Harris Teeter 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 RUDDICK ANNUAL REPORT AND PROXY STATEMENT

301 S. Tryon Street, Suite 1800, Charlotte, NC 28202 • 704-372-5404 • www.ruddickcorp.com

Table of contents

-

Page 1

2011 R U DDIC K A NN U A L R E PO R T A N D P R O XY S TATE ME NT -

Page 2

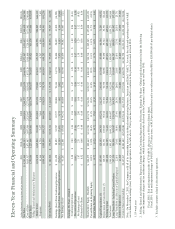

... 128,717 Working Capital 280,300 total assets 1,984,424 long-term Debt - including Current Portion 287,330 long-term Debt as a Percent of Capital Employed 22.8% Number of Employees 24,500 Common shares Outstanding 49,147,817 1. 53-week year 2. selling, General and Administrative Expenses, Earnings... -

Page 3

..., Charlotte, North Carolina (Address of principal executive ofï¬ces) Registrant's telephone number, including area code: (704) 372-5404 Securities registered pursuant to Section 12(b) of the Act: 28202 (Zip Code) Title of each class: Common Stock Name of exchange on which registered: New York... -

Page 4

... and Financial Statement Schedules ...51 Directors, Executive Ofï¬cers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneï¬cial Owners and Management and Related Shareholder Matters ...Certain Relationships and Related Transactions, and Director Independence... -

Page 5

...in supermarket formats. As a result, Harris Teeter is likely to compete with more, larger food chains in its markets. Principal competitive factors include store location, price, service, convenience, cleanliness, product quality and product variety. No one customer or group of related customers has... -

Page 6

... major new competitors. The number and type of competitors faced by Harris Teeter vary by location and include: traditional grocery retailers (both national and regional), discount retailers such as "supercenters" and "club and warehouse stores," specialty supermarkets, drug stores, dollar stores... -

Page 7

... manage expansion, including the effect on sales at existing stores when a new store is opened nearby; the ability to secure any necessary ï¬nancing; change in regional and national economic conditions; and increasing competition or changes in the competitive environment in Harris Teeter's markets... -

Page 8

... and warranties provided to the buyers. Further, there are certain purchase price adjustments that will occur within 60 days of the closing date. The Company also expects to incur additional expenses, primarily related to the settlement of the pension liability and other employee beneï¬t plans that... -

Page 9

... statistics with respect to Harris Teeter stores for each of the last three ï¬scal years: 2011 2010 2009 Stores Open at Period End Average Weekly Net Sales Per Store* Average Square Footage Per Store at Period End Average Square Footage Per New Store Opened During Period Total Square Footage at... -

Page 10

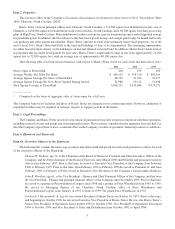

... Company's common stock (the "Common Stock"), number of shareholders of record, market price information per share of Common Stock and dividends declared per share of Common Stock for each quarterly period in ï¬scal 2011 and 2010 is set forth below. The Common Stock is listed on the New York Stock... -

Page 11

... Ending October 2, 2011 The following graph presents a comparison of the yearly percentage change in the Company's cumulative total shareholders' return on Common Stock with the (i) Standard & Poor's 500 Index, (ii) Standard & Poor's Midcap 400 Index, (iii) Standard & Poor's Food Retail Index, and... -

Page 12

...its common stock during the quarter ended October 2, 2011. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs Period Total Number of Shares Purchased Average Price Paid per Share July... -

Page 13

.... Generally, Harris Teeter's markets continue to experience new store opening activity and increased feature pricing or everyday low prices by competitors. Harris Teeter utilizes information gathered from various sources, including its Very Important Customer ("VIC") loyalty card program, and works... -

Page 14

...week of the annual period), sales increased by 5.10% from ï¬scal 2009 to ï¬scal 2010. The ï¬scal 2010 sales increase was partially offset by a comparable store sales decline. During ï¬scal 2011, Harris Teeter opened seven new stores (one of which replaced an existing store) and closed two stores... -

Page 15

... increase in total SG&A expenses from ï¬scal 2009 to ï¬scal 2010. Even though store labor and associated beneï¬t costs increased, as a result of Harris Teeter's new store growth, there was a 29 basis point reduction in these costs as a percent to sales from ï¬scal 2010 to ï¬scal 2011 and a 23... -

Page 16

...The Company's operating performance and strong ï¬nancial position provide the ï¬,exibility to continue with Harris Teeter's store development program that includes new and replacement stores along with the remodeling and expansion of existing stores. During ï¬scal 2012, Harris Teeter plans to open... -

Page 17

... capital expenditures, sales and operating results. Startup costs associated with opening new stores under Harris Teeter's store development program can negatively impact operating margins and net income. In the current competitive environment, promotional costs to maintain market share could also... -

Page 18

... total expected payments of principal and interest. Payment on variable interest debt is estimated using an interest rate of 2.2% applied to the outstanding balance. Represents the minimum rents payable and includes leases associated with closed stores. The obligations related to the closed store... -

Page 19

... payments associated with certain deferred compensation contracts. The net present value of these obligations is recorded by the Company and included with other long-term liabilities in the Company's consolidated balance sheets. (4) In connection with the closing of certain store locations, Harris... -

Page 20

... for price markdowns are credited to the cost of sales during the period in which the related markdown was taken and charged to the cost of sales. Slotting and stocking allowances received from a vendor to ensure that its products are carried or to introduce a new product at the Company's stores are... -

Page 21

... over the lease terms associated with the closed stores, unless settled earlier. Harris Teeter management estimates the subtenant income and future cash ï¬,ows based on its historical experience and knowledge of (1) the market in which the store is located, (2) the results of its previous efforts... -

Page 22

... speciï¬c real estate markets, inï¬,ation rates and general economic conditions and may differ signiï¬cantly from those assumed and estimated. Store closings generally are completed within one year after the decision to close. Adjustments to closed store liabilities primarily relate to changes in... -

Page 23

... cash ï¬,ows and related weighted average interest rates by expected maturity dates for the Company's Senior Notes due at various dates through 2017 (which accounts for 97% of the Company's ï¬xed interest debt obligations) (dollars in thousands): 2012 2013 2014 2015 2016 Thereafter Total Fair Value... -

Page 24

... Data RUDDICK CORPORATION AND CONSOLIDATED SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SCHEDULE Page Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets, October 2, 2011 and October 3, 2010 Statements of Consolidated Operations for the ï¬scal years... -

Page 25

Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders Ruddick Corporation: We have audited the accompanying consolidated balance sheets of Ruddick Corporation and subsidiaries (the Company) as of October 2, 2011 and October 3, 2010, and the related ... -

Page 26

Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders Ruddick Corporation: We have audited Ruddick Corporation and subsidiaries' (the Company) internal control over ï¬nancial reporting as of October 2, 2011, based on criteria established in "Internal ... -

Page 27

... Operations Total Current Liabilities Long-Term Debt and Capital Lease Obligations Deferred Income Taxes Pension Liabilities Other Long-Term Liabilities Long-Term Liabilities of Discontinued Operations Commitments and Contingencies Equity Common Stock, no par value - Shares Outstanding: 2011 - 49... -

Page 28

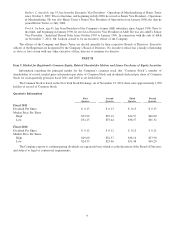

STATEMENTS OF CONSOLIDATED OPERATIONS RUDDICK CORPORATION AND SUBSIDIARIES (dollars in thousands, except per share data) 52 Weeks Ended October 2, 2011 53 Weeks Ended October 3, 2010 52 Weeks Ended September 27, 2009 Net Sales Cost of Sales Selling, General and Administrative Expenses Operating Pro... -

Page 29

... $333 for taxes Total Comprehensive Income Dividends ($0.48 a share) Exercise of stock options, including tax beneï¬ts of $1,366 Share-based compensation Shares effectively purchased and retired for withholding taxes Shares purchased and retired Directors stock plan Acquisition from noncontrolling... -

Page 30

... for taxes Total Comprehensive Income Dividends ($0.52 a share) (25,555) Exercise of stock options, including tax beneï¬ts of $1,157 38,256 1,779 Share-based compensation 273,844 8,073 Shares effectively purchased and retired for withholding taxes (65,765) (2,485) Directors stock plan 3 Acquisition... -

Page 31

... Proceeds from Long-Term Debt Borrowings Payments on Long-Term Debt and Capital Lease Obligations Dividends Paid Proceeds from Stock Issued Share-Based Compensation Tax Beneï¬ts Shares Effectively Purchased and Retired for Withholding Taxes Purchase and Retirement of Common Stock Other, Net... -

Page 32

... grocery (including related real estate and store development activities) - through its wholly-owned subsidiary Harris Teeter. Harris Teeter is a regional supermarket chain operating primarily in the southeastern and mid-Atlantic United States, and the District of Columbia. New Accounting Standards... -

Page 33

... are generally intended to defray the costs of promotion, advertising and selling the vendor's products. Vendor rebates, credits and other promotional allowances that relate to Harris Teeter's buying and merchandising activities, including lump-sum payments associated with long-term contracts... -

Page 34

... of (1) the market in which the store is located, (2) the results of its previous efforts to dispose of similar assets and (3) the current economic conditions. Investments The Company's Harris Teeter subsidiary invests in certain real estate development projects, with a managing partner or partners... -

Page 35

RUDDICK CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued) Insurance The Company utilizes a combination of self-insured retention and high-deductible programs for workers' compensation claims, healthcare claims, and general liability and automotive liability losses... -

Page 36

... of product sold by the dairy operation to outsiders are included in cost of sales in the period in which the sales are recognized in revenues. Selling, General and Administrative Expenses The major components of selling, general and administrative expenses are (a) the costs associated with store... -

Page 37

... effect of potential common stock equivalents resulting from the operation of the Company's comprehensive stock option and awards plans. Stock Options and Stock Awards The Company uses fair-value accounting for all share-based payments to employees. Compensation expense for stock awards are based... -

Page 38

RUDDICK CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued) 3. COMPANY OWNED LIFE INSURANCE (COLI) The Company has purchased life insurance policies to fund its obligations under certain beneï¬t plans for ofï¬cers, key employees and directors. The cash surrender ... -

Page 39

RUDDICK CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued) 2011 2010 Notes Payable Current Portion of Long-Term Debt and Capital Lease Obligations Accounts Payable Federal and State Income Taxes Accrued Compensation Deferred Income Taxes Other Current ... -

Page 40

... 203,683 (99,358) $104,325 In connection with the closing of certain store locations, Harris Teeter has assigned leases to several sub-tenants with recourse. These leases expire over the next 10 years and the future minimum lease payments totaling $38,001,000 over this period have been assumed by... -

Page 41

... excluding the applicable margin and associated fees. Both interest rate swaps were designated as cash ï¬,ow hedges. In the ï¬rst quarter of ï¬scal 2010, Harris Teeter entered into a series of purchased call options and written put options in order to limit the price variability in fuel purchases... -

Page 42

...October 2, 2011 or October 3, 2010. The Board of Directors adopted a stock buyback program in 1996, authorizing, at management's discretion, the Company to purchase and retire up to 10% of the then outstanding shares of the Company's common stock for the purpose of preventing dilution as a result of... -

Page 43

... to $35.24. The total cash received from stock options exercised for the exercise price and related tax deductions are included in the Consolidated Statements of Shareholders' Equity and Comprehensive Income. The Company has historically issued new shares to satisfy the stock options exercised. The... -

Page 44

... (in thousands): 2011 2010 2009 Income tax on pre-tax income at the statutory federal rate of 35% Increase (decrease) attributable to: State and other income taxes, net of federal income tax beneï¬t Tax credits Employee Stock Ownership Plan (ESOP) COLI Other items, net Income tax expense $63,390... -

Page 45

... the above positions would not affect the annual effective tax rate but would accelerate the payment of cash to the tax authority to an earlier period. 13. EMPLOYEE BENEFIT PLANS The Company maintains various retirement beneï¬t plans for substantially all full-time employees of the Company and its... -

Page 46

...adjustment, net of tax beneï¬t, is reported as a component of other comprehensive income and included in the Statements of Consolidated Shareholders' Equity and Comprehensive Income. Net periodic pension expense for the Company's deï¬ned beneï¬t pension plans for ï¬scal years 2011, 2010 and 2009... -

Page 47

... 1,376 $4,578 $ 664 2,119 247 $3,030 Net periodic pension expense for the Company's deï¬ned beneï¬t pension plans is determined using assumptions as of the beginning of each year and the market-related value of plan assets that recognizes changes in fair value in a systematic and rational manner... -

Page 48

... then divided by the number of shares outstanding. The NAV is a quoted price in an active market. Group Annuity Contract - Fair value is calculated by discounting the related cash ï¬,ow based on current yields of similar instruments with comparable durations considering the credit-worthiness of the... -

Page 49

... are overseen by the Retirement Plan Committee which is made up of certain Company and subsidiary ofï¬cers. The Company has developed an Investment Policy Statement based on the need to satisfy the long-term liabilities of the Pension Plan. The Company seeks to maximize return with reasonable and... -

Page 50

... TO CONSOLIDATED FINANCIAL STATEMENTS - (continued) The Savings Plan is a deï¬ned contribution retirement plan pursuant to Section 401(k) of the Internal Revenue Code, and was authorized for the purpose of providing retirement beneï¬ts for employees of the Company. The Company provides a matching... -

Page 51

... and contingencies. 16. QUARTERLY INFORMATION (UNAUDITED) The Company's stock is listed and traded on the New York Stock Exchange. The following table sets forth certain ï¬nancial information, the high and low sales prices and dividends declared per share of common stock for the periods indicated... -

Page 52

RUDDICK CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued) First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year 2010 Operating Results Net Sales Gross Proï¬t Earnings From Continuing Operations Earnings (Loss) From Discontinued Operations ... -

Page 53

...Financial Statement and Supplementary Data included herein, expresses an unqualiï¬ed opinion on the effectiveness of the Company's internal control over ï¬nancial reporting as of October 2, 2011. (d) Changes in internal control over ï¬nancial reporting. During the Company's fourth ï¬scal quarter... -

Page 54

... of the Board of Directors," "Corporate Governance Matters: Audit Committee Financial Expert," and "Section 16(a) Beneï¬cial Ownership Reporting Compliance" in the Company's Proxy Statement to be ï¬led with the Securities and Exchange Commission with respect to the Company's 2012 Annual Meeting of... -

Page 55

... are ï¬led as part of this report: (1) Financial Statements: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets, October 2, 2011 and October 3, 2010 Statements of Consolidated Operations for the ï¬scal years ended October 2, 2011, October 3, 2010 and September 27... -

Page 56

...10 of the Registrant's Annual Report on Form 10-K for the ï¬scal year ended September 27, 1992 (Commission File No. 1-6905).** Ruddick Corporation 1995 Comprehensive Stock Option Plan (the "1995 Plan"), incorporated herein by reference to Exhibit 10.1 of the Registrant's Quarterly Report on Form 10... -

Page 57

... No. 1-6905).** Form of Ruddick Corporation Non-Employee Director Nonqualiï¬ed Stock Option Agreement for use in connection with the 1995 Plan, 1997 Plan, 2000 Plan and 2002 Plan, incorporated herein by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K dated November 17, 2004... -

Page 58

...with the 2011 Plan.** Form of Time-Vested Restricted Stock Award Agreement for use in connection with the 2011 Plan.** Summary of Non-Employee Director Compensation. List of Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm. Certiï¬cation of Chief Executive Of... -

Page 59

...from Ruddick Corporation's Annual Report on Form 10-K for the ï¬scal year ended October 2, 2011, formatted in extensible Business Reporting Language (XBRL): (i) the Consolidated Balance Sheets, (ii) the Statements of Consolidated Operations, (iii) the Statements of Consolidated Shareholders' Equity... -

Page 60

... duly authorized. RUDDICK CORPORATION (Registrant) Dated: December 1, 2011 By: /s/ THOMAS W. DICKSON Thomas W. Dickson, Chairman of the Board, President and Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 61

... I RUDDICK CORPORATION AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS AND RESERVES For the Fiscal Years Ended October 2, 2011, October 3, 2010 and September 27, 2009 (in thousands) COLUMN A COLUMN B BALANCE AT BEGINNING OF FISCAL YEAR COLUMN C ADDITIONS CHARGED TO COSTS AND EXPENSES COLUMN... -

Page 62

This page intentionally left blank. -

Page 63

..., 2011 TO THE SHAREHOLDERS OF RUDDICK CORPORATION The Annual Meeting of the Shareholders of Ruddick Corporation (the "Company") will be held in the Auditorium, 12th Floor, Two Wells Fargo Center, 301 S. Tryon Street, Charlotte, North Carolina, on Thursday, February 16, 2012 at 10:00 A.M., local time... -

Page 64

This page intentionally left blank. -

Page 65

...Articles of Incorporation to change the name of the Company to "Harris Teeter Supermarkets, Inc."; To consider and provide an advisory (non-binding) "Say on Pay" vote to approve the compensation of the Company's named executive ofï¬cers as described in the Proxy Statement; To ratify the appointment... -

Page 66

This page intentionally left blank. -

Page 67

... Articles of Incorporation to change the name of the Company to "Harris Teeter Supermarkets, Inc.", (iii) in favor of providing an advisory (non-binding) "Say on Pay" vote to approve the compensation of the Company's named executive ofï¬cers as described in the Proxy Statement, (iv) in favor of... -

Page 68

VOTING SECURITIES Pursuant to the provisions of the North Carolina Business Corporation Act, December 9, 2011, has been ï¬xed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of the Common Stock of record at ... -

Page 69

...of beneï¬cial ownership of the shares included is presented in the notes following the table. Name and Address of Beneï¬cial Owner Number of Shares Beneï¬cially Owned (1) Percent of Class T. Rowe Price Trust Company (2) ...Trustee of the Ruddick Retirement and Savings Plan Post Ofï¬ce Box 89000... -

Page 70

... be ï¬xed and determined from time to time by resolution of the Board of Directors. The number of directors currently is ï¬xed at ten. All of the members of the Board of Directors will be elected annually to serve one year terms. At the Annual Meeting the shareholders will elect all ten members of... -

Page 71

... owned subsidiary of the Company until November 2011. Mr. Dickson brings executive decision making skills, operating and management experience, and broad supermarket and real estate experience to the Board of Directors from his 30 years of experience with the Company and its subsidiaries. These... -

Page 72

... as close as ï¬rst cousin with any other executive ofï¬cer, director or nominee for director of the Company. Directors' Fees and Attendance The Company compensated each director elected to the Board of Directors at the Company's 2011 Annual Meeting of Shareholders who was not an employee of... -

Page 73

... of the Company were also able to defer the payment of the annual fee and/or board meeting fees into the Ruddick Corporation Flexible Deferral Plan ("FDP"). However, during Fiscal 2011, the Company determined to eliminate the FDP as a deferral option for non-employee directors due to a review of the... -

Page 74

... entitled "Stock Options and Stock Awards" in the Notes to Consolidated Financial Statements included within the Company's Annual Report on Form 10-K for the ï¬scal year ended October 2, 2011, except that for the purposes of this table the estimates of forfeitures related to service-based vesting... -

Page 75

... at the Annual Meeting of Shareholders held on February 17, 2011, and prior to the approval thereof, the Addendum to the Ruddick Corporation 2002 Comprehensive Stock Option and Award Plan ("Addendum"). The Compensation Committee grants restricted stock to the employees of the Company and its... -

Page 76

...ï¬cial ownership of the Common Stock, within the meaning of applicable securities regulations, of all current directors and all nominees for director of the Company and the executive ofï¬cers named in the Summary Compensation Table for 2011 included herein, and of such directors and executive of... -

Page 77

... termination of service as a director. As of October 31, 2011, the Company was authorized to deliver up to 500,000 shares of Common Stock pursuant to the Deferral Plan and has delivered 20,986 shares to the participating non-employee directors who have left the Board of Directors. Additionally there... -

Page 78

...ï¬cially as to which such persons have sole voting and investment power; (ii) 64,298 shares that may be acquired by such persons upon the exercise of stock options that are currently exercisable or become exercisable within sixty days of October 31, 2011, as to which such persons would have sole... -

Page 79

... the Company's Audit Committee, Compensation Committee and Corporate Governance & Nominating Committee are also included on the Company's website. Director Independence For a director to be considered independent under the listing standards of the New York Stock Exchange, the Board of Directors must... -

Page 80

... in the New York Stock Exchange Listed Company Manual. Executive Sessions of Non-Management Directors Non-management directors meet without management present at regularly scheduled executive sessions. In addition, to the extent that, from time to time, the group of non-management directors includes... -

Page 81

...Suite 1800, Charlotte, North Carolina 28202, Attention: Secretary of the Corporation. Pursuant to its Charter, the Corporate Governance & Nominating Committee (i) periodically reviews the Company's corporate governance principles, including criteria for the selection of Board of Directors members to... -

Page 82

... risk management functions to its committees. Pursuant to the Audit Committee Charter, one of the primary roles and responsibilities of the Audit Committee is to assist the Board of Directors with the oversight of: (1) the integrity of the ï¬nancial statements and internal controls of the Company... -

Page 83

...this review and discussion, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company's Annual Report on Form 10-K for the year ended October 2, 2011. SUBMITTED... -

Page 84

... long-term incentive awards covering 35,000 shares of Common Stock to Mr. Dickson and covering an aggregate of 41,500 shares of Common Stock to the other NEOs. • • For Fiscal 2011, Mr. Dickson received total compensation of $3,371,225, reï¬,ecting strong Company and individual performance... -

Page 85

corporate and individual performance to compensation levels. The Company's executive compensation program consists generally of annual base salary, annual cash incentive bonuses, long-term equity incentive compensation, such as stock options, restricted stock and performance share grants, and other ... -

Page 86

..., performs the annual evaluation of the Chief Executive Ofï¬cer. The compensation for the Chief Executive Ofï¬cer is approved by the independent directors upon the recommendation of the Compensation Committee. At the 2011 Annual Meeting of Shareholders, the Shareholders provided an advisory vote... -

Page 87

... foreign investment company; Harris Teeter opened 13 new stores, and completed the major remodeling of 2 stores, and achieved productivity, cost savings and operational goals, but did not achieve the stated positive same store sales goals at Harris Teeter; and A&E increased global market share and... -

Page 88

... would be required to meet in order to earn an Incentive Bonus under the plan. For Fiscal 2011, Incentive Bonuses for executives employed directly by the holding Company were based on NOPAT Return. With respect to an executive ofï¬cer employed directly by Harris Teeter or A&E, the Incentive Bonus... -

Page 89

...Company's stock. The Company typically provides long-term equity incentive compensation to its executives through the grant of restricted stock and performance shares pursuant to its shareholder approved equity incentive plans. Generally, the Company plans its equity incentive award grant dates well... -

Page 90

... of management employees, including the NEOs, to achieve the annual operating proï¬t projections which are provided to the Company's Board of Directors. During Fiscal 2011, with respect to performance share awards, the Harris Teeter executives, the A&E executives and the Company's executives earned... -

Page 91

... 2011. (d) Once issued, these shares of restricted stock vest 25% per year on each of the ï¬rst four anniversaries of the date of the issuance. Pension Plan and Supplemental Executive Retirement Plan. NEOs participate in the Ruddick Corporation Employees' Pension Plan (the "Pension Plan"), a tax... -

Page 92

... Liability Insurance. The Company generally provides income protection in the event of disability under group insurance plans for its employees. These group plans have limitations on income replacement and, as a result, highly compensated employees are not provided proportional income protection... -

Page 93

...Incentive Plan Compensation All Other Earnings Compensation Awards Compensation ($) ($)(2) ($)(3) ($)(4) Name and Principal Position Year Salary ($) Bonus ($) Stock Awards ($)(1) Total ($) Thomas W. Dickson ...2011 682,000 Chairman of the Board, 2010 620,000 President and Chief Executive 2009... -

Page 94

... Executive Bonus Insurance Plan ...Ruddick Retirement and Savings Plan ...Ruddick Corporation Flexible Deferral Plan ...Key Employee Life Insurance Plan ...Tax Reimbursement ...Executive Long Term Disability Plan ...Dividends on unvested Restricted Stock Awards ...Meals and Entertainment Expenses... -

Page 95

... entitled "Stock Options and Stock Awards" in the Notes to Consolidated Financial Statements included within the Company's Annual Report on Form 10-K for the ï¬scal year ended October 2, 2011, except that for the purposes of this table the estimates of forfeitures related to service-based vesting... -

Page 96

... ($)(4) Name Number of Securities Underlying Unexercised Options (#) Exercisable Number of Securities Underlying Unexercised Options (#) Unexercisable Option Exercise Price ($) Option Expiration Date Number of Shares or Units of Stock That Have Not Vested (#)(1) Market Value of Shares or... -

Page 97

...Date # of Shares Vesting John B. Woodlief ... 11/15/2011 11/16/2011 11/18/2011 11/19/2011 11/20/2011 11/15/2012 11/18/2012 11/19/2012 11/20/2012 11/18/2013 11/19/2013 11/20/2013 11/18/2014 11/19/2014 11/18/2015 11/15/2011 11/16/2011 11/18/2011... 11/19/2011 11/20/2011 11... -

Page 98

... by the closing market price of the Company's Common Stock on September 30, 2011, the last trading day in Fiscal 2011 ($38.99) (the "Closing Market Price"). (3) Amounts shown are target number of shares of performance shares granted in Fiscal 2011, assuming Harris Teeter and A&E meet or exceed their... -

Page 99

...on such contributions. All NEOs had 45 points or more as of December 31, 2005. A participant's normal annual retirement beneï¬t under the Pension Plan at age 65 is an amount equal to 0.8% (and through the Company's sale of A&E in November 2011, 0.6% for employees of A&E) of the participant's ï¬nal... -

Page 100

... the Common Stock. Participants make an election for each year's deferral election regarding the timing of plan distributions, subject to limitations under the plan and Code Section 409A. A participant may elect up to ï¬ve (5) in-service accounts and one (1) retirement account for payment of... -

Page 101

... one-half (1.5) times the sum of his annual base salary plus the greater of (a) his "severance accrued bonus" or (b) the average of his total bonus payments for the prior three full ï¬scal years ending on or before his termination, and (ii) if terminated other than for "cause", a pro-rated portion... -

Page 102

...scal quarter ending on or before such NEO's termination. When used in the Change-in-Control and Severance Agreements, "CIC accrued bonus" means a bonus payment based upon the current bonus schedule provided in the Cash Incentive Plan, calculated utilizing (a) the Company's annualized NOPAT return on... -

Page 103

... between any customer, supplier, or other person or entity in a business relation with the Company during the same period. Furthermore, under the terms of the Ruddick Corporation 2002 Comprehensive Stock Option and Award Plan (the "2002 Plan"), in the event of a change in control of the Company, as... -

Page 104

... stock awards and performance share awards. The value of the restricted stock awards and performance share awards is calculated by multiplying the number of accelerated shares by the average of the high and low trading price on the last business day prior to the assumed termination of service date... -

Page 105

... performance share awards. The value of the restricted stock and performance share awards is calculated by multiplying the number of accelerated shares by the average of the high and low trading price on the last business day prior to the assumed termination of service date in accordance with plan... -

Page 106

... the Company's restricted stock and performance share grants, see Note 11 to the Consolidated Financial Statements included within the Company's Annual Report on Form 10-K for the ï¬scal year ended October 2, 2011. (2) The weighted average exercise price does not take into account performance share... -

Page 107

... to the New York Stock Exchange that the Board of Directors has determined that all members of the Audit Committee are "independent" as deï¬ned in the New York Stock Exchange Listed Company Manual. Management is responsible for the Company's internal controls and the ï¬nancial reporting process... -

Page 108

... HARRIS TEETER SUPERMARKETS, INC." RESOLVED, that the shareholders authorize the ofï¬cers of the Corporation to ï¬le such amendment with the North Carolina Secretary of State at such time as may be determined by the Board of Directors in its sole discretion, or to abandon the proposed name change... -

Page 109

...shareholders approve the compensation of the Company's named executive ofï¬cers for the ï¬scal year ended October 2, 2011, as disclosed in Company's Proxy Statement for Fiscal 2011 pursuant to the compensation disclosure rules of the Securities and Exchange Commission." The above "Say on Pay" vote... -

Page 110

... respect to this matter at the Annual Meeting in person or by proxy. The Board of Directors recommends that the shareholders vote FOR the ratiï¬cation of the appointment of KPMG LLP as the Company's Independent Registered Public Accounting Firm for the Fiscal Year Ending September 30, 2012. If the... -

Page 111

..., that decision is required to be presented at the next meeting of the Audit Committee. Prior to approving any services, the Audit Committee considers whether the provision of such services is consistent with the Securities and Exchange Commission's rules on auditor independence and is compatible... -

Page 112

...'s existing lease for the Harris Teeter store located at 820 South College Road in Wilmington, North Carolina. The amendment was entered into in connection with Landlord's purchase of the real estate from an unrelated party that had listed the property for sale on the open market. Under the terms of... -

Page 113

... Dickson's 38 years of service as a Company executive and his invaluable contributions to the Company, upon the approval of the Board of Directors, the Company entered into a Supplemental Executive Retirement Plan (the "March 2006 Retirement Plan") that provides an annual life-time payment in the... -

Page 114

... reports, without charge, upon request to: Ruddick Corporation, 301 South Tryon Street, Suite 1800, Charlotte, North Carolina 28202, Attention: Secretary of the Corporation. OTHER MATTERS The Board of Directors knows of no other business that will be presented for consideration at the Annual Meeting... -

Page 115

... Executive Vice President, Operations & Merchandising, Harris Teeter, Inc. shareholder information corPorate aDDress 301 s. tryon street suite 1800 Charlotte, NC 28202 704-372-5404 NeW York stock exCHANGE (NYsE) listing Common stock symbol: rDK AND clOsiNG stock Price FisCAl Year eND (In Dollars... -

Page 116

Subsidiary of Ruddick Corporation Ruddick Corporation is a holding company with one primary operating subsidiary- Harris Teeter, a leading regional supermarket chain. 301 S. Tryon Street, Suite 1800, Charlotte, NC 28202 • 704-372-5404 • www.ruddickcorp.com