Equifax 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

– 15 –

Cost of services increased $57.4 million in 2014 compared to the prior year. The increase in cost of services, when

compared to 2013, was due primarily to the acquisition of TDX in the first quarter of 2014 and the 2013 acquisitions. The

effect of changes in foreign exchange rates reduced cost of services by $7.7 million.

Selling, General and Administrative Expenses. Selling, general and administrative expenses increased $132.6

million in 2015 as compared to 2014. The increase was principally due to increases in people costs, and to a lesser extent to

increases in marketing expenses, professional fees, as well as litigation expenses. The increase was also due to the costs related

to the realignment of internal resources of $20.7 million recorded in the first quarter of 2015. The impact of changes in foreign

currency exchange rates decreased our selling, general and administrative expenses by $24.6 million.

Selling, general and administrative expenses increased $35.9 million in 2014 as compared to 2013. The increase was

due to the impact of the TDX acquisition in the first quarter of 2014 and the 2013 Acquisitions, an increase in litigation and

regulatory compliance expenses, including a third quarter 2014 settlement of a legal dispute over certain software license

agreements, and an increase in incentives. These increases were partially offset by decreases in marketing and professional

services expenses, as well as smaller decreases in expense in various other categories. The impact of changes in foreign

currency exchange rates decreased our selling, general and administrative expenses by $6.8 million.

Depreciation and Amortization. Depreciation and amortization expense for 2015 were slightly lower compared to

2014, due to foreign currency fluctuations of $4.1 million.

The increase in depreciation and amortization expense in 2014, as compared to 2013, was driven by $18.5 million of

incremental expense resulting from the TDX Acquisition primarily related to amortization of purchased intangibles. The TDX

Acquisition amortization is partially offset by certain purchased intangible assets related to the TALX acquisition in 2007 that

became fully amortized during the second quarter of 2013.

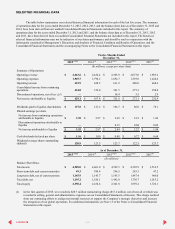

Operating Income and Operating Margin

Twelve Months Ended December 31, Change

Operating Income and

Operating Margin

2015 vs. 2014 2014 vs. 2013

2015 2014 2013 $ % $ %

(Inmillions)

Consolidated operating

revenue $2,663.6 $2,436.4 $2,303.9 $227.2 9%$132.5 6 %

Consolidated operating

expenses 1,969.7 1,798.2 1,692.7 171.5 10%105.5 6 %

Consolidated operating

income $693.9 $638.2 $611.2 $55.7 9%$27.0 4 %

Consolidated operating

margin 26.1%26.2%26.5%(0.1)pts (0.3)pts

Total company margin decreased slightly in 2015 due to the costs for the realignment of internal resources of $20.7

million and other increases in people costs. The decrease was mostly offset by the margin improvements of 290 basis points

and 510 basis points in our USIS and Workforce Solutions segments, respectively.

Total company margin decreased slightly in 2014 due to a third quarter 2014 settlement of a legal dispute over certain

software license agreements and increased cost of services and acquisition-related amortization expense related to the

acquisition of TDX. The decrease was partially offset by a reduction in amortization of certain purchased intangible assets

related to our TALX Corporation acquisition in 2007 that became fully amortized during the second quarter of 2013.

32

CONTENTS