Eversource 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

NUCLEAR PLANT PERFORMANCE AND DIVESTITURE

Millstone: The Millstone units completed one of their best years ever in 2000. Millstone 2 operated at a

capacity factor of 82 percent in 2000 and completed a refueling outage in early June more than four days

ahead of schedule. The 40-day, 21-hour outage set a world record for a refueling that included a full

generator rewind. Millstone 3 operated at virtually a 100 percent capacity factor in 2000 and ran for 585

consecutive days before beginning a scheduled refueling outage on February 3, 2001. Millstone 3 returned

to service by the end of the first quarter of 2001.

On August 7, 2000, CL&P, WMECO and certain other joint owners reached an agreement to sell substantially

all of the Millstone units, located in Waterford, Connecticut, to Dominion for approximately $1.3 billion,

including approximately $105 million for nuclear fuel.

The transaction closed on March 31, 2001, whereupon CL&P and WMECO received gross proceeds of

approximately $843.2 million and $196.2 million on a pretax basis for their respective ownership interests.

PSNH received $26 million on a pretax basis, which will be reflected as a gain in accordance with the

Settlement Agreement.

In connection with the prior settlement of Millstone 3 joint owner claims, the NU system will record a

pretax gain in excess of $150 million at closing.

Seabrook: Seabrook operated at a capacity factor of 78 percent in 2000. The unit began a scheduled

refueling outage on October 21, 2000. The outage was extended by approximately two months as a

result of the need to repair extensive problems with a back-up diesel generator. Seabrook returned to

service on January 29, 2001.

On December 15, 2000, NU filed its divestiture plan for Seabrook with the NHPUC and the DPUC. NU

hopes to complete the sale in 2002.

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, which are statements of future expectations and not facts. Actual results or developments

might differ materially from those included in the forward-looking statements because of factors such as

competition and industry restructuring, changes in economic conditions, changes in historical weather

patterns, changes in laws, regulations or regulatory policies, developments in legal or public policy doctrines,

technological developments and other presently unknown or unforeseen factors. Other risk factors are

detailed from time to time in NU’s reports to the Securities and Exchange Commission.

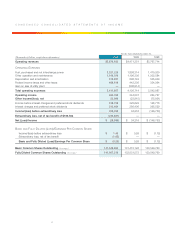

RESULTS OF OPERATIONS

NU’s revenues increased by $1.4 billion, or 31 percent, in 2000, primarily due to higher revenues from the

competitive energy subsidiaries, the acquisition of Yankee and higher wholesale revenues.

Fuel, purchased and net interchange power expense increased in 2000, primarily due to higher purchased

energy and capacity costs as a result of higher sales.

Other operation and maintenance expenses decreased in 2000, primarily due to lower spending at the

nuclear units due to better performance, lower expenses due to the sale of certain fossil generation assets

in 1999, lower corporate support expenses, and lower environmental expenses.

Depreciation and amortization decreased in 2000, primarily due to the sale of certain generation assets in

1999 and changes in amortization as a result of industry restructuring.

Federal income taxes and other taxes increased in 2000, primarily due to higher pretax earnings.

Other, net increased in 2000, primarily due to a one-time gain related to Mode 1 Communications, Inc.’s

investment in NEON Communications, Inc. and a loss in 1999 on the CL&P assignment of market-based

contracts to Select Energy, an affiliated company.

Interest charges, net and preferred stock dividends increased in 2000, primarily due to higher short-term

borrowings associated with the NGC asset transfer and Yankee acquisition, slightly offset by lower pre-

ferred stock dividends due to lower preferred stock outstanding.

The extraordinary loss in 2000 is primarily due to an after-tax write-off by PSNH in excess of $200 million

as a result of the Settlement Agreement and discontinuing SFAS No. 71.