Eversource 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

NUCLEAR SUCCESSES

In addition to the dramatic impr ovement of our unr egulated businesses, the excellent per formance

at Millstone nuclear station and ef fective cost contr ol contributed to our positive year . Millstone 3

operated at virtually a 100 per cent capacity factor in 2000 and had been on line for 585 consecutive

days prior to its shutdown for a scheduled r efueling outage on February 3, 2001. Millstone 2

operated at an 81.9 per cent capacity factor for the year (although it achieved a 97.4 per cent

capacity factor for June thr ough December following a r efueling outage), while Seabr ook operated

at a capacity factor of 78.1 per cent, r etur ning to service in January 2001 after an extended r efueling

and maintenance outage.

In August, the Connecticut Department of Public Utility Contr ol announced an agr eement for the

sale of the thr ee-plant Millstone Station to Dominion Resour ces, Inc. of V ir ginia for $1.3 billion, a

recor d price for the sale of a nuclear power facility in the country. NU r eceived all necessary state

regulatory appr ovals by mid-February 2001, and we closed on the sale on Mar ch 31, 2001.

Finally, I want to extend my personal thanks to W illiam F. Conway, who r etired from our

Boar d of Trustees this year , for helping dir ect us thr ough our nuclear challenges. His knowledge

and expertise in the nuclear power industry was valued and appr eciated.

ANEXCITING FUTURE

Based on our solid financial position and our continued str ong competitive position in our r egional

markets, I am highly confident that our company is well positioned to cr eate new gr owth and build

shar eholder value in today’s competitive ener gy markets. We may choose to go it alone for a

while, or we may opt to combine in one for m or another with a smaller, lar ger , or equally sized

company. Whichever path we choose, you can be confident it will be one that continues to

maximize the value of your investment in our company.

Sincer ely,

Michael G. Morris

Chairman, President and Chief Executive Officer

April 12, 2001

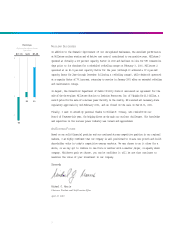

Earnings

(before extraordinary losses)

$ per share

2

1

0

-1

$1.45$.26$(1.12)

98

99 00