Goldman Sachs 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

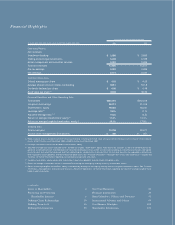

2GO LDMAN SA CH S 2002 A N N UA L R EPO RT

It was a challenging year for Goldman Sachs.

The business environment was perhaps the most

difficult in recent history, marked by weak or

negative growth throughout much of the world,

international uncertainty, the third consecutive

year of broad equities market declines and the

continued aftermath of the technology/telecom-

munications bubble collapse.

As a firm, we cannot control the external

forces that shape the business climate. What we

can control is how we manage our business and

execute our strategy. On those terms, Goldman

Sachs’ 2002 results demonstrated the firm’s

resilience and ability to produce a solid perform-

ance for shareholders.

Net earnings for the year were $2.11 billion,

on total net revenues of $13.99 billion. Earnings

per diluted share were $4.03, down 5% from 2001.

Return on shareholders’ equity was 11% for the

year, and return on tangible shareholders’ equity

was 15%. Evident in this performance were both

the strength and diversity of the Goldman Sachs

franchise and our discipline concerning expense

reduction. This performance also reflected, as it

has throughout the 133 years since the firm’s

founding, in good times and bad, the quality of

the people of Goldman Sachs and their ability to

develop and execute business.

From right: HENRY M. PAULSON, JR. Chairman and Chief Executive Officer

JOHN A. THAIN President and Co-Chief Operating Officer

JOHN L. THORNTON President and Co-Chief Operating Officer

Fellow Shareholders: