Freeport-McMoRan 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Flow

Freeport-McMoRan Copper & Gold Inc. generated record operating

cash flow of $1.55 billion in 2005, more than four times the 2004

operating cash flow of $341 million. The significant improvement in

2005 reflects significantly higher production and sales, higher copper

and gold prices and a decrease in working capital requirements.

Operating activities are expected to generate positive cash flows

for the foreseeable future based on anticipated operating results and

the current outlook for metals prices. Using estimated sales volumes

for 2006 of 1.3 billion pounds of copper and 1.7 million ounces

of gold and assuming average 2006 prices of $2.00 per pound of

copper and $550 per ounce of gold, we would generate operating

cash flows of approximately $1.1 billion in 2006.

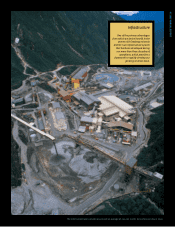

Capital Expenditures

Because of the fully developed nature of our currently producing

mines and associated infrastructure, capital expenditures in recent

years have been low. Capital spending totaled $143 million in 2005,

including costs to maintain our production capacity, to develop the

Common Infrastructure Project, and to expand our underground

DOZ mine. Capital expenditures for 2006 are currently estimated at

approximately $250 million and to average $200 million per year for

the five-year period 2006–2010.

Debt Reduction

We reduced total debt in 2005 by almost $700 million. Total debt at

December 31, 2005, approximated $1.26 billion, $492 million net

of $764 million of cash. We continue to assess opportunities to repay

debt in advance of scheduled maturities.

Dividends and Share Purchases

During 2005, our Board of Directors authorized three supplemental

common stock dividends totaling $1.50 per share, and increased our

current regular annual common stock dividend to $1.25 per share,

which is payable quarterly beginning February 1, 2006, at a rate of

$0.3125 per share. Our Board of Directors regularly reviews our

dividend policy. In January 2006, our Board authorized an additional

$0.50 per share supplemental dividend payable March 31, 2006. We

purchased 2.4 million shares of our common stock for $80.2 million

($33.83 per share average) during 2005 and have purchased a

total of 5.8 million shares for $179.7 million ($31.22 per share average)

under a 20-million-share open market purchase program authorized

by our Board of Directors. As of February 28, 2006, 14.2 million

shares remain available under this open market purchase program.

$1.2 Billion In Financial

Transactions In 2005

Debt Reduction

Dividends

Share Purchases

$1,000

$2,000

0504030201

Operating Cash Flow

in millions of dollars

1 | 005 ANNUAL REPORT OPERATIONS OVERVIEW