Einstein Bros 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

sales represent sales at stores that were open for one full year and have not been relocated or closed during the current year. Comparable store sales

are also referred to as "same-store" sales and as "comp sales" within the restaurant industry.

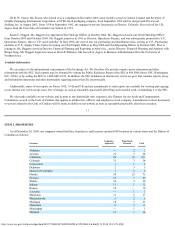

Throughout fiscal 2004, the adverse trend of lower comparable store sales began to level out. The following table summarizes the elements of

comparable store sales for each quarter in fiscal 2004:

Period

Transactions

Average

Check

Comparable

Store Sales

12/31/03 to 3/30/04 -5.5% 0.7% -4.8%

3/31/04 to 6/29/04 -7.3% 3.9% -3.7%

6/30/04 to 9/28/04 -6.3% 5.0% -1.6%

9/29/04 to 12/28/04 -2.5% 5.2% 2.6%

We believe the trend in comparable store sales throughout fiscal 2004 was the result of improvements in the operation of our restaurants, the

introduction of new menu items, improved catering programs in certain markets, and the marketing and advertising campaigns that were initiated in

the fourth fiscal quarter.

Gross Profit

Our total gross profit improved 2.4% for fiscal 2004 compared to fiscal 2003. The improvement was primarily due to improvements in our

retail costs of sales. Our retail margins improved by 1.3% in fiscal 2004 as compared to fiscal 2003. All store-level operating expenses other than

depreciation, amortization and taxes impact our retail margins. For fiscal 2004, approximately $8.2 million of the improvement we experienced

was attributable to our decision to temporarily reduce marketing expenditures as we focused on modifications to our customer service system,

menu offerings and the "look and feel" of our company-operated restaurants. Additionally we experienced an improvement in labor utilization and

reductions in group insurance and workers' compensation claims of approximately $1.1 million, offset by increases of approximately $2.4 million

in commodity costs. We will continue to implement solutions that improve our margins but expect this trend to level out during the next year, as

many of our store-level cost reduction initiatives will have been in place for approximately one year.

Hurricanes in Florida caused many of our restaurants in that state to be closed for a short period of time due to evacuations and power

shortages. During fiscal 2004, we estimate a loss of approximately $0.5 million in revenue due to the temporary closures. The loss of revenue

resulted in a negative impact to our margins of approximately $0.3 million. We have filed a claim under our business interruption insurance

coverage for these losses but due to the deductibles, we have not recorded any reimbursement for the losses incurred. We believe that the amount

of reimbursement for these losses, if any, would be minimal.

Our total gross profit decreased 14.9% in fiscal 2003 compared to fiscal 2002. The decline was primarily due to a 15.9% decrease in retail

margins in fiscal 2003 when compared to fiscal 2002. Cost of retail sales increased in 2003 as a result of an increase in restaurant operating

expenses. This increase was in part driven by additional food and labor costs associated with a transition in menu item mix in response to changes

in customers' menu preferences. The new items introduced had a lower contribution margin and required more labor for preparation than the items

they replaced. Consumer preferences determine the menu items selected by our customers, which in turn affects our overall cost of sales.

Furthermore, certain elements of cost of sales are fixed in nature such as rent, utilities, property taxes and manager salaries. Accordingly, when

2003 sales volumes decreased as compared to 2002 sales volumes, costs of sales did not decrease in the same proportion. Therefore, cost of sales

as a percentage of sales is adversely affected by reduced sales volume.

22

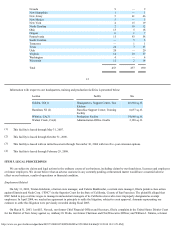

Other Expenses

General and administrative expenses decreased 21.6% and 2.0% during fiscal 2004 and 2003, respectively, when compared to the preceding

fiscal year. The decline in fiscal 2004 general and administrative expenses is primarily due to reduced spending of $3.9 million for non-

capitalizable legal and consulting expenses that were related to our 2003 debt refinancing and equity recapitalization, and the re-audit of our 2000

and 2001 financial results that occurred during 2003, which did not recur in 2004. Additionally, in 2004, bad debt expense decreased $1.8 million

due to improved collection efforts and management of franchisee receivables. Fiscal year 2003 general and administrative expenses declined as a

result of reduced spending as compared to fiscal 2002. General and administrative expenses in the 2002 period included approximately