Equifax 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

– 18 –

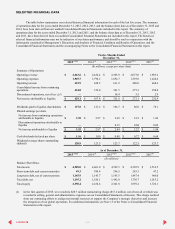

Segment Financial Results

U.S. Information Solutions

Twelve Months Ended December 31, Change

U.S. Information

Solutions

2015 vs. 2014 2014 vs. 2013

2015 2014 2013 $ % $ %

(Inmillions)

Operating revenue:

Online Information

Solutions $842.1 $779.5 $743.9 $62.6 8 %$35.6 5 %

Mortgage Solutions 124.1 105.7 114.3 18.4 17 %(8.6)(8)%

Financial Marketing

Services 205.1 194.7 196.3 10.4 5 %(1.6)(1)%

Total operating revenue $1,171.3 $1,079.9 $1,054.5 $91.4 8 %$25.4 2 %

% of consolidated revenue 44%44%46%

Total operating income $491.2 $421.0 $401.3 $70.2 17 %$19.7 5 %

Operating margin 41.9%39.0%38.1%2.9pts 0.9pts

U.S. Information Solutions revenue increased 8% in 2015 as compared to the prior year. USIS realized solid growth

from our mortgage business, as well as continued revenue growth in the automotive and financial services verticals.

U.S. Information Solutions revenue increased 2% in 2014 as compared to the prior year. Solid growth from strategic

product and market penetration as well as pricing initiatives were partially offset by the expected decline in mortgage market

activity compared to the first half of 2013 when mortgage refinancing activity was still high.

Online Information Solutions. Revenue for 2015 increased 8% when compared to the prior year, due to higher

average revenue per unit and increased volumes to mortgage resellers, auto, and other resellers. Revenue also benefited from

growth in identity and fraud solutions.

Revenue for 2014 increased 5% when compared to the prior year, due to increased volumes in the financial services

and auto verticals. These increases were partially offset by lower average unit revenue due to a less favorable mix of business,

primarily mortgage resellers. The period also benefited from growth in our identity and fraud solutions business.

Mortgage Solutions. Revenue increased 17% in 2015 when compared to prior year, driven by a strong market for

refinancing and purchase activity, as well as growth from other mortgage product offerings.

Revenue decreased 8% in 2014 when compared to prior year due primarily to the expected lower mortgage

refinancing activity.

Financial Marketing Services. Revenue increased 5% in 2015 as compared to 2014. The increases were driven by

growth in our credit marketing services due to increased demand from financial services customers.

Revenue decreased 1% in 2014 as compared to 2013. The decline was driven by one-time revenue recognized in 2013

related to the collection of amounts billed in 2012 which did not recur in 2014. The decline is partially offset by strong growth

in our customer base for our wealth-based consumer information services products.

U.S. Information Solutions Operating Margin. USIS operating margin increased to 41.9% in 2015 as compared to

2014 of 39.0%. Margin expansion resulted from strong revenue growth and product mix. USIS operating margin increased to

39.0% in 2014 as compared to 2013 of 38.1%. Margin expansion resulted from realized synergies related to our CSC Credit

Services Acquisition completed at the end of 2012 including certain transitional expenses in 2013 that did not recur in 2014.

The increase in margin for 2014 was partially offset by a third quarter 2014 settlement of a legal dispute over certain software

license agreements of $7.9 million.

35

CONTENTS