Goldman Sachs 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

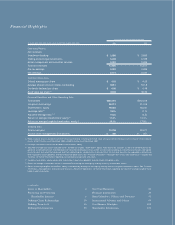

GO LDMAN SA CH S 2002 A N N UA L R EPO RT 3

BUSINESS RESULTS

Investment banking activity and net revenues for

the industry declined throughout the year. Those

declines are clearly seen in our investment banking

results, although relative performance remained

strong. Once again, Goldman Sachs ranked first

in announced and completed global mergers and

acquisitions, and we advised on seven of the ten

largest deals completed during 2002.(1) We were

also the leading underwriter of global public equity

offerings in 2002, and ranked second in global

initial public offerings.(1)

Within our Trading and Principal Investments

business, Fixed Income, Currency and Commodities

(FICC) produced record net revenues for the firm,

demonstrating the ability to serve clients and take

risk prudently. In particular, we were able to avoid

significant credit losses as the business environment

deteriorated and spreads widened. Performance

was strong across most of our FICC businesses,

particularly in currencies, mortgages and fixed

income derivatives. Net revenues declined in our

Equities trading business, reflecting weaknesses

in global equities markets in what continues to be

a very difficult environment. At the same time,

however, we continued to strengthen our equities

franchise in the most important trading centers

across the globe. And, as a result of the fuller

integration of Spear, Leeds & Kellogg, we are truly

at the cutting edge of technology-driven innovation

and efficiency. Principal Investments had another

disappointing year, with further declines in the

value of several technology and telecom investments

more than offsetting favorable results from the real

estate portfolio. During the year, however, we were

successful at finding a number of very attractive

investments in which to participate, and we

continue to believe this is a particularly good time

to be an active investor.

Asset Management and Securities Services

continued its strong performance in 2002. Despite

significant equities market depreciation, assets

under management declined only slightly, reflect-

ing net inflows. This is, we believe, an affirmation

of our investment track record as well as our

focus on client service.

MANAGEMENT DISCIPLINE

In response to the difficult operating environment,

we reduced operating expenses by 11% from the

prior year’s level. Non-compensation expenses were

pared back and we made painful but necessary

reductions to our workforce, taking great care

not to impair our ability to compete today or in

the future. Compensation is, of course, our largest

expense and we imposed rigorous discipline in

making 2002 bonus awards. Most professionals

saw reductions in total compensation, starting

with the firm’s senior management.

Finally, we took important steps throughout

2002 to refocus the entire Goldman Sachs organi-

zation on our business principles, which begin

and end with an absolute insistence on integrity.

In particular, we have a major continuing initiative

aimed toward insuring that we exhibit unimpeach-

able professionalism in everything we do and

reinforcing our culture. That culture, with its

emphasis on client service, teamwork, strict

compliance and excellence, is our greatest strength,

but it requires constant reinforcement, particularly

in difficult markets and under adverse conditions.

Safeguarding our culture will continue to be one

of our highest priorities in 2003.

RESTORING INVESTOR CONFIDENCE

The continuing after-effects of the late 1990s

technology/telecommunications bubble posed sig-

nificant challenges to the financial markets and

our industry in 2002. The huge losses associated

with the bubble’s collapse severely affected

investor confidence—which in turn was further

shaken by the large and highly visible corporate

scandals that emerged beginning in late 2001.

All this led to a storm of public criticism and

calls for new laws and regulations. Notwithstanding

some of the rhetoric, much of the criticism has been

warranted, as are many of the regulations recently

enacted or proposed. And while it is simply wrong

to say that investment banks, such as Goldman

Sachs, created the market bubble, it is true that,

in common with much of the media, academia and

the business community, we misjudged it.

Letter to Shareholders