9/30/10 9/30/11

Ruddick Corporation 100.00 130.77 128.25 107.28 141.97 161.76

S & P 500 100.00 116.44 90.85 84.58 93.17 94.24

S & P Midcap 400 100.00 118.76 98.95 95.87 112.92 111.47

S & P Food Retail 100.00 113.74 85.64 72.27 77.51 83.46

S & P Apparel, Accessories & Luxury Goods 100.00 114.34 78.40 81.69 101.57 138.32

* $100 invested on 9/30/06 in stock or index, including reinvestment of dividends.

** The Company historically has utilized two indices, rather than a single index, for its peer group comparison: Standard

& Poor’s Food Retail Index and Standard & Poor’s Apparel, Accessories & Luxury Goods Index. The Company

believes that the separate presentation of these indices more accurately corresponds to the Company’s current business

and historical thread manufacturing business. As previously noted, the Company sold all of its ownership interest in

A&E, its thread manufacturing business, subsequent to the end of fiscal 2011.

7