Goldman Sachs 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

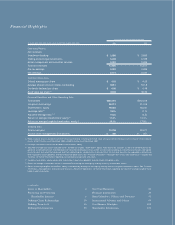

Financial H ighlights

C O N T E N T S

Letter to Shareholders . . . . . . . . . . . . . . . . . . . . . . 2

Promoting and Protecting

Shareholder Interests . . . . . . . . . . . . . . . . . . . . . 6

Defining Client Relationships . . . . . . . . . . . . . . . . 10

Defining Teamwork . . . . . . . . . . . . . . . . . . . . . . . . 16

Defining Determination . . . . . . . . . . . . . . . . . . . . . 20

AS OF OR FOR YEAR ENDED NOVEMBER

($ AND SHARE AMOUNTS IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 2002 2001

Operating Results

Net revenues

Investment banking $ 2,830 $ 3,836

Trading and principal investments 5,249 6,349

Asset management and securities services 5,907 5,626

Total net revenues 13,986 15,811

Pre-tax earnings 3,253 3,696

Net earnings 2,114 2,310

Common Share Data

Diluted earnings per share $ 4.03 $ 4.26

Average diluted common shares outstanding 525.1 541.8

Dividends declared per share $ 0.48 $ 0.48

Book value per share(1) 38.69 36.33

Financial Condition and Other Operating Data

Total assets $355,574 $312,218

Long-term borrowings 38,711 31,016

Shareholders’ equity 19,003 18,231

Leverage ratio(2) 18.7x 17.1x

Adjusted leverage ratio(3, 4) 15.2x 14.5x

Return on average shareholders’ equity(5) 11.3% 13.0%

Return on average tangible shareholders’ equity(6) 15.3% 17.8%

Selected Data

Total employees 19,739 22,677

Assets under management ($ in billions) $ 348 $ 351

(1) Book value per share is based on common shares outstanding, including restricted stock units granted to employees with no future service require-

ments, of 491.2 million as of November 2002 and 501.8 million as of November 2001.

(2) Leverage ratio equals total assets divided by shareholders’ equity.

(3) Adjusted leverage ratio equals adjusted assets divided by tangible shareholders’ equity. Adjusted assets excludes (i) low-risk collateralized assets

generally associated with our matched book and securities lending businesses (which we calculate by adding our securities purchased under agree-

ments to resell and securities borrowed, and then subtracting our nonderivative short positions), (ii) cash and securities we segregate in compliance

with regulations and (iii) goodwill and identifiable intangible assets. See “ Financial Information —Management’s Discussion and Analysis — Capital and

Funding” for further information regarding our adjusted leverage ratio calculation.

(4) Tangible shareholders’ equity equals total shareholders’ equity less goodwill and identifiable intangible assets.

(5) Return on average shareholders' equity is computed by dividing net earnings by average monthly shareholders' equity.

(6) Return on average tangible shareholders’ equity is computed by dividing net earnings by average monthly tangible shareholders’ equity. See “ Financial

Information —Management’s Discussion and Analysis—Results of Operations” for further information regarding our return on average tangible share-

holders’ equity calculation.

Our Core Businesses . . . . . . . . . . . . . . . . . . . . . . . 26

Financial Information . . . . . . . . . . . . . . . . . . . . . . 29

Board Members, Officers and Directors . . . . . . . . 93

International Advisors and Offices . . . . . . . . . . . . 99

Our Business Principles . . . . . . . . . . . . . . . . . . . . 100

Shareholder Information . . . . . . . . . . . . . . . . . . . 101