Eversource 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

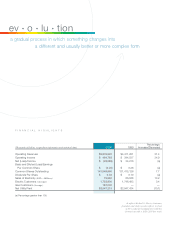

2

Revenue Growth

(billions)

98 99 00

6

5

4

3

2

1

0

$5.9$4.5$3.8

A GREAT YEAR

NU ear ned $205.3 million or $1.45 per shar e in 2000, excluding extraor dinary items, compar ed

to $34.2 million or 26 cents per shar e in 1999. When extraor dinary items ar e added, including a

write-of f of Public Service Company of New Hampshir e’s (PSNH) stranded costs in excess of

$200 million and a write-down of hydr oelectric generating assets in Massachusetts, NU r eported

a net loss of $28.6 million, or 20 cents per shar e, for the year .

Ther e wer e multiple r ounds of cr edit rating upgrades for Northeast Utilities and its operating

companies. NU’s unsecur ed debt is now rated investment grade for the first time in five years,

and senior secur ed debt at our operating companies is now rated BBB+ by Standar d & Poor’s,

up as many as five notches since mid-1998.

Annual electric sales wer e up 0.8 per cent, 1.9 per cent on a weather -adjusted basis, in 2000. Y ankee

Ener gy System (the par ent company of Connecticut’s lar gest natural gas distribution company)

joined NU on Mar ch 1, 2000, and contributed appr oximately $262 million in r evenues over the

remainder of the year . Since the first two months of the year ar e traditionally the highest ear ning

months for Yankee, we look forwar d to an even gr eater contribution to NU in 2001.

NU’s unr egulated businesses had an outstanding year, ear ning $13.6 million befor e extraor dinary

losses on r evenues of nearly $1.9 billion in 2000, compar ed to a loss of about $37 million on

revenues of appr oximately $649 million in 1999. That impr oved per for mance is due in lar ge part

to the businesses’ better balancing of their supply and pur chase obligations, which included the

transfer of 1,289 megawatts of hydr oelectric and pumped storage generation in Mar ch 2000. Select

Ener gy is the lar gest wholesale and r etail electric ener gy marketer in New England, measured by

megawatt load. In 2000, Select Ener gy pr ovided mor e than 5,000 megawatts of standar d of fer service.

RESTRUCTURING PROGRESS

Electric industry r estructuring has pr ogr essed well in Connecticut and Massachusetts, wher e

regulators have appr oved the securitization of up to $1.55 billion and $155 million, r espectively.

On Mar ch 31, 2000, Connecticut Light and Power Company sold nearly $1.44 billion of securitization

bonds. Wester n Massachusetts Electric Company expects to sell $155 million in bonds this May.

In New Hampshire, wher e PSNH, NU and the state have been engaged in litigation for the past

few years over this issue, a Settlement Agr eement was appr oved, and r estructuring can now go

forwar d. Under ter ms of that settlement, PSNH was r equir ed to write of f in excess of $200 million

of its after -tax stranded costs, was allowed to r ecover $670 million thr ough securitization and will

recover the balance of its stranded costs as a sur char ge on customers’ bills. Customers’ rates wer e

reduced 5 per cent in October 2000 and will be r educed another 11.2 per cent when competition

begins this May.