Freeport-McMoRan 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

We are pleased to report our 2005 performance, a record year for

our company. The availability of high-grade ore from our Grasberg

mine enabled us to achieve exceptional operating performance

during a period of strong copper and gold prices. We generated

over $1.5 billion in operating cash flows with only $143 million in

capital expenditures, and reduced debt substantially, enabling us

to return significant cash to shareholders.

Our mining team performed admirably during 2005, resulting

in 2005 sales for PT Freeport Indonesia, our Indonesian mining

affiliate, of 1.46 billion pounds of copper and a record 2.8 million

ounces of gold. Realized prices for our primary commodities were

$1.85 per pound of copper, 35 percent higher than 2004, and

$456.27 per ounce of gold, nearly 11 percent higher than 2004. Spot

copper and gold prices on the London Metals Exchange (LME)

were $2.08 per pound and $513 per ounce at the end of 2005 and

have increased further in early 2006.

This strong performance enabled us to provide to the Republic

of Indonesia $1.2 billion attributable to 2005 through taxes,

royalties, dividends and fees. Since 1992, these direct benefits have

totaled $3.9 billion, demonstrating that our partnership with the

Government of Indonesia continues to be mutually beneficial.

Safety is our highest priority. We achieved continued progress

in safety performance at PT Freeport Indonesia, with no fatalities

during 2005 and a lost time injury rate per 200,000 working hours

of 0.13, a 28 percent improvement over 2004 and comparing

favorably to the United States (U.S.) metals mining industry average

of 1.9. The total reportable injury rate also improved to 0.38, a

17 percent improvement over the prior year. The U.S. metals mining

industry average was 3.27.

These accomplishments provide the theme of this year’s Annual

Report, “The Elements of Shareholder Value.”

Perhaps the most critical “Element of Shareholder Value” is

having “The Right Asset.” The Grasberg minerals district is one of the

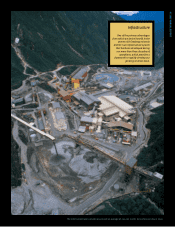

The “6 South” section of the Grasberg open-

pit mine provided important high-grade

ore that allowed us to achieve strong sales

in 2005.

| 005 ANNUAL REPORT LETTER TO SHAREHOLDERS