Eversource 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

RESTRUCTURING

As a result of industry restructuring, CL&P and Western Massachusetts Electric Company (WMECO)

stopped supplying power directly to customers in 2000. Instead, CL&P and WMECO became energy

delivery companies, delivering electricity to customers that is produced by other companies and some-

times bought by customers through intermediaries. In 2000, customers in both states had the option of

choosing alternative power suppliers or relying on CL&P and WMECO to acquire the power for them

through standard offer service.

In 1999, under the oversight of the Connecticut Department of Public Utility Control (DPUC), CL&P

secured four-year fixed-price contracts with three suppliers to provide power to customers who choose

standard offer service. CL&P is fully recovering from retail customers the cost of buying power from these

three standard offer suppliers and expects to continue recovery through the expiration of the contracts

on December 31, 2003.

In 2000, WMECO supplied power to standard offer customers at a rate of slightly more than $0.045 per

kilowatt-hour. As a result of new one-year standard offer supply contracts signed in December 2000, that

rate will increase significantly in 2001 to approximately $0.073 per kilowatt-hour. In January 2001, the

Massachusetts Department of Telecommunications and Energy approved an average overall rate increase

of approximately 17.4 percent for WMECO standard offer customers, allowing WMECO to fully recover

these increased power procurement costs.

Public Service Company of New Hampshire (PSNH) remained a vertically integrated utility in 2000 with a

fuel and purchased-power adjustment charge. However, in September 2000, the New Hampshire Public

Utilities Commission (NHPUC) approved a comprehensive restructuring settlement (Settlement Agreement).

Provisions for transition service are but one element of the Settlement Agreement. Other provisions allow

for issuing rate reduction bonds to securitize stranded costs; implementing a rate decrease of approxi-

mately 15.5 percent; an after-tax write-off of stranded costs in excess of $200 million, which was recorded

in the fourth quarter of 2000; selling North Atlantic Energy Corporation’s share of Seabrook no later than

December 31, 2003, and fixing PSNH’s delivery rates at $0.028 per kilowatt-hour for the first 33 months

after the Settlement Agreement takes effect. Restructuring is expected to take effect the first day of the

month after PSNH issues rate reduction bonds, which is anticipated to be May 1, 2001.

COMPETITIVE ENERGY SUBSIDIARIES

NU’s competitive energy subsidiaries engage in a variety of energy-related activities, primarily in the

competitive energy retail and wholesale commodity, marketing and services fields. In addition, these

subsidiaries own and manage 1,521 megawatts of capacity, and provide services to the electric generation

market and large commercial and industrial customers in the Northeast.

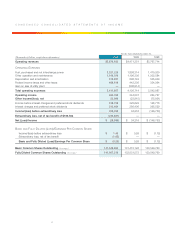

NU’s competitive energy subsidiaries contributed $13.6 million before extraordinary items in 2000 toward

NU’s consolidated earnings, compared with a net loss of $37 million in 1999. In July 1999, NGC was

announced as one of the winning bidders of certain CL&P and WMECO hydroelectric generation assets.

Although management expected this transaction to close by January 1, 2000, it actually closed on

March 14, 2000. This transaction has allowed the competitive energy subsidiaries to better balance their

energy purchase and supply commitments, improving profitability. Since January 1, 2000, these assets

have been managed by the competitive energy subsidiaries and earnings of $6.9 million have been included

in the contributed earnings reported above of $13.6 million. As a result of the delayed closing, however,

the $6.9 million was recorded by CL&P and WMECO for the period from January 1, 2000 to March 14,

2000. Unconsolidated revenues for the competitive energy subsidiaries were $1.9 billion in 2000, compared

with $648.9 million in 1999. CL&P’s standard offer purchases from Select Energy Inc. (Select Energy)

represented $651.9 million of total competitive energy subsidiaries’ revenues in 2000, which is eliminated

in consolidation.

The servicing of CL&P’s standard offer load is a significant risk for Select Energy, as this contract is for a

four-year period, ending December 31, 2003, at fixed prices. This risk is partially mitigated by Select

Energy entering into purchase contracts with other energy providers to supply a portion of the standard

offer requirement. Although there can be no assurance that it will be able to do so, management believes

that Select Energy will be able to source its remaining load requirement at reasonable prices. If Select

Energy is unable to source its remaining load requirement at prices below the standard offer contract

price as a result of energy price increases, Select Energy’s earnings would be adversely impacted.