Equifax 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

– 1 –

CHANGING

THE GROWTH

CURVE

2015 ANNUAL REPORT

2 | FINANCIAL HIGHLIGHTS

3 | LETTER TO SHAREHOLDERS

8 | CORPORATE OFFICERS AND CONTACTS

9 | FINANCIAL SECTION

84 | SHAREHOLDER INFORMATION

86 | BOARD OF DIRECTORS

2 | FINANCIAL HIGHLIGHTS

3 | LETTER TO SHAREHOLDERS

8 | CORPORATE OFFICERS AND CONTACTS

9 | FINANCIAL SECTION

84 | SHAREHOLDER INFORMATION

86 | BOARD OF DIRECTORS

Table of contents

-

Page 1

CHANGING THE GROWTH CURVE 2015 ANNUAL REPORT 2 | FINANCIAL HIGHLIGHTS 3 | LETTER TO SHAREHOLDERS 8 | CORPORATE OFFICERS AND CONTACTS 9 | FINANCIAL SECTION 84 | SHAREHOLDER INFORMATION 86 | BOARD OF DIRECTORS -1- -

Page 2

... of unique trusted data, technology and innovative analytics, Equifax has grown from a consumer credit company into a leading provider of insights and knowledge that helps its customers make informed decisions. The company organizes, assimilates and analyzes data on more than 800 million consumers... -

Page 3

... 19% 38% -2% 16% Operating revenue Operating income Operating margin Adjusted operating margin (non-GAAP)1 Consolidated net income Net income attributable to Equifax Diluted earnings per share attributable to Equifax Stock price per share at December 31 Weighted-average common shares outstanding in... -

Page 4

... in global information solutions. This is changing the growth curve of the company by allowing us to deliver powerful insights to customers across a broad range of industries and applications. The success of our evolution is evident in the strength of our 2015 results. It was the best ï¬nancial and... -

Page 5

... best-in-class technology platforms. One of our key data assets is The Work Number ®, the most extensive source of income and employment information in the U.S. During 2015, we grew that database to include information from more than 5,000 employers. The Work Number helps individuals obtain credit... -

Page 6

...-based line of products for employers that assists them in Affordable Care Act management responsibilities. This success has made Equifax a meaningful participant in the healthcare sector. Leveraging customer relationships throughout the company will enable continued Workforce Solutions expansion... -

Page 7

... the agreement we reached on the largest acquisition in our company's history. Veda Group, the leading provider of consumer and commercial credit reporting information in Australia and New Zealand, is a wellestablished business with great leadership and customer relationships. This acquisition will... -

Page 8

... information solutions and insights company, technology is at the core of everything we do. We are investing in the right foundation to enable new capabilities to adapt to the changing market needs and provide solutions that deliver insights to our customers faster than ever. We have a clear vision... -

Page 9

... Transfer Agent and Registrar American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, New York 11219 866-665-2279 [email protected] Shareholder Services Christy Cooper Ofï¬ce of the Corporate Secretary [email protected] Independent Registered Public Accounting Firm Ernst & Young... -

Page 10

...10 SELECTED FINANCIAL DATA 12 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 35 MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING 36 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON INTERNAL CONTROL OVER FINANCIAL REPORTING 37 REPORT OF... -

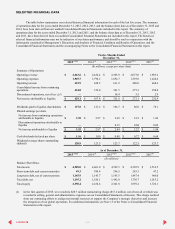

Page 11

... report. Twelve Months Ended December 31, 2013(4)(5) 2012(6)(7) 2015 (1)(2) Summary of Operations: Operating revenue $ Operating expenses Operating income Consolidated income from continuing operations Discontinued operations, net of tax (2)(7) Net income attributable to Equifax $ Dividends paid... -

Page 12

...offered a one-time 9% increase to the service benefit. The settlement and amendment resulted in a $38.7 million pension charge. For additional information, see Note 11 of the Notes to Consolidated Financial Statements in this report. On May 31, 2011, we completed the merger of our Brazilian business... -

Page 13

... information, technology and services to support the debt collections and recovery management. Our revenue stream is diversified among businesses across a wide range of industries, international geographies and individual consumers. Proposed Acquisition of Veda Group Limited On November 21, 2015... -

Page 14

... the United States, Canada and the United Kingdom Personal Solutions and Direct to Consumer Reseller operating activities into one segment, Personal Solutions. The Workforce Solutions segment consists of the Verification Services and Employer Services business lines. Verification Services revenue is... -

Page 15

...USIS and Workforce Solutions business units for 2014 as compared to the same period for 2013. The effect of foreign exchange rates reduced revenue by $34.9 million or 1% in the 2014 compared to 2013. Operating Expenses Twelve Months Ended December 31, Operating Expenses Consolidated cost of services... -

Page 16

... TDX Acquisition amortization is partially offset by certain purchased intangible assets related to the TALX acquisition in 2007 that became fully amortized during the second quarter of 2013. Operating Income and Operating Margin Twelve Months Ended December 31, Operating Income and Operating Margin... -

Page 17

... average cost of debt to decrease as compared to the prior year. The increase in other income (expense), net, in 2015 is due to the settlement of escrow amounts related to an acquisition from January 2014, and the gain on foreign currency options put in place as an economic hedge of Veda's purchase... -

Page 18

... the realignment of our internal resources, and increases in people costs. Consolidated net income from continuing operations increased by $32.5 million, or 10%, in 2014 compared to 2013 due to increased operating income in our USIS, Workforce Solutions and Personal Solutions operating segments, and... -

Page 19

... as compared to 2014 of 39.0%. Margin expansion resulted from strong revenue growth and product mix. USIS operating margin increased to 39.0% in 2014 as compared to 2013 of 38.1%. Margin expansion resulted from realized synergies related to our CSC Credit Services Acquisition completed at the end of... -

Page 20

... U.S. dollar negatively impacted revenue by $19.2 million, or 14%, in 2015. Reported revenue decreased 11% in 2015. Local currency revenue increased 3% in 2014 compared to 2013, primarily due to new customers within marketing and decision solutions, as well as, growth in information services. Local... -

Page 21

... a result of inflation-driven pressures on margin in Argentina. Workforce Solutions Twelve Months Ended December 31, Workforce Solutions Operating Revenue: Verification Services Employer Services Total operating revenue % of consolidated revenue Total operating income Operating margin 2015 2014 2013... -

Page 22

... 2015. Operating margin decreased in 2015 to 27.5% as compared 31.8% in prior year, due to higher technology and marketing expenses. Revenue increased 6% for 2014, as compared to prior year. Local currency revenue grew 6% principally due to the growth in Canada and the U.K. consumer direct revenue... -

Page 23

... remain in a strong financial position managing our capital structure to meet short- and long-term objectives including reinvestment in existing businesses and strategic acquisitions. Sources and Uses of Cash Funds generated by operating activities and our credit facilities continue to be our most... -

Page 24

...quarter of 2013, we acquired TrustedID, a direct-to-consumer identity protection business that is included as part of our Personal Solutions business unit. During the fourth quarter of 2013, we completed two acquisitions in Paraguay and Mexico in the Latin America region of our International segment... -

Page 25

... financing arrangements. At December 31, 2015, interest rates on our variable-rate debt ranged from 0.65% to 0.75%. The obligations of the lenders to fund the Term Loan Facility and the 364-Day Revolver are subject to certain conditions, including the approval by Veda shareholders of the acquisition... -

Page 26

... Financial Statements in this report. Equity Transactions Net cash provided by (used in): Treasury stock purchases Dividends paid to Equifax shareholders Dividends paid to noncontrolling interests Proceeds from exercise of stock options Excess tax benefits from stock-based compensation plans... -

Page 27

....6 Data processing, outsourcing agreements and other purchase obligations (3) Other long-term liabilities (4) (6) Interest payments (5) $ (1) 2,145.2 The amounts are gross of unamortized discounts totaling $(1.6) million at December 31, 2015. Total debt on our Consolidated Balance Sheets is net... -

Page 28

... additional information about our benefit plans, see Note 11 of the Notes to Consolidated Financial Statements in this report. Seasonality We experience seasonality in certain of our revenue streams. Revenue generated from the Employer Services business unit within the Workforce Solutions operating... -

Page 29

... portion of our revenues relate to subscription-based contracts under which a customer pays a preset fee for a predetermined or unlimited number of transactions or services provided during the subscription period, generally one year. Revenue related to subscription-based contracts having a preset... -

Page 30

... reported are recorded in the period in which actual volumes are reported. Effects if actual results differ from assumptions - We have not experienced significant variances between our estimates of marketing information services and tax management services revenues reported to us by our customers... -

Page 31

... Financial Marketing Services), Europe, Latin America, Canada, Personal Solutions, Verification Services, and Employer Services. Based on the Company's enterprise-wide strategy, we've consolidated the Identity Management reporting unit with the U.S. Information Solutions reporting unit in 2015. We... -

Page 32

... judgments about a number of actuarial assumptions, which include discount rates, expected return on plan assets, interest cost and mortality and retirement rates. Actuarial valuations are used in determining our benefit obligation and net periodic benefit cost. During 2015 we adopted the new... -

Page 33

...date of acquisition. We primarily estimate fair value of identified intangible assets using discounted cash flow analyses based on market participant based inputs. Any amount of the purchase price paid that is in excess of the estimated fair values of net assets acquired is recorded in the line item... -

Page 34

... denominated or measured in foreign currencies at the applicable year-end rate of exchange on our Consolidated Balance Sheets and income statement items of our foreign subsidiaries at the average rates prevailing during the year. We record the resulting translation adjustment, and gains and losses... -

Page 35

... long-term and short-term debt, as well as the proportionate amount of fixed-rate and variable-rate debt, can be expected to vary as a result of future business requirements, market conditions and other factors. CONTENTS - 34 - 51 -

Page 36

...Committee of its Board of Directors. The effectiveness of Equifax's internal control over financial reporting as of December 31, 2015 has been audited by Ernst & Young LLP, Equifax's independent registered public accounting firm. There were no acquisitions completed during 2015 that were material to... -

Page 37

... have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Equifax, Inc. as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, cash flows, and shareholders... -

Page 38

... REGISTERED PUBLIC ACCOUNTING FIRM REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders of Equifax Inc.: We have audited the accompanying consolidated balance sheets of Equifax Inc. as of December 31, 2015 and 2014, and the related consolidated statements... -

Page 39

... FOR EACH OF THE THREE YEARS IN THE PERIOD ENDED DECEMBER 31, 2015 CONSOLIDATED STATEMENTS OF INCOME Twelve Months Ended December 31, 2014 $ 2,436.4 $ 2015 (In millions, except per share amounts) Operating revenue Operating expenses: Cost of services (exclusive of depreciation and amortization... -

Page 40

... Total Equifax Shareholders 2014 Noncontrolling Interests (In millions) Net income Other comprehensive income: Foreign currency translation adjustment Change in unrecognized prior service cost and actuarial gains (losses) related to our pension and other postretirement benefit plans, net Change... -

Page 41

..., net Long-term pension and other postretirement benefit liabilities Other long-term liabilities Total liabilities Commitments and Contingencies (see Note 7) Equifax shareholders' equity: Preferred stock, $0.01 par value: Authorized shares - 10.0; Issued shares - none Common stock, $1.25 par value... -

Page 42

... expenditures Acquisitions, net of cash acquired Cash received from divestitures Investment in unconsolidated affiliates, net Cash used in investing activities Financing activities: Net short-term borrowings (repayments) Payments on long-term debt Treasury stock purchases Dividends paid to Equifax... -

Page 43

... THREE YEARS IN THE PERIOD ENDED DECEMBER 31, INCOME 2015 CONSOLIDATED STATEMENTS SHAREHOLDERS' EQUITY AND OTHER COMPREHENSIVE Equifax Shareholders Common Stock Shares Outstanding Balance, December 31, 2012 Net income Other comprehensive income (loss) Shares issued under stock and benefit plans, net... -

Page 44

... losses and prior service cost related to our pension and other postretirement benefit plans net of accumulated tax of $138.2, $150.1 and $115.3 in 2015, 2014 and 2013, respectively Cash flow hedging transactions, net of tax of $1.0, $1.1 and $1.2 in 2015, 2014 and 2013, respectively Accumulated... -

Page 45

... portfolio of products offered directly to consumers. As of December 31, 2015, we operated in the following countries: Argentina, Canada, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru, Portugal, Spain, the United Kingdom, or U.K., Uruguay, and the United States of America... -

Page 46

...information databases. These development services do not meet the requirement for having stand-alone value, thus any related development fees are deferred when billed and are recognized over the expected period that the customer will benefit from the related decisioning technologies service. Revenue... -

Page 47

...information services relating generally to the deferral of subscription fees and arrangement consideration from elements not meeting the criteria for having stand-alone value discussed above. Deferred revenues are subsequently recognized as revenue in accordance with our revenue recognition policies... -

Page 48

... months ended December 31, 2015, 2014, and 2013, respectively. Other Current Assets. Other current assets on our Consolidated Balance Sheets includes amounts in specifically designated accounts that hold the funds that are due to customers from our debt collection and recovery management services... -

Page 49

...continuing operations related to property and equipment was $75.7 million, $71.7 million and $71.2 million during the twelve months ended December 31, 2015, 2014, and 2013, respectively. Industrial Revenue Bonds. Pursuant to the terms of certain industrial revenue bonds, we have transferred title to... -

Page 50

... value of acquired intangible assets used in our business. Purchased data files represent the estimated fair value of consumer credit files acquired primarily through the purchase of independent credit reporting agencies in the U.S. and Canada. We expense the cost of modifying and updating credit... -

Page 51

... Veda acquisition and have been marked to market. The options have an expiry date of February 18, 2016, and are reflected in other current assets, net, on our Consolidated Balance Sheet. We recorded a mark-to-market gain on the options of $4.7 million for the year ended December 31, 2015, which... -

Page 52

... consists of mutual funds reflective of the participants investment selections and is valued at daily quoted market prices. Variable Interest Entities. We hold interests in certain entities, including credit data, information solutions and debt collections and recovery management ventures, that are... -

Page 53

... Balance Sheet for the years ended December 31, 2015 and 2014. We have also updated Item 6 "Selected Financial Data" for this change. The Company believes that this presentation leads to further simplification of financial reporting. This change did not affect our consolidated statements of... -

Page 54

..., a direct-to-consumer identity protection business that is included as part of our Personal Solutions business unit. During the fourth quarter of 2013, we also completed two acquisitions in Paraguay and Mexico in the Latin America region of our International segment. The total purchase price of... -

Page 55

...the United Kingdom Personal Solutions and direct to consumer reseller operating activities into one segment, Personal Solutions. To reflect this new organizational structure, we have reallocated goodwill from the USIS, Canada, and Europe reporting units to the Personal Solutions reporting unit based... -

Page 56

... NACS operating segment was consolidated into the Canada operations of the International operating segment. To reflect this new organizational structure, we have reallocated goodwill from NACS reporting unit to U.S. Information Solutions and Canada reporting units based on the relative fair values... -

Page 57

... (11.8) (28.5) $ (521.5) $ Gross Definite-lived intangible assets: Purchased data files Acquired software and technology Customer relationships Reacquired rights Proprietary database Non-compete agreements Trade names and other intangible assets Total definite-lived intangible assets $ 665.9 52... -

Page 58

...Credit Facilities"). The Company expects to use proceeds from the Term Loan Facility and the 364-Day Revolver to finance the Veda acquisition. The commitments under the Term Loan Facility and the 364-Day Revolver will terminate if the agreement to acquire Veda is terminated or if the initial funding... -

Page 59

..., business continuity and recovery services, help desk service and desktop support functions, operation of our voice and data networks, maintenance and related functions and to provide certain other administrative and operational services. The agreements expire between 2016 and 2023. The estimated... -

Page 60

... of our mainframe and midrange operations, help desk service and desktop support functions, and the operation of our voice and data networks. The scope of services provided by IBM, and the term of our agreement with respect to such services, varies by geography and location. The estimated future... -

Page 61

... STATEMENTS these credit agreements, we also bear the risk of certain changes in tax laws that would subject payments to non-U.S. lenders to withholding taxes. In conjunction with certain transactions, such as sales or purchases of operating assets or services in the ordinary course of business... -

Page 62

..., as follows: Twelve Months Ended December 31, 2015 2014 2013 (In millions) 35.0%...information about our income tax policy, see Note 1 of the Notes to Consolidated Financial Statements. The intercompany restructuring of legal entity ownership resulted in the recognition of taxeffected net operating... -

Page 63

... and 2014, were as follows: December 31, 2015 2014 (In millions) Deferred income tax assets: Employee pension benefits Net operating and capital loss carryforwards Foreign tax credits Employee compensation programs Reserves and accrued expenses Deferred revenue Other Gross deferred income tax assets... -

Page 64

... expiration of various statutes of limitations, it is reasonably possible that Equifax's gross unrecognized tax benefit balance may change within the next twelve months by a range of zero to $9.4 million. 9. STOCK-BASED COMPENSATION We have one active share-based award plan, the amended and restated... -

Page 65

... weighted-average assumptions: Twelve Months Ended December 31, 2015 2014 2013 1.4% 1.5% 1.2% 21.1% 25.8% 21.2% 1.6% 1.3% 1.3% 4.8 4.9 4.8 12.63 11.95 $ $ 16.75 Dividend yield Expected volatility Risk-free interest rate Expected term (in years) Weighted-average fair value of stock options granted... -

Page 66

... of grant. The fair value of the performance-based shares is estimated on the date of grant using a Monte-Carlo simulation. The following table summarizes changes in our nonvested stock during the twelve months ended December 31, 2015, 2014 and 2013 and the related weighted-average grant date fair... -

Page 67

... plan that covers most salaried and hourly employees in Canada (the Canadian Retirement Income Plan, or CRIP), also frozen to new hires on October 1, 2011. During 2015, we adopted the new generational projection scale with MP-2015 in determining the liability for the U.S. pensions plan. This updated... -

Page 68

... payments, based on salary and years of service. Other Benefits. We maintain certain healthcare and life insurance benefit plans for eligible retired employees. Substantially all of our U.S. employees may become eligible for the retiree healthcare benefits if they reach retirement age while working... -

Page 69

... table represents the net amounts recognized, or the funded status of our pension and other postretirement benefit plans, in our Consolidated Balance Sheets at December 31, 2015 and 2014: Pension Benefits Other Benefits 2015 2014 2015 2014 (In millions) Amounts recognized in the statements of... -

Page 70

... Expected return on plan assets Amortization of prior service cost Recognized actuarial loss (gain) Net periodic benefit cost Curtailments Settlements Total net periodic benefit cost $ 4.2 30.4 (39.6) 0.9 15.8 11.7 - - 11.7 $ Pension Benefits 2014 $ 4.5 31.1 (39.7) 0.8 12.9 9.6 - - 9.6 $ $ 2013 2015... -

Page 71

...59% 4.71% Pension Benefits 2015 4.26% 7.44% 4.71% 2014 5.07% 7.43% 3.34% 2013 4.17% 7.43% 3.26% Other Benefits 2015 2014 4.05% 4.39% N/A N/A Other Benefits Weighted-average assumptions used to determine net periodic benefit cost at December 31, Discount rate Expected return on plan assets Rate of... -

Page 72

... Effect on accumulated postretirement benefit obligation 2015: We estimate that the future benefits payable for our retirement and postretirement plans are as follows at December 31, Non-U.S. Defined Benefit Plans (In millions) $ 1.8 $ 1.9 $ 1.9 $ 2.0 $ 2.0 $ 11.6 Years ending December 31, 2016... -

Page 73

..., comparable financial transactions or other factors relevant to the specific asset for assets with no observable market. These investments are redeemable quarterly with a range of 30 - 90 days notice. For the portion of this asset class categorized as Level 3, fair value is reported by the fund... -

Page 74

... to enhance asset return, reduce volatility or both. Derivatives are primarily employed by the Plans in their fixed income portfolios and in the hedge fund-of-funds area. Derivatives can be used for hedging purposes to reduce risk. No shares of Equifax common stock were directly owned by the Plan at... -

Page 75

... rules under the Plan. We also provide a discretionary direct contribution to certain eligible employees, the percentage of which is based upon an employee's credited years of service. Company contributions for the Plan during the twelve months ended December 31, 2015, 2014 and 2013 were $23... -

Page 76

... for the twelve months ended December 31, 2015. Payments related to the above restructuring charges will be substantially completed in the first quarter of 2016. In the fourth quarter of 2013, we recorded a restructuring charge to realign internal resources of $9.3 million ($5.9 million, net of tax... -

Page 77

... United Kingdom Personal Solutions and Direct to Consumer Reseller operating activities into one segment, Personal Solutions. As a result, we modified our segment reporting effective 2015. Our financial results for the years ended December 31, 2014 and 2013 have been recast below to reflect our new... -

Page 78

... social security number verification services as well as complementary payroll-based transaction services and employment tax management services. Personal Solutions. This segment includes credit information, credit monitoring and identity theft protection products sold directly to consumers via the... -

Page 79

... Solutions Personal Solutions General Corporate Total capital expenditures Financial information by geographic area is as follows: $ 2013 16.7 19.7 14.6 6.9 25.4 83.3 $ 2015 Operating revenue (based on location of customer): U.S. U.K. Canada Other Total operating revenue Twelve Months Ended... -

Page 80

..., the TDX and Forseva, for a total of $338.8 million. For additional information about our acquisitions, see Note 4 of the Notes to Consolidated Financial Statements. • • 16. SUBSEQUENT EVENT The Company intends to acquire 100% of the ordinary shares of Veda, as announced on November 21, 2015... -

Page 81

....4 128.6 2013 Column A Column B Balance at Beginning of Period Column C Additions Charged to Charged to Costs and Other Expenses Accounts (In millions) Column D Column E Balance at End of Period Description Reserves deducted in the balance sheet from the assets to which they apply: Trade accounts... -

Page 82

... alternative to net income, operating income, operating margin or earnings per share, and may not be comparable to non-GAAP financial measures used by other companies. 2015 Diluted earnings per share attributable to Equifax - GAAP Veda acquisition related amounts Income from the settlement of escrow... -

Page 83

...items that relate to acquisition-related intangible assets. 2015 2,663.6 $ 693.9 3.7 7.5 23.4 728.5 27.4% 2014 2,436.4 638.2 - 7.9 - 646.1 26.5% Operating revenue Operating income Veda specific expenses Settlement of a legal dispute over certain software agreements Realignment of internal resources... -

Page 84

... quarter of 2015, we recorded a charge of $23.4 million ($14.9 million, net of tax). This charge was predominantly related to the realignment of our internal resources to support the Company's strategic objectives and increase the integration of our global operations. Management believes excluding... -

Page 85

... by calling toll-free (866) 665-2279. ANNUAL SHAREHOLDERS' MEETING A proxy statement and notice of the Equifax annual meeting of shareholders will be distributed to shareholders with this report. EQUIFAX ON THE INTERNET A broad range of consumer, business, investor and governance information is... -

Page 86

... Index (S&P 500) and a peer group index, the Dow Jones U.S. General Financial Index. The graph assumes that value of the investment in our Common Stock and each index was $100 on the last trading day of 2010 and that all quarterly dividends were reinvested without commissions. Our past performance... -

Page 87

... Executive Ofï¬cer Time Warner Cable Inc. Siri S. Marshall Retired Senior Vice President, General Counsel and Secretary General Mills, Inc. John A. McKinley CEO, SaferAging Inc. and Co-Founder, LaunchBox Digital Mark B. Templeton Retired President and Chief Executive Ofï¬cer Citrix Systems, Inc. -

Page 88

EQUIFAX INC. 1550 Peachtree Street, N.W. Atlanta, Georgia 30309 404-885-8000 equifax.com Copyright © 2016, Equifax Inc., Atlanta, Georgia. All rights reserved. Equifax and EFX are registered trademarks of Equifax Inc. 15-1002 CONTENTS - 87 -