Exxon 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Exxon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We maintain our steadfast commitment to generate long-term shareholder value by helping to supply the world’s

growing demand for energy. As you will read in the following pages, we achieved strong financial and operating results

in 2013 and continued to advance a unique and balanced set of profitable growth opportunities across our businesses.

Our success is underpinned by our strong safety performance, unwavering ethical behavior, good corporate citizenship,

operational excellence, and technology leadership. Our efforts are helping to generate prosperity and improve living

conditions for people around the world by providing safe, reliable, and affordable energy.

Our Corporation achieved strong operating and financial performance this year despite global economic challenges

and uncertainty. Earnings were lower in 2013, in line with industry conditions, while our leadership position within the

industry continues in many key areas. In particular, a sustained focus on safety and the collective commitment of our

employees and contractors around the world resulted in improved overall safety performance versus 2012. We also have

maintained our relentless focus on operational excellence and risk management. We delivered earnings of $32.6 billion

and a return on capital employed of 17 percent, which continues to lead our peer group and reflects the strength of

our investment discipline, balanced portfolio, and integrated business model. Robust operating cash flow enabled us to

fund $42.5 billion in capital and exploration expenditures

to advance large, new projects and bring energy to world

markets, while distributing $25.9 billion to shareholders

in the form of dividends and share purchases to reduce

shares outstanding. Over the last five years, ExxonMobil

distributed $131 billion to our shareholders, while dividends

per share have increased by 59 percent, including an

11-percent increase in the second quarter of 2013.

In the Upstream, we have an industry-leading global

resource base of more than 90 billion oil-equivalent barrels. In 2013, we continued to build our diverse, global portfolio

by adding 6.6 billion oil-equivalent barrels. We also replaced 103 percent of our proved reserves, the 20th consecutive

year our company has replaced more than 100 percent of our production. We continue to develop this resource base

through safe and reliable execution of our major projects. We started up six major projects in 2013 with gross facility

capacity of more than 930 thousand oil-equivalent barrels per day, highlighted by the Kearl Initial Development in Canada.

In addition, we continue to ramp up liquids production in North America through increased drilling activity in liquids-rich

U.S. plays such as the Bakken, Permian, and Woodford Ardmore. Going forward, we are working to start up an additional

21 major projects by 2017, including Papua New Guinea Liquefied Natural Gas in 2014 and the Kearl Expansion project

in 2015. We anticipate all of these projects will deliver 1 million net oil-equivalent barrels per day of production volumes

by 2017. The new production we are bringing online from our major projects and other activities positions us to achieve

profitable growth as our liquids and liquids-linked gas volumes as a percentage of total volumes are projected to increase

to nearly 70 percent in 2017.

Our successful exploration program continues to yield discoveries and new acreage additions that contribute to our

large, global hydrocarbon resource base. Exploration discoveries in 2013 totaled 1.5 billion oil-equivalent barrels including

finds in Australia, Canada, Tanzania, and the United States. In Tanzania, we are partnering with Statoil to explore and

develop offshore fields that are estimated to hold as much as 20 trillion cubic feet of natural gas in place. We also

continue to progress international unconventional resource opportunities in Argentina, Colombia, and West Siberia in

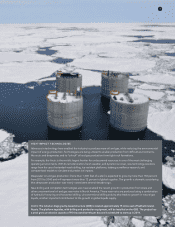

Russia. We have begun preparations with Rosneft to begin drilling our first exploration well in the Kara Sea during 2014

in the Russian Arctic. Our technological leadership and arctic operating expertise will enable us to manage the harsh,

challenging conditions to explore this highly-prospective region. In the largely untapped, high-potential northern

Black Sea, we expect to progress exploration programs in Romania and Russia during the next several years.

In the Downstream, ExxonMobil is the world’s largest refiner. Our world-class refining assets are geographically

diverse and highly integrated with chemicals and lubes manufacturing facilities. We are making targeted investments

to strengthen the portfolio and increase production of high-value products, such as ultra-low sulfur diesel, jet fuel, and

We delivered earnings of $32.6 billion and a return on

capital employed of 17 percent, which continues to

lead our peer group and reflects the strength of our

investment discipline, balanced portfolio, and integrated

business model.

To Our Shareholders

EXXONMOBIL 2013 SUMMARY ANNUAL REPORT

2